Corporate Finance PowerPoint presentation. In this presentation, we will be discussing the cash budget Get ready, it’s time to take your chance with corporate finance, cash budget, as we consider the cash budget, let’s take a step back and think about the budgeting process. So we can think about where the cash budget will fit in it. So we got to start off with the sales projection, that’s going to be our first step. So we can think about the production plan if we manufacture inventory, or we think about the purchasing plan. If we purchase and sell inventory, then we can think about the pro forma income statement. Now the pro forma income statement is going to be on an accrual basis. But we also want to be considering the cash budget. So obviously, once we have once we start to construct the income statement, on an accrual basis, we can also think about what the cash flows will be.

00:50

And part of that process will be to think about the accrual process related to possibly purchases here that could take place as well as sales that will be take place meaning the inflows in terms of sales, what are those sales going to be on account that are going to flow through accounts receivable? And what’s going to be the cash related to those sales? And then with the payments or the expense side of things? What is that going to look like in terms of the payments, including the payments for materials or inventory that might go through accounts payable, and then what’s going to be looking like in terms of the cash budget, we also might have other things that we’re going to need in order to create the cash budgets, including capital expenditure budgets, for things like property, plant and equipment, if we plan to be purchasing property, plant and equipment, those are items that will not be will not be on the income statement except in the form of depreciation, because they’re going to be put on the balance sheet as an asset and then depreciate it.

01:43

So they’re going to be on the balance sheet even if there was a cash expenditure for them. So we can think about the cash budget in large part similar to the income statement showing the performance what’s going to happen over time as the income statement is doing. However, the income statement doing it on an accrual basis revenue, recognizing revenue and expenses when incurred and used, whereas the cash will show inflows and outflows basically a cash basis method to think about the inflows and outflows. However, we do have kind of balance sheet components on the cash budget as well, because we’re also going to have a beginning point in cash, the beginning balance of cash, which is basically the balance sheet point in cash. And then the Indian Point in cash, we’re going to say, where do we stand at the end of the point at the end of the timeframe, after we have our inflows and outflows.

02:28

And we also have items on the cash budget that may not be on the income statement, due to the fact that they’re not being cash spent for current period activities, but rather for investments, such as cash expenditures for property, plant, and equipment. So then once we think about these items in the income statement, then we think about the beginning balance for the balance sheet. So when we think about the income statement, that’s going to be saying what has happened, similar to the cash flow part of the cash statement, and then we’re going to tie that out to the beginning balance where we started, that’s going to be the prior period balance sheet. And that’ll give us to our ending point, the balance sheet here. So when we, when we get the pro forma balance sheet, we’re going to need the income statement, which is going to tell us you know what we did during the time period, the beginning balance sheet here, which will Vince we’ll add the income statement to it.

03:22

And then we’re also going to need the cash budget as well, which of course will tie into the cash flows, and help us to determine the ending point that we should be at in terms of cash on the balance sheet. cash budget. So in a lot of ways we can compare the cash flow budget to the income statement and the income statement showing the activity on a flow basis. So the performer income statement uses an accrual method, while the cash budget is going to use a cash flow method showing performance on the income statement in terms of an accrual method showing revenue when it’s earned expenses when they are incurred, as opposed to when the cash flow happens. On the cash flow statement, we’re going to have those same kind of components that you would find on the income statement that we’re going to basically convert into a cash method showing the cash flows related to performance. But then of course, we’re going to have to add to that on the cash flow statement.

04:12

Anything that’s in a capital expenditure, things that are going to be cash related, that are not typically things that would be on the income statement, such as purchases for capital expenditures, and possibly financing type of activities, things like loans and issuing equity and things of that nature. So must use more precise timeframes, to predict and estimate patterns of cash flows. So the cash flows can actually be a little bit more difficult. Because when we think about something like revenue on an accrual basis method, we can think about what the revenue generation is and and not have to worry so much about what the cash flow is going to be related to it meaning whether we make the sale on a cash basis or we make the sale on on account going through accounts receivable receiving the cash later, we’re going to have it on the on the Income Statement possibly in a more even kind of format.

05:03

When we think about the cash flow, however, then we got to break that down into chunks and say, Okay, now, how much of that revenue are we actually going to be receiving and in which period will we be receiving it? The same will be true with the outflows. If we’re paying for something, if we’re buying things on account, we will record them as an expense whether or not we paid for them or just put them into accounts payable, and we’ll be paying them in the future. When we think about the cash budget, we have to think about when we’re actually going to be paying the things that we purchased for the cash flow. So the cash flow process will just basically start with a cash inflow. Let’s think about cash coming into the company. When cash comes into the company. Typically, that’s going to be coming in from sales. Now it could come in from like owners, or taking out a loan. But we’re thinking about, in this case, a cash inflow. Generally, with regards to sales, what will that look like we’re going to have the starting point will basically be the sales projections.

