3:17

And we can track inventory in all of them. Notice within the enterprise, we have advanced inventory items here. This is another area when we have advanced type of inventory tracking depending on the industry we are in where we may need more specialization within the software, anyone anytime we need more specialization, that’s when we basically generally need to be upgrading the type of accounting software we use in order to customize it to those specialized needs.

3:44

Inventory can be one of those areas where we have specialized needs lyst limits, we have the pay tending 1099 contractor. So it’ll help us to generate those 1099. Again, with all three of them, those meet most of the basic needs of most business is those are all included. And Pro, that’s what we’ll be concentrating mainly on in this course, advanced features and premier and enterprise include forecasting with those items. So forecasting into the future, industry specific features.

4:16

And again, this is usually when you need to go beyond basic accounting software, such as pro because you need some kind of customization. Next, we have a mobile inventory barcode that’s only going to be in the enterprise to help us to be tracking that inventory.

4:30

And then we have the QuickBooks priority cycle, again, in the enterprise, the enhanced pick and pack in the enterprise, again, these having to do with typically inventory flow type of items and managing those types of systems. And then of course, we have the multiple users when we think of the pro and this is another big consideration that that could limit which type of package we want. We have the QuickBooks desktop user desktop version, enterprise we have the 30 users.

5:09

And when we think about the users, what we’re talking about here is it allows more than one user at a time. So in other words, if you have an accounting system, and you have multiple people working in the accounting system, obviously you want them all to be able to access the QuickBooks system at the same time as opposed to basically one person being able to be in the QuickBooks system on one computer, and then them having to log out before the next person can get into the system.

5:36

So you want to basically, when you have a larger department, of course, you want to have more users that can access that data at the same time. Next, we have add ons. Now the add ons can be included is exactly what it says or what it sounds like we have the QuickBooks that would then be purchased.

5:51

And then you basically have the add ons that could be purchased and acquired on top of the price of whatever type of system of QuickBooks we use. We have the upgrade to plus in the add ons, all the features of Pro with over $399 worth of added value and their added value, get unlimited support plus access to QuickBooks experts.

6:16

This can be nice, because the support that you do get if you were to simply call QuickBooks and you had QuickBooks Pro is limited to the amount of support you have. Now there’s a lot of other support that you can use with QuickBooks, many people are very familiar with QuickBooks very popular software.

6:32

So there’s a lot of people that you can you can go to in order to get help with the QuickBooks system. But if you want to go to Intuit itself, and call them they have a lot of resources to online resources and whatnot will talk about in future presentations. However, to get actual live direct support is not as easy with QuickBooks directly.

6:52

And you can get more of that with the plus feature, safeguard your most valuable information with automated data backup and recovery, get access to to the latest features and updates. So you always have the latest version. The next add on is the pay employees in essence, the payroll.

7:11

So when we think about these systems, note that the payroll is an add on. So you would buy whatever kind of QuickBooks desktop version you would have, you would have to then add on the payroll if you need payroll. And part of the reason for that is there’s some customization with the type of service you would need for payroll, therefore, the payroll would be added over and above.

7:31

Now, we will look at payroll and will actually look at payroll with the free version or manual version within the QuickBooks system. So you won’t have to purchase it which is a great for testing payroll not good if you actually want to run payroll because it can be quite complicated payrolls, even with a small amount of employees, something that you typically would want help with.

7:52

So pay employees and E file, pay employees with free direct deposit and create unlimited paychecks easy pay and file federal and state payroll taxes, print and file w two at your end. So the payroll is going to be another one that would be an add on.

8:09

And then we have the remote hosting the remote hosting and remember, we’re on the desktop version, then it’s less easy for us to basically access it from multiple location as it is we were on the cloud version, in which case we would just access the cloud.

8:26

The remote version can help us with that if we have people at multiple location or we are going to multiple locations, we might be able to set up then the added service of remote hosting. That would be lower cost network with reliable hosting access on the go. Your data is stored in the cloud not at your office making access easy and convenient password protect connections and ongoing it maintenance. So that would be the hosting option here.

