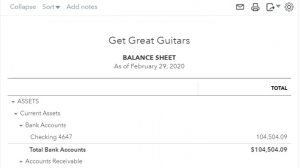

This presentation and we’re going to break out the short term portion of a loan, this time taking a look at a loan that has both a short term and long term portion to it. Let’s get into it with QuickBooks Online. Here we are in our get great guitars file. Let’s start off by opening up our report our favorite report that being the balance sheet report. So we’re going to go into the reports we’re going to go into the balance sheet, we’re going to be changing the dates up top.

00:25

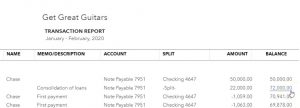

Remember, our cutoff date is at the end of the second month. So we’re going to be saying oh 10120220 229 to zero, then we’re going to go ahead and run that report. I’m gonna duplicate the report by going up top right clicking up top and duplicating. Then I’m going to close up the hamburger hold down Control and we’re going to scroll up just a bit. We’re going to then go down to our loans. Once again, I’m looking at those long term loans where we have one left, this is the 69 879. Now this one, you’ll recall that we put on the Books, it was on the books, and we’re going to say we consolidated it to get to 72,000.

01:06

So the loan, we’re going to say it’s at 72,000. After that consolidation, then we made two payments on it, to bring it down to the 69 879. This one’s going to be more of a traditional loan like a mortgage or loans, we’ve probably seen a car payment or something where we have the monthly payments being made. And this case, then, the monthly payments being made, I’m going to go back to the back to the balance sheet are going to be more than a year, so we’re gonna have to be making monthly payments for more than a year. So that means that we’re going to have a short term portion and a long term portion when we report this.

01:39

In other words, on an accrual basis, we got to break this thing out between the short term and long term portion. So a couple things we need to do, we got to consider whether or not the interest is recorded correctly. In this case, we have been recorded the interest correctly so that should be okay. Now we’re going to be breaking out the short term and long term portion. To do that, we’re going to need the amortization schedule. So I’m going to have to go to the amortization schedule.

02:03

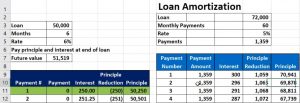

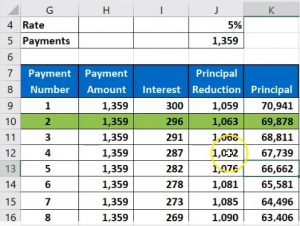

This is our amortization schedule on the second loan over here. And you’ll recall that we made these two payments. So we’re basically here at this point in time. So at this point in time, this number is correct, right, I’m going to make that the lighter green, the lighter, I want the lighter one. At this point in time, we’re at that 69 878. And that should tie out to the 69 878 here. So that’s correct. The only problem is now that we need to be breaking out the short term and long term portion.

02:35

Now, this gets a little bit confusing when you look at the amortization schedule, because the thing that you would think is you’d say, Well, the short term portion is just simply going to be the payment amount that I’m going to make 1359 times 12. Right, I’m going to pay 16,000 308 in the next year, and the definition of something being short term is that it’s going to be due within the next year. There’s a problem with that. However, What’s the problem with that? The problem is that there’s interest involved in that payment. And you might say, so I’m paying interest within the next year.

03:09

So I should be able to, you know, that’s what to do within the next year. But you can’t really include the interest because that would be like saying that I’m going to pay the rent on my on my office space for the next year. So I’m going to include that as a liability right now, you can’t do that. Why? Because you haven’t incurred the rent yet. You haven’t been in the office building, therefore the rent isn’t due, you’re going to incur it, you know, you’re going to incur a lot of expenses that you can predict that you will incur in the future, but you’re not going to put them on the books until they haven’t been incurred. And the interest is just like rent, right? you’re renting the use of the money.

03:45

You haven’t incurred the interest yet, you will be paying it but you don’t owe it yet because you haven’t had the purchasing power of the money over that time period to incur the interest just like you haven’t, you know, use the office space yet that you will be using less next year. So that means that we have to, it’s a bit more complicated, then we have to be breaking out just the principle, not the future interest payments. So this is the principal portion we have. And so this is going to be the principle that we’re going to have. And I think I spelled it wrong principal principal. Wow. Something like that principal. Wow. Alright, just to correct that for in case anyone was looking at that, and like I didn’t spell it right. I’m pretty sure that’s the right way. I’m still not positive, but I think it’s bad anyway.

04:29

Now we’re going to be saying that this is the principal portion, the reduction in the principal and this is the interest. So this is the total payment, this is the interest on it. This is going to be the principal portion. So I’m going to count down 12 months from here, this is where we’re at at this point in time, we’re going to be starting on payment three next time 1-234-567-8910 1112 12 payments, I’m going to make that yellow. So those are going to be the payments we’re going to make and you could see QuickBooks will basically add it up for you down below. That comes out to the 1313 109. So if I go back down here, then at the end of 12 months after those payments are made, this is going to be the new principal mount. So that’s going to be the new principal amount.

05:15

So in other words, if I was to say the short term I want to take a look at this is the total amount of the loan right now, short term portion is going to be equal to the yellow items. So the yellow items are going to be the short term, 12 months of payments of just the principal. And then the long term is going to be the difference, it’s going to be the difference about the total loan at this time minus the short term portion. There’s the long term portion which of course matches the long term portion here leftover after 12 months of payments. So that’s what we’re going to do then we’re going to be breaking out between the short term and long term portion. And so we’re going to we’re going to go in and make an adjusting journal entry for that 13 901 13 109.

