This presentation and we’re going to enter payroll for the second month of operations. Recall that we’re not going to be entering payroll using the QuickBooks system. We will do that in a future presentation, we’ll get into more detail in payroll in and of itself, we don’t want to add the added feature of payroll, which costs more into our practice problem here, we will be imagining we have a third party processing the payroll like a ADP or a paychecks, we’re going to be getting the register from them, then we need to enter that information somehow into our system. So our financial statements then reflect the payroll information.

00:33

Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file. I’m going to jump over to the desktop version just to take a look at the flowchart for payroll just to get an idea of what we’re doing. So we’re just considering the flowchart here. We’re down in here in the employees section. Within the employee section. Typically, we might enter the time directly into QuickBooks. This isn’t necessarily however, we may do this in some other system as well. Then we’re going to take the time for the hourly employees and then the salary employees.

01:03

We’re going to be then entering the payroll here. So now we’re going to enter the payroll. And note once again, the payroll would be very simple. If it weren’t for withholdings, it would be just like any other expense, we would debit payroll expense, credit cash for it. However, we have to deal with those withholdings which resulted in us having liabilities as well, as well as the employer taxes that we have to deal with. So we’ll then enter the payroll, which will generate the expense and it will also generate those liabilities and then we would be paying off the liabilities. In month one we had done this we entered the payroll and then we paid off the liabilities for the first month. So we entered payrolls resulting in liabilities, then we paid them off.

01:44

Now it’s month two, we’re going to do the same kind of process. We’re going to now enter the payroll for month two, which will result in expense accounts and liabilities going up. They would then be paid off in month three. Now we’re going to jump over to our expense report. we’re imagining that this is going to be coming from an ADP or paychecks, we have a third party person processing our payroll, which is quite common in depending on the type of industry you’re in, then we need to take that financial information entered into our system in some way.

02:12

If you do get a process such as that you’ll typically get reports after each payroll or monthly or quarterly or so. And they’ll be very detailed, they’ll have a register or something like that. And you’ll have to figure out how we’re going to integrate, you know, this reporting information into our system. Now, the reporting information is going to be detailed by by employee, because we need each employee data to give them on their pay stub. So it’s going to be a very detailed report. If we have a lot of employees or even what only like five employees, it could still be a pretty, pretty large report, you know, to deal with all this information and breaking this stuff out by employee.

02:48

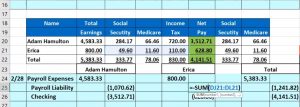

We won’t go over the process of creating it again, as we did last time. We’ll simply look at the report here. I’ll just analyze it fairly quickly, and then we’ll enter it into the system. So we have Adam Smith. We had a salaried employee, this was his total earnings. It was taken out from his total earnings. We could see on this payroll, you know, register, that Social Security was taken out Medicare and in income tax, federal income tax hits federal income tax, resulting in a net check of this, which is his earnings minus what was taken out. And this you know, many more things could be taken out of the check like benefits and state taxes.

03:25

We’re not going to get into that here. Then we had to pay our portion of employee or taxes matching in essence, Social Security and Medicare that we had we as the employer had to pay. Then we had Erica, Erica earned 800 total for the month, then that was taken from her paycheck Social Security, Medicare income taxes, were forced to take it out. We had to take it out not our fault as the employer, and then that brings her net check down to this. And then we had to also then we also matched Social Security and Medicare that we had to pay. So note you can think of Then employee by employee, which we need to have, so that we can then tie out to two, we can give the employee either detailed data on it, or we can think about it as one lump journal entry, such as the total here.

04:14

Here’s the total gross pay for both employees. Here’s what was taken from there pay for both employees. Here’s the net kind of check with the net checks that we wrote, this would be multiple checks, but the bottom line that came out for payroll for the payroll account, then we have the amount that we owe for Social Security, Medicare in total. Now you can think about this in terms of journal entries. How are we going to put this into our system so it’s reflected in the financial statements in journal entry format, you can think about it by employee payroll expense going up by the gross pay, the liabilities going up by what was taken out, the difference being the net check. Right? And you can do that for Erica gross pay, the liabilities going up.