8:55

So again, we here will basically be using the pro version or the features net sorry for the pro version. That’s what you would need to make sure to have all the features available. We won’t be getting into a lot of detail with the added features or any with the premier or enterprise although we might add some information later to says add on to the course for those too, but the Pro is what you need for if you want to follow along with the course.

9:21

Also note that you don’t need to add on even for payroll although we will be looking at payroll because QuickBooks does provide a manual payroll option, which gives us all the features which is great to use, but it doesn’t do some of that automatic stuff. That’s really helpful to double check your work within the system. So QuickBooks Pro, that’s what we’ll be using here.

This presentation and we will take a look at QuickBooks desktop options. In a prior presentation, we talked about the fact that if you’re looking to purchase QuickBooks, it can be confusing because there are a lot of options for it.

0:13

The first step and breaking out those options, as we seen in a prior presentation is generally to consider whether we want a desktop type of version of QuickBooks or an online type version of QuickBooks. We’re now thinking about the desktop type version.

0:27

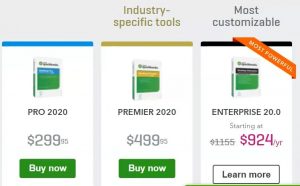

So we’ve made the decision here, we want the desktop versus the online. Now we’re going to be considering the different options with regards to the desktop version, desktop version of QuickBooks include QuickBooks Pro, QuickBooks Premier, and QuickBooks enterprise. For most small to mid sized businesses, QuickBooks Pro is enough to meet their needs. That’s what we will be focusing in on for the most part, the type of activities that you can do and can be done within QuickBooks Pro.

0:57

For more advanced features, of course, then you would go to the books per premiere. And then for more advanced features to the enterprise, you can take a look at these features at the Intuit website into it is the owner of QuickBooks, the link here is quickbooks.intuit.com, slash desktop.

1:16

If we scroll down to some of these features, that will give you some information on what will be included within these features. And so obviously, the items that have a check in all three are going to be the ones that are going to be included in either of the items that we have. If you look at any of these three versions of QuickBooks, unlike the difference between QuickBooks desktop and QuickBooks Online, and they will look much the same.

1:40

They’re basically all the desktop version, it’s simply the case that the the advanced versions here have more features to them. So in other words, if you get good at using QuickBooks Pro, you will be able to go to QuickBooks enterprise, it’s not going to look completely different, you’re not going to be going where is this type of item that I used to know where it wasn’t pro as you might do?

2:01

When you go from QuickBooks desktop to QuickBooks Online, so the format will be the same. The added the premier and enterprise will just have more features to the features then include the new features for 2020, which we’ll discuss in a later presentation, we have the track income and expenses, which are included in all of them the invoices, which will be included in all of them, obviously invoicing, we can run the feedback and all of them, we can have the estimates in all of the versions.

2:29

Obviously with their reports, the advance of the reports, there’s 100 plus reports in the Pro, again, that usually fits the needs for most type of businesses will need advanced reports for premier and enterprise.

2:41

That’s usually the case when we have more specialized type of industry reports that we need. And or we’ve grown to some size where we have different regional reports or those types of things where we would need more advanced type of reporting systems,

2:54

we didn’t have the track sales tax and all of them, which is an important feature because we have to track and pay them sales tax that’s included in all in all of the versions, managed bills and accounts payable, which of course is important time tracking, which we may or may not use within the system, but it will be included in all the features will talk a bit about time tracking as we go through our work.

3:17

And we can track inventory in all of them. Notice within the enterprise, we have advanced inventory items here. This is another area when we have advanced type of inventory tracking depending on the industry we are in where we may need more specialization within the software, anyone anytime we need more specialization, that’s when we basically generally need to be upgrading the type of accounting software we use in order to customize it to those specialized needs.

3:44

Inventory can be one of those areas where we have specialized needs lyst limits, we have the pay tending 1099 contractor. So it’ll help us to generate those 1099. Again, with all three of them, those meet most of the basic needs of most business is those are all included. And Pro, that’s what we’ll be concentrating mainly on in this course, advanced features and premier and enterprise include forecasting with those items. So forecasting into the future, industry specific features.

