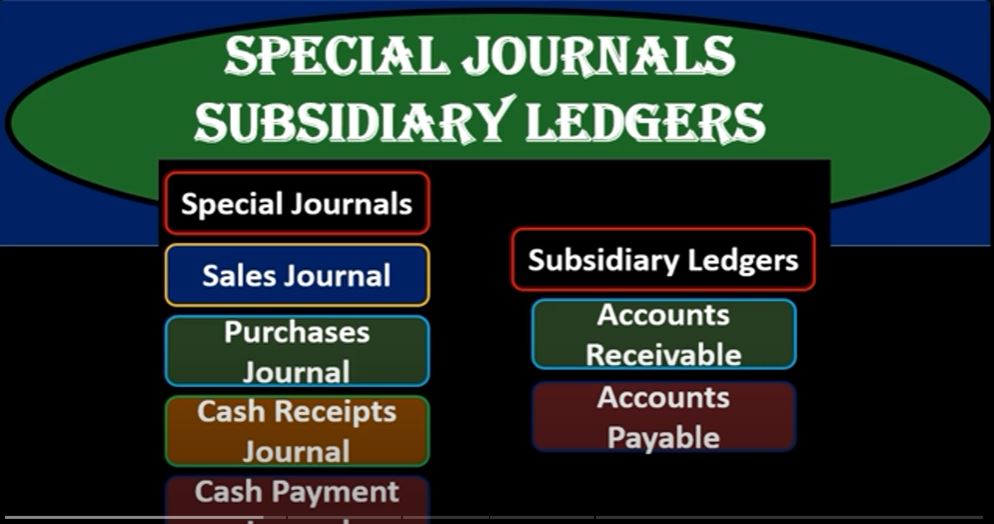

In this presentation, we’re going to discuss special journals and subsidiary ledgers, both of which play crucial roles in accounting systems. These tools are particularly useful when dealing with manual accounting systems, as they streamline data input and make financial reporting more efficient. However, they also offer valuable insights for understanding and customizing automated systems.

Special Journals:

Special journals are designed to group specific types of transactions together, simplifying the accounting process. They are especially helpful in manual systems, but understanding their principles can benefit anyone dealing with accounting systems. The primary special journals include:

- Sales Journal: This journal is used to record sales transactions where customers are buying on credit (i.e., on account). Sales for cash are not recorded in the sales journal.

- Purchases Journal: The purchases journal is employed to record purchases made on credit, typically referring to inventory items in a merchandising company. Cash purchases are not recorded here.

- Cash Receipts Journal: Transactions where cash is received are entered into the cash receipts journal. It’s important to note that this journal can get more complex if cash is received from various sources.

- Cash Payments Journal: Conversely, the cash payments journal records cash outflows, making it especially effective if these payments are primarily for specific expenses like supplies or merchandise.

Special journals streamline the data entry process by allowing you to enter multiple transactions as a summary during the month, which can then be recorded in the general journal as one total entry at the end of the period, whether that’s a day, a week, or a month. This approach saves time and reduces the need to post individual debit and credit entries to the general ledger for each transaction.

Subsidiary Ledgers:

Subsidiary ledgers are essential when you need more detailed information about specific accounts. They serve to break down the data beyond what’s provided by the controlling account in the general ledger. Two common examples of subsidiary ledgers are:

- Accounts Receivable Subsidiary Ledger: This ledger provides details about who owes your company money. It’s particularly valuable for tracking outstanding balances by individual customers, offering a more detailed view than what’s shown on the balance sheet or general ledger.

- Accounts Payable Subsidiary Ledger: Similar to the accounts receivable subsidiary ledger, this ledger helps you manage your outstanding obligations by providing specific information about the vendors you owe money to.

Subsidiary ledgers are especially useful in both manual and automated systems. In automated systems, the software typically handles the subsidiary ledgers automatically. However, understanding their purpose can help you make informed decisions about how to organize and customize your accounting systems effectively.

In conclusion, special journals and subsidiary ledgers are critical tools in accounting, helping to streamline data entry, provide more detailed information, and improve the overall efficiency of accounting systems. Whether you’re dealing with a manual or automated system, understanding these principles can enhance your accounting knowledge and decision-making capabilities.