04:58

That’s what was taken out the difference being Net check. So so that means the payroll expenses going up liabilities going up checking account going down the total, then same format, you could take the total and do the do the same thing with the bottom line, then we also have to pay the employee or portion. And I would think about that in total, a total journal entry, which we’re taking the payroll expenses that we have to take pay for ourselves, and then the liability.

05:25

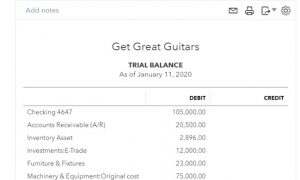

Okay, let’s enter this into the system, we could enter this into the system with a journal entry, just one journal entry like this. However, if we do that, then we’re not going to be able to see the two checks that are going to be paid out and coming out of our checking account. So we’ll enter it as we did last time, by employee this transaction, this transaction, and then we’ll enter this transaction as as one lump sum. All right, let’s do it. We’re going to go back into QuickBooks. And let’s open up our reports. First, I’m going to go to the trial balance or reports down below and just simply open the trial balance At this point, so I’m going to go into the fine type in the trial balance.

06:05

That’s the one we want. And then I’ll change the dates up top from a 10120 to 1230 120, January through December 2020. Run that report, going to go back up top to the tab up top, right click on it and duplicate that tab. And then I’ll close the hamburger. And again, the accounts that are going to be affected checking accounts going to be affected, the payroll liabilities going to be in the liability section is going to be affected. And then the payroll expense accounts including payroll expense and payroll taxes.

06:41

Now, I’m going to do this by using a form and that’s going to be the expense form. So we’re going to use the expense form to record the two checks basically, or the you could take them as checks. We’re going to call them electronic transfers that are going to come out. So let’s do that. We’re going to go back to the left. I’m going to say the plus button and then we’re going to Go to the add the expense, which is kind of like a check but not gonna have a check number on it. I’m going to go to the other reasons down below. And then we’re going to say who did we pay I’m gonna be bouncing back and forth from our Excel sheet first is going to be Adam Hamilton, that’s our first employee.

07:16

So I’m going to say Adam Hamilton on to 29 checking account, that’s what we want. Notice it’s memorizing what we did last time with the payroll expense and liability. So that looks good. We just have to see if there’s any change to the current period. There may not be it just kind of depends. You know if there’s any change or not, especially if it’s a salaried employee, it might be the same. So we’re going to say it’s, it’s the payroll expense should be the 458 3.33. So 4583 3.33, and then the liability should be these three, which is the 107062. So it’s a little bit different. So it’s a little bit different, should be 107 0.62. Let’s change it, negative 107 0.62. And there is that, that gives us the net check of the 3005 1271. So back over here, there’s the 3005 1271.

08:18

Let’s do the same thing for Erica. So we’re going to do the same thing for Erica. So I’m going to say, not the saving clothes. I’m going to select a drop down or the rhizome. And I’m going to check up the Save and new will pick up the Save and new and we’re going to do another one of these this time for Erica. So we’re going to say who did we pay it’s going to be Erica, we paid Erica Smith we’re going to say Erica Smith and to 29 we got the same payroll information popped up for us, then the gross pay is going to be the 800 so we’re going to pick up the 800. Again, that’s what we want looks good there.

08:51

Other side on the expenses or the liability 171 that might be different dollar Different negative 171. All right, that means the check amounts going to be 629. Let’s see if that is indeed the case over here. It’s 620 8.8. I’m going to keep it I’m going to take off the pennies will make it to 629. Or let’s add the penny. I mean, it’s, it’s point two. So this was the wrong one. Let’s go back to our account. This is going to be point two. So now we’re at the 620 8.8. Let’s check that out. We got 620 8.8. Alright, that looks good. If we go back, I’m just going to minimize this this time we go back.

