In this presentation, we will discuss the process of recording transactions in a sales journal. We will use the information related to sales to demonstrate this process, particularly focusing on transactions involving both accounts receivable, sales, and cost of goods sold, which typically occurs when selling inventory items. This is in contrast to businesses that don’t deal with inventory, such as service companies, which would have a simpler sales journal with only accounts receivable and sales entries.

The sales journal serves as a useful tool for companies that may have less automated or more manual accounting systems. Even for businesses using automated systems, the sales journal provides valuable information for reporting and understanding different accounting formats and structures, as well as their pros and cons.

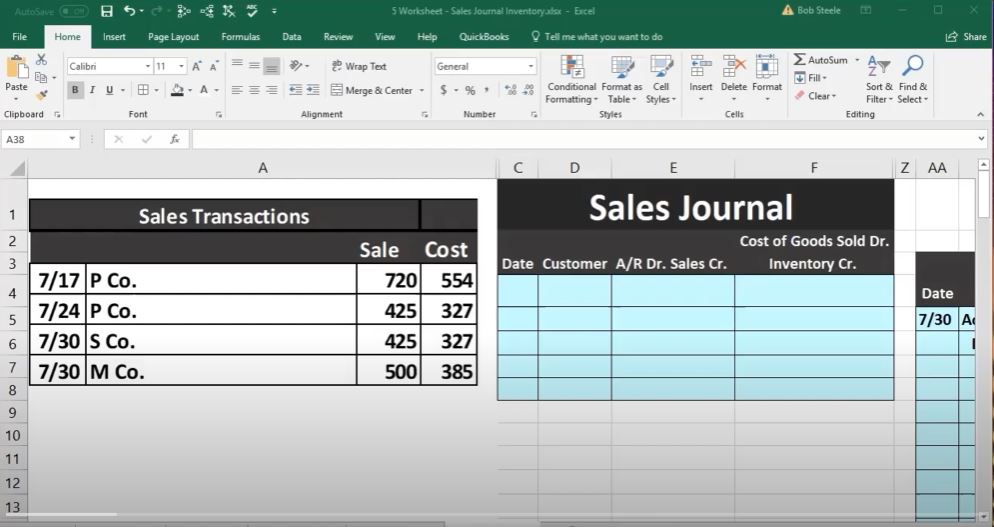

Let’s go through an example with the following transactions:

- P Company:

- Sales Amount: $720

- Cost of Goods Sold: $540

- S Company:

- Sales Amount: $425

- Cost of Goods Sold: $327

- M Company:

- Sales Amount: $425

- Cost of Goods Sold: $327

- M Company:

- Sales Amount: $500

- Cost of Goods Sold: $385

Now, we’ll enter these transactions into the sales journal:

- P Company:

- Debit: Accounts Receivable ($720)

- Credit: Sales ($720)

- S Company:

- Debit: Accounts Receivable ($425)

- Credit: Sales ($425)

- M Company:

- Debit: Accounts Receivable ($425)

- Credit: Sales ($425)

- M Company:

- Debit: Accounts Receivable ($500)

- Credit: Sales ($500)

We will post these transactions to the subsidiary ledger for accounts receivable, tracking who owes us money for later collection.

- P Company – Debit in Accounts Receivable subsidiary ledger

- S Company – Debit in Accounts Receivable subsidiary ledger

- M Company – Debit in Accounts Receivable subsidiary ledger

- M Company – Debit in Accounts Receivable subsidiary ledger

Now, let’s calculate the total sales for the month by adding up these transactions:

Total Sales: $720 + $425 + $425 + $500 = $2070

Now, we will post these total sales to the general ledger:

- Debit: Accounts Receivable ($2070)

- Credit: Sales ($2070)

Next, we’ll handle the cost of goods sold and inventory. Note that since we are recording the sales journal before the purchases journal, the inventory balance may be negative until the purchases are recorded.

- Cost of Goods Sold:

- Debit: Cost of Goods Sold ($1005.93)

- Credit: Inventory ($1005.93)

Now, let’s post these transactions to the general ledger:

- Cost of Goods Sold – Debit in the General Ledger

- Inventory – Credit in the General Ledger

This completes the recording of transactions in the sales journal for the month. The total effect of these transactions is reflected in the general ledger, and we can generate a trial balance to ensure that everything is in balance. The trial balance will show the net result of these transactions as an increase in revenue (sales) and an increase in the cost of goods sold, resulting in the net income for the period.