Tax season can be as daunting as facing a flock of crows on a cornfield, especially when it involves reporting rental income, expenses, and losses. To be a great tax preparer, you must be like a scarecrow—outstanding in your field, calmly and stoically staring down the crows, even as they pick at your innards. In this blog, we’ll guide you through the essential details of reporting rental income, expenses, and losses for the tax year 2023-2024, based on IRS Publication 527.

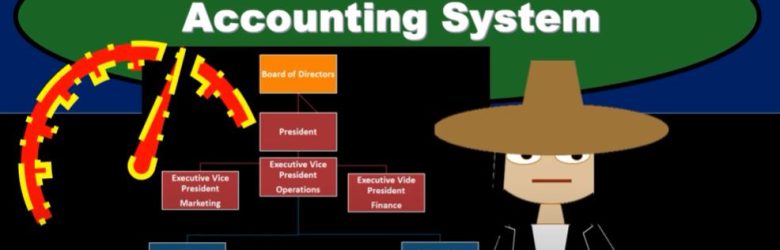

Responsibility Accounting System – Managerial Accounting

In this presentation, we delve into the concept of responsibility accounting systems. When implementing a responsibility accounting system, the goal is to decentralize our organization, assigning distinct managers to oversee different segments. This decentralization empowers managers with increased responsibilities over specific areas, holding them accountable for controllable items within their purview.

Tax Calculation – Line 16 7020 Tax Preparation 2023-2024

In today’s digital world, presentations are often needed for various purposes such as business meetings, academic lectures, or sharing project updates. While tools like PowerPoint and Google Slides are commonly used, there are times when you have individual image files that need to be combined into a single PDF presentation. Python, with its extensive library support, provides an efficient way to accomplish this. In this blog, we will explore how to merge multiple images into a single PDF file using Python and the PyMuPDF library.

Earned Income Tax Credit (EIC) Overview 8220 Tax Preparation 2023-2024

Grab your coffee, and let’s dive into the essentials of the Earned Income Tax Credit (EIC) for 2023-2024. The EIC is a valuable tool within our tax system, acting as both a benefit and a safety net. To get started, we will explore its structure, eligibility requirements, and key aspects. You can find most of this detailed information in the Form 1040 instructions, specifically under the “Tax and Credits” section, available on the IRS website at irs.gov.

Child & Dependent Care Expenses Credit Overview 8520 Tax Preparation 2023-2024

Grab your coffee and let’s dive into saving some money for vacation by maximizing our income tax preparation for 2023-2024!

Balance Scorecard 250 – Responsibility Accounting

In this presentation, we’ll explore the balanced scorecard approach to performance measurement. The balanced scorecard is a strategic management tool that provides a comprehensive framework to evaluate the performance of different divisions within an organization.

Payments 7260 Tax Preparation 2023-2024

Grab a cup of coffee and get ready to maximize your refunds for the tax year 2023-2024. We’ll break down the essentials, focusing on income tax payments and how to ensure you’re on the right track. Most of this information can be found in the Form 1040 instructions for the tax year 2023 on the IRS website (irs.gov).

Business Expenses Bad Debts 6525 Tax Preparation 2023-2024

In the intricate maze of income tax preparation, business expenses often stand as towering corn stalks, waving in the financial breeze. Among these expenses lies a peculiar patch: bad debts. It’s like entering a dark corner of the field, where unpaid invoices and delinquent accounts lurk like hungry ravens eyeing your lunch. But fear not, fellow tax preparer, for with a little guidance, you can navigate this labyrinth with ease.

Other Common Expenses & De Minimis Safe Harbor for Tangible Property 6765 Tax Preparation 2023-2024

Get ready with a cup of coffee because income tax preparation for the year 2023-2024 will require some careful attention. This blog will guide you through some of the common expenses and the de minimis safe harbor for tangible property, primarily based on the IRS Publication 946: How to Depreciate Property. For further details, you can refer to the IRS website at irs.gov.

Business Expenses Interest 6710 Tax Preparation 2023-2024

Are you ready to take charge of your income tax preparation for 2023-2024? With the IRS lurking around the corner, it’s time to arm yourself with knowledge about business expenses, interest deductions, and more. Grab a cup of coffee and let’s dive in.