09:38

Now let’s say Save and Close. But before we do, what’s this, what’s this going to do when we record this? It’s an expense account, which which doesn’t mean that only expense accounts are affected. But it’s kind of like a check without a check number. We know that there that means that the checking accounts going to be going down by the full amount of the 628 ad, then the other side is going to be the expense expense. is going to be going up for this one by the 800. The difference being the liability what we took out of the paycheck, that’s going to be increasing the payroll liability by the 171 2020. Let’s go ahead and check that now we’re going to say, drop down or rise up, we’re going to select the Save and Close this time, then let’s go to the trial balance. Let’s refresh the screen I’m going to refresh the screen up top.

10:24

Then I’ll close the hamburger hold down Control and scroll up a bit to the one to five, then let’s go down to the checking account will go into the checking account. And if we go to the bottom of the checking account, we should have our two checks that we paid. here’s here’s Erica’s check here and there’s Adams check so Erica and Adam. And it’s the net check that’s going to be appear in here. This is the net check that came out not the gross pay. If we select one of them, then of course, we will go back to the expense form that we created. Closing that back out and going back to up top, we’re going to go back to our trial bounce back to the TV. The other side is going to be on the expense side of things. So the expense side of things is down here, payroll expenses.

11:12

Let’s go into those payroll expenses. And we see that we have our two checks once again, for Adam. So if we open up, let’s open up Adam says time, this is for the gross pay now. So this is this is not the net check. This is the gross pay that was paid. And that’s because note that the liability portion that we took out is really their liability. The fact that we’re paying it for them, it’s just something that we have to do, but it’s their payroll taxes, supposedly, that’s being paid, I think, and I say supposedly, because obviously in real life, it changes the whole dynamics of how much you’re going to get paid and everything like that, but it came supposedly it comes out of out you know, it’s being paid by the customer.

11:50

So we’re going to say or the employee, so we’re going to close this back out, scroll back up top. Go back to our trial balance, then the The other side is going to be in the payroll liabilities. So here’s the payroll liability. If we open that up then and scroll down, we have Eric and Adam. And that’s the increase. This is what we took out of their check for their their taxes. This is what they owe for their taxes, supposedly, but we had to take it out because we’re required to and pay it on their behalf. That’s kind of how you want to think about it. Then I’m going to go back up top, go back to the trial balance.

12:28

Now we’re going to enter the what we have to pay over and above this is really what the payroll tax expenses. So the payroll tax expense for us then In other words, doesn’t include these three items, even though they’re kind of payroll taxes, but they’re not the the payroll taxes to us, their payroll taxes that supposedly are paid by the employee, they come out of their check. This is the payroll tax expense for us that we’re going to pay so if you have payroll tax expense broken out versus payroll expense on the income statement, the payroll tax expense should only include the pay the employee or portion, not the employee portion. Okay, there’s no there’s no cash affected here.

13:09

Therefore, we’re going to have to use some other method other than a form to enter this in, we could use a journal entry. Or we could use the the registers. And we’re going to go ahead and use the registers to do it since there’s only the two accounts. Also note that because cash is not affected, we don’t need to tie out to the net checks like we like we did up here so that we can do the bank reconciliation more easily. And therefore I’m just going to use the totals here, rather than break out our portion that we had to pay by employee. So we’ll just put the total in there to get the financial statements right. I don’t have to worry about the reconciliation process. So let’s do it. I’m going to go back to our our QuickBooks Online.

13:50

Let’s go back to the first tab then and I’m going to hold down Control and scroll down just a bit so we’re back to 100. So it doesn’t mess anything up there. We’re going to go on down to our accounts. And I’m going to look for an appropriate register in our chart of accounts here that we can then use, we’re going to be, we can’t use the income statement account because you’ll note if I go down and I look at the registers over here, the income statement accounts don’t have one because they’re they’re temporary accounts. So we have to use the permanent account, the permanent account, then is going to be the liability account, which is going to be the payroll liability. So this is the register, I need to use payroll liability, it’s going to be increasing. So let’s go into that register for the payroll liability.

