QuickBooks Online 2021. Now, report formatting basics. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive file, which you can find by searching in your favorite browser. For QuickBooks Online test drive, we’re in Craig’s design and landscaping services practice file, we’re going to practice formatting of reports and customization of reports from the basic or standard reports, we will do so with the balance sheet report.

Posts with the accrual basis tag

Report Formatting Basics 2.15

QuickBooks Online 2021. Now, report formatting basics. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive file, which you can find by searching in your favorite browser. For QuickBooks Online test drive, we’re in Craig’s design and landscaping services practice file, we’re going to practice formatting of reports and customization of reports from the basic or standard reports, we will do so with the balance sheet report. But many of these things can be done to many other types of reports as well.

Cash Budget 415

Corporate Finance PowerPoint presentation. In this presentation, we will be discussing the cash budget Get ready, it’s time to take your chance with corporate finance, cash budget, as we consider the cash budget, let’s take a step back and think about the budgeting process. So we can think about where the cash budget will fit in it. So we got to start off with the sales projection, that’s going to be our first step. So we can think about the production plan if we manufacture inventory, or we think about the purchasing plan. If we purchase and sell inventory, then we can think about the pro forma income statement. Now the pro forma income statement is going to be on an accrual basis. But we also want to be considering the cash budget. So obviously, once we have once we start to construct the income statement, on an accrual basis, we can also think about what the cash flows will be.

Statement of Cash Flows 235

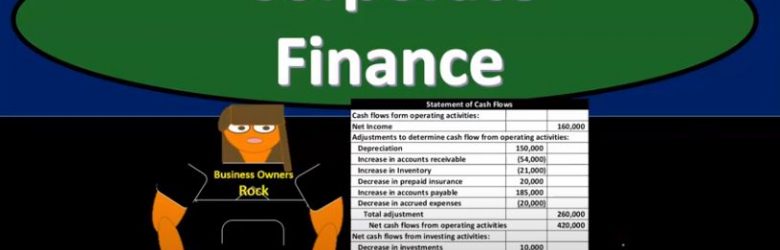

Corporate Finance PowerPoint presentation. In this presentation, we will discuss Statement of Cash Flows Get ready, it’s time to take your chance with corporate finance statement of cash flows. So remember when we’re thinking about the financial statements, we can think about them as answering two major questions to users of the financial statements. For examples, if we’re thinking about investing to the company in some type of way, and are using the financial statements to help us make a decision with regards to that, we want to know where does the company stand at this point in time, what’s basically their worth at this point in time. For that we get help from the balance sheet, which is going to give us the assets liabilities, equity, assets, minus liabilities equals equity, which is basically the book value as of a point in time.

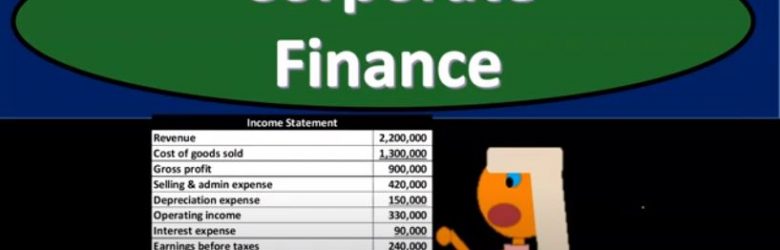

Income Statement Overview 225

Corporate Finance PowerPoint presentation. In this presentation, we’re going to continue on discussing the income statement. Get ready, it’s time to take your chance with corporate finance income statement continued. Remember that as we think about the financial statements, we can break them out into basically two objectives that an investor might have the investor would want to know two general things one, where does the company stand at a point in time with their approximate value as of a point in time? And two? What is the likelihood of their performance in the future? What how well, will they do in the future? How can we predict how well they will do, we’re going to base it on past performance. So the point in time statement is going to be the balance sheet. So remember, if you’re looking at financial statements, for the year ended, say, December 31, the balance sheet will be as of a point in time and therefore as of December 31, it will not be a range. Whereas if you’re looking at a time frame, meaning the beginning to the end of the period, so if you’re looking for financial statements for the period ended, or the year ended, December 31, then the income statement, the primary timing statement, will be represented, it’ll say January through December or for the year ended December 31.

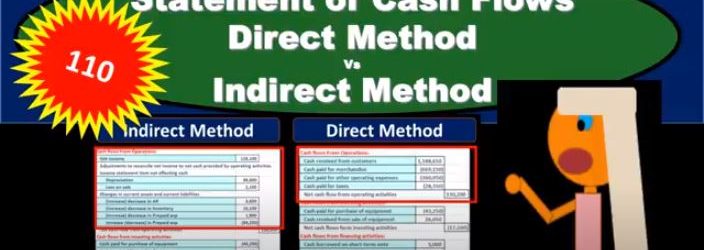

Statement of Cash Flows Direct Method Vs Indirect Method

In this presentation, we will compare and contrast the direct method versus the indirect method for the statement of cash flows. It’s important to note that when we’re comparing the direct and indirect methods, we’re really only talking about the top part, the operating activities portion of the statement of cash flows. In other words, the investing activities and financing activities and in result will remain the same, we’re going to end up with the same result, which of course, will be the Indian cash that we can tie out to the balance sheet. And we’ll have the change of cash here, which is really kind of the what we’re looking for in the statement of cash flows. What’s going to differ is the operating activities, why are they going to differ? Why would we have the operating activities differ? Remember that the operating activities have to do with kind of the income statement you can think of it basically as the income statement being reformatted to a cash flow statement versus an accrual statement. So the income statement that we use is on an accrual basis, and we recognize that Revenue when it’s earned rather than when cash is received expenses when expenses are incurred rather than when cash is paid, that’s gonna be on an accrual basis.

Statement of Cash Flows Introduction

In this presentation, we will introduce the financial statement of statement of cash flows. When thinking about the statement of cash flows, we want to compare and contrast the reasons for it to what the other financial statements are providing us what information in other words, are we going to get from the statement of cash flows that’s not on the other financial statements, those being the balance sheet, the income statement, the statement of equity, we’re mainly comparing against the income statement, because the statement of cash flows going to give us some similar information. It’s going to give us information over time, what’s happening over time, unlike the balance sheet, which is going to have a point in time. So we’re still looking at at timing what is what is going on over time. That’s typically our income statement, which measures performance. The major goal of the income statement is to measure performance, how have we done how much work have we done, revenue minus expenses, revenue being recognized when we earn the work when we’ve done the job expenses when we We’ve incurred something in order to help generate in the same time period. And that’s going to be the net income. What that doesn’t do, however, is measure cash flow. And when we first learn about the income statement, that’s going to be a real big distinction we want to look at, we want to say, okay, the income statements on an accrual basis.

Short Term Loan Adjusting Entry 10.10

This presentation we will look into recording and adjusting entry related to a short term loan. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file. Let’s first take a look at our reports our balance sheet report for this transaction that we’re going to be recording or this adjusting entry, we’re going to be opening up our favorite report that being the balance sheet report, we’re going to change the dates up top the dates from let’s make it a 1012020 229 to zero. Now, when we think about the adjusting entries, we’re always going to be thinking of them as kind of like the cutoff dates, we’re trying to make things correct as of the cutoff date, which in this case, it’s going to be the end of the second month.