4:16

And again, this is usually when you need to go beyond basic accounting software, such as pro because you need some kind of customization. Next, we have a mobile inventory barcode that’s only going to be in the enterprise to help us to be tracking that inventory.

4:30

And then we have the QuickBooks priority cycle, again, in the enterprise, the enhanced pick and pack in the enterprise, again, these having to do with typically inventory flow type of items and managing those types of systems. And then of course, we have the multiple users when we think of the pro and this is another big consideration that that could limit which type of package we want. We have the QuickBooks desktop user desktop version, enterprise we have the 30 users.

5:09

And when we think about the users, what we’re talking about here is it allows more than one user at a time. So in other words, if you have an accounting system, and you have multiple people working in the accounting system, obviously you want them all to be able to access the QuickBooks system at the same time as opposed to basically one person being able to be in the QuickBooks system on one computer, and then them having to log out before the next person can get into the system.

5:36

So you want to basically, when you have a larger department, of course, you want to have more users that can access that data at the same time. Next, we have add ons. Now the add ons can be included is exactly what it says or what it sounds like we have the QuickBooks that would then be purchased.

5:51

And then you basically have the add ons that could be purchased and acquired on top of the price of whatever type of system of QuickBooks we use. We have the upgrade to plus in the add ons, all the features of Pro with over $399 worth of added value and their added value, get unlimited support plus access to QuickBooks experts.

6:16

This can be nice, because the support that you do get if you were to simply call QuickBooks and you had QuickBooks Pro is limited to the amount of support you have. Now there’s a lot of other support that you can use with QuickBooks, many people are very familiar with QuickBooks very popular software.

6:32

So there’s a lot of people that you can you can go to in order to get help with the QuickBooks system. But if you want to go to Intuit itself, and call them they have a lot of resources to online resources and whatnot will talk about in future presentations. However, to get actual live direct support is not as easy with QuickBooks directly.

6:52

And you can get more of that with the plus feature, safeguard your most valuable information with automated data backup and recovery, get access to to the latest features and updates. So you always have the latest version. The next add on is the pay employees in essence, the payroll.

7:11

So when we think about these systems, note that the payroll is an add on. So you would buy whatever kind of QuickBooks desktop version you would have, you would have to then add on the payroll if you need payroll. And part of the reason for that is there’s some customization with the type of service you would need for payroll, therefore, the payroll would be added over and above.

7:31

Now, we will look at payroll and will actually look at payroll with the free version or manual version within the QuickBooks system. So you won’t have to purchase it which is a great for testing payroll not good if you actually want to run payroll because it can be quite complicated payrolls, even with a small amount of employees, something that you typically would want help with.

7:52

So pay employees and E file, pay employees with free direct deposit and create unlimited paychecks easy pay and file federal and state payroll taxes, print and file w two at your end. So the payroll is going to be another one that would be an add on.

8:09

And then we have the remote hosting the remote hosting and remember, we’re on the desktop version, then it’s less easy for us to basically access it from multiple location as it is we were on the cloud version, in which case we would just access the cloud.

8:26

The remote version can help us with that if we have people at multiple location or we are going to multiple locations, we might be able to set up then the added service of remote hosting. That would be lower cost network with reliable hosting access on the go. Your data is stored in the cloud not at your office making access easy and convenient password protect connections and ongoing it maintenance. So that would be the hosting option here.

8:55

So again, we here will basically be using the pro version or the features net sorry for the pro version. That’s what you would need to make sure to have all the features available. We won’t be getting into a lot of detail with the added features or any with the premier or enterprise although we might add some information later to says add on to the course for those too, but the Pro is what you need for if you want to follow along with the course.

9:21

Also note that you don’t need to add on even for payroll although we will be looking at payroll because QuickBooks does provide a manual payroll option, which gives us all the features which is great to use, but it doesn’t do some of that automatic stuff. That’s really helpful to double check your work within the system. So QuickBooks Pro, that’s what we’ll be using here.