14:32

I’m going to select this little drop down to see what type of form we want to use. Notice we only have very few options, basically just the journal entry. So we’re going to use a journal entry, it’s going to look like an up and up and down. But the journal entry when we go back into it from the form will be in the format of debit and credit because there’s no other there’s no other method, no other form that QuickBooks has for this transaction. So I’m going to say all right, this is going to be owed to 29 to zero and we’re going to we’re going to put here The P, I’m going to just keep the P as is. And we’re going to say this is going to increase by the 41182. So increase for one 1.82. And then the other side. And notice it’s in terms of increase and decrease.

15:18

You might get confused looking over here in terms of debits and credits, and say what you know, you know, we’re increasing the liability here with a credit. And that’s the first column is an increase over here. So you know, when you switch between debits and credits, and increase and decrease, it can be kind of confusing, but it’s increasing the liability, which is the credit, okay, and then the other side is going to be going to the expense account, and we set up a separate expense account for the payroll expense. So it’s going to be payroll tax expense, I’m sorry, we set up a separate payroll account payroll tax expense account, separate from the payroll expense account, the payroll tax expense account, you’ll recall is only including the employer portion of a payroll taxes.

15:59

So what’s this going to When we record it, it’s going to be increasingly bad expense, payroll tax expense. And it’s going to be increasing the liability for the for what we owe. So we’re going to say save. And then let’s take a look at that is indeed the case. Let’s go on back to the trial balance, let’s hold down Control and scroll up a bit. So we can see it a little bit more closely. Don’t have to strain those eyes as much. And then we’re going to go down to the payroll liabilities. So here’s the payroll liability. Let’s take a look at that. And scroll down to the bottom. There’s our journal entry.

16:31

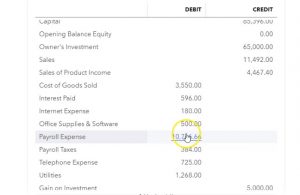

Notice that it appears as a journal entry here, if I go to the right, even though we entered it into the register. If I click on it, it doesn’t take us to the register, but instead to a journal entry. So here’s the journal entry. Closing that back out. Let’s see the other side of things. If I scroll back up top and go back to our report, the other side of things is of course going to be in the payroll tax expense. So here’s the payroll tax expense, open up the payroll tax expense. There’s the two journal entries, one for January one for February. Alright, let’s go back up top, go back to our reports. Let’s just take a quick look at the income statement to see the effect on the income statement here.

17:10

So I’m going to go back to the first tab, open up the hamburger, go down to the reports, we want to be down in the reports tab, which I’m not seeing right Oh, there it is, I went too far. I’m gonna hold down Control, scroll down just a bit. back down to 100. And let’s pick up our favorite report that being the P and L, the profit and loss the income statement, changing the dates up top from a 10120 to 1230 120. Running that report. We then close the hamburger hold down control back to one to 5%. And we see here that we have the two expense accounts, right we have the payroll expense account and then we have the payroll taxes account that are going to be affected. Those of course are significant often and increasing the expense will decrease the net income down below.

18:04

Just a reminder, we can see this payroll expense report for the full two month time period here, or we could see it just for the month of February, which is a one Oh, say, Oh 202012020 229 to zero, run that report. And now we see the numbers just for the month of February. So you can compare the performance performance How did we do over this time period, you can also compare both periods by this time I’ll take a look at the prior period by selecting the prior period right we can select this previous period and then say, okay, run it please. And so now we have the February and and January, side by side so you can kind of make a comparison between the two. Just remember that that this is different than the balance sheet because When you look at the balance sheet, you’re talking about permanent accounts. You’re talking about a point in time. February February here means is February 1 through February 29 January 1 through January 31.