05:58

So let’s go back to QuickBooks. And if I go, can I just minimize this? No, I can’t do that, cuz I didn’t have this one open. So I’m going to go back over here, we’re going to go into this account, we should do this with journal entries. But we can also use the register. So we’ll get used to using that register, we will be using a journal entry form like we did before, I’m going to be taking it out just the short term portion of this account, we’re going to be putting it into then the short term account that we made up here, notice again, I’m going to be combining these two loans together in the short term portion.

06:29

Because this is just for reporting purposes for financial reporting. And for reporting purposes will basically combine all of our notes together as short term and then I’ll and then the long term if they were more combined, I would just combine them as one number for the loan for financial reporting purposes. And then I’m going to reverse it back out and record it down here as a single amount in the long term section its own subsection with the account numbers for to make it easier for us to make the payments and track those loans. balances.

07:01

Alright, so let’s go back up top, we’re going to look for the register, we’re going to go back to the second tab going to hold down Control, scroll down just a bit, we’re going to be looking for the accounting on the left hand side, we’re going to be in the chart of accounts. Scrolling down, we’re looking for the liabilities again. So I’m down here in the long term liability, we’re looking for that 7951, the note payable, it has the 68 something in it when I close the hamburger, and maybe we’ll be able to see it. Now. That’s okay, that’s the one we want. And then I’m going to go into the register. Let’s go into the register. And then I’m going to select the old drop down here and see what we have noticed we only have a couple things, we want the journal entry, we’re going to make a journal entry.

07:40

We’re not going to be using debits and credits, but it’s going to be making a journal entry form when we look at it on the financial statement and then we’ll get to see those debits and credits which will be exciting. Okay, let’s change the date to our cutoff date as all adjusting entries are as of the end of the month Oh to 29 to zero that’s we’re going to make our financial statements correct as of that time period, as of date, we’re going to say that this account will be decreasing, it’s going to be decreasing by the short term portion or the 13 109. So 13109 and it’s going to be going to the other amount that we had of the other accounts, which was the notes payable short term.

08:17

So notes payable current or no stable current. That’s what we set up. And I’m going to say tab. That’s the one we want. And let’s go ahead and record this and then go to the balance sheet and see what happens with it. So I’m going to say save that please. And then we’re going to go back to the balance sheet within the balance sheet will refresh the bounce, it doesn’t look like it’s fresh. I only work with fresh reports. So I’m going to refresh it. That looks fresh. Alright, so now I’m going to scroll back down. And we said that this one now went down.

08:51

So the long term portion is now at 56 760-950-6769. And that ties out to this I’m out here or this amount, the long term portion, then if we go up to the short term portion on the loan, we’re going to go up to the short term portion, it’s grouped together in this 63 109. Because we grouped those two amounts together. If I open that up, then we see it’s consisting of two items. These are the two items, one being that 50,000 for the short term loan, which was all short term. And there’s our 13 109, which, of course, is the short term portion here of that loan. I’m going to go back in I’m going to open up the journal entry. And I should be putting in that it’s an adjusting journal entry, which I forgot to do too.

09:37

So I’m going to go ahead and do that. I’m going to open this up. And now we get to see those debits and credits we were looking to see we were hoping to see in the adjusting entries. Those are the things that we were waiting for. We made them happen at the end of the video here to keep you keep you waiting. So that’s going to be an adjusting entry adjust. I’m just going to say a DJ entry, just to note that it’s an adjusting entry.

09:59

So when We make our reports, we can see that it’s really nice to do that, by the way too, because it might be the possible that you are entering the adjusting entries possibly as like a CPA firm or the adjusting department being separate from the bookkeeping department. And even if you’re not separate from the bookkeeping department, you might think of it in your mind is something separate. When you do the bookkeeping, you’re doing something logistically correct. You’re trying to do things as quickly as possible as easily as possible from a bookkeeping perspective.

10:28

The adjusting entries are designed to then alter anything to be more on an accrual basis to be more properly accrual as of the end of the month. So if you think about these two things as being separate, especially if you have different departments, like a CPA firm, and and the client possibly, or two different departments of bookkeeping and then the adjusting entry department at month in, then you want to be able to say to if you’re saying you’re a client, let’s say you’re a CPA firm to the client, when they see the the Justin entry in there, they’re gonna say, Oh, that’s something that CPA did.

11:03

That’s something that, you know, the accountants did. And, and so so it’s not something I did, and therefore if I have a question about it, I can ask them about it. And so what we want to do is think about those two things being separately, Mark label what we’re doing in there. And if, uh, if I count shows up and they see something funny, we want to be able to explain that. And we also want to be able to reverse anything we do that messes up the accounting department logistically, because we’re not really correcting things oftentimes here, what we’re really doing with the adjusting entry process is something that’s part of the adjusting entry process.

11:36

It’s part of the accounting process. And we want to make it adjusted as of the time period end, so that it’s right on a financial statement purpose, and then make it go back to what it was before, so that it works logistically correctly, which is what the accounting department will be working with. So I’m going to go ahead and say save and close here. And there we have it. So now we haven’t marked off as the adjusting entry. And then we’re going to go back and there it is. So everything looks good there. We have our long term and short term portion broken out.