05:58

So we’re going to take the sales projections, meaning these are going to be the sales that took place, or that we projected to be happening. And then we got to think about what of those sales we got to predict the amount of sales that will be for cash and the amount sold on account going through accounts receivable? In other words, when we think about the sales number, we get to break it down then to are we making these sales for cash? Meaning you can imagine being in a store someone come up to the cash register, and we’re actually collecting payment at that point in time? Or are we having some of these sales or all of these sales on account meaning, possibly, we’re in a business where we do work, we invoice the client, meaning it goes into accounts receivable at that point in time, when we invoice the client and we record the revenue, then they pay us later on the income statement, we would still record that as a sale when we did the work under the accrual method, but we would be receiving cash later.

06:51

So we have to determine I mean, do we make all of our sales for cash, and we get paid at the same time? Do we make some of our sales or all of our sales on an accrual basis on account? meaning we’re going to put it through accounts receivable, before we get the cash, then the items that we have on credit, any credit sales that we have made, meaning we sent out an invoice recorded the accounts receivable and the sales at the point we send out the invoice and they get paid later, then we have to determine when we’re going to get paid. Meaning we have to estimate on average, how often do we get paid? You know, how long is a receivable outstanding? Do we usually get paid in the following month? Or does it usually take two months? How much do we think we’re going to get paid in the following month after the sale? How much do we think we’re going to get paid two months after the sale, and so on and so forth. As we break it down to the cash flow, then we have the cash payments. Now, when we think about the cash payments, there’s a lot more categories that we could have.

07:49

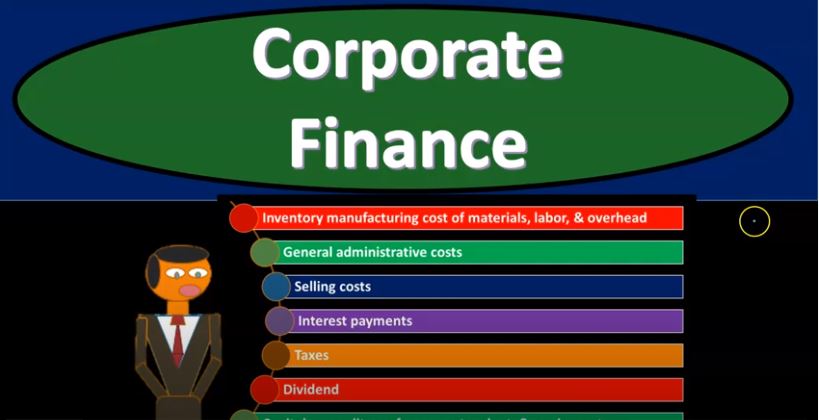

Because if you compare this to like the income statement, obviously with the with the revenue, the inflows of cash, you know, on the income statement, it would be on an accrual basis, but revenue, the cash equivalent of revenue or revenue on a cash basis, we only do like one thing, right, so there’s only one line item, and then we basically pay for everything else. So we have a lot of categories of expenses on the income statement. And the same will be due for for a cash budget, right, we’re gonna have a lot of categories for cash outflows hoping hopefully that the sum of all the cash that’s been out flowed is less than the inflow, but the categories for which we are paying the outflows will be greater. So we’re gonna have that same kind of kind of issue with the with the cash flow. So the cash outflows could include things like inventory manufacturing costs, if we make the inventory for things like material, labor and overhead. So anytime we make something, and it’s inventory, we want to break it down into those components, materials, labor and overhead. If we simply purchase and sell inventory, then we’re just going to be purchasing inventory.

08:53

So that would be purchases, basically, for inventory of cash outflow, General administrative expenses. So these are going to be the categories category on the income statement that we typically see the administrative expenses. Now, the admin expenses are usually going to be somewhat more standardized. So as we talked about on the income statement, and then oftentimes the cash flow will be somewhat standardized as well. So that the admin expenses for things like salaries for the for the officer salaries and whatnot are usually somewhat standardized. Some things might not be on the cash flow, such as depreciation, which would be on the income statement, because it’s a non cash items. But these are usually things that are fairly standard from period to period, and fairly easy then to put into the cash budget as well as the income statement budget. And then the selling costs, also, usually period costs meaning they they’re gonna usually not change a whole lot, but change a little bit more than the general and admin. For example, we might have something like commissions that will change with regards to the sales level.

09:57

But again, usually the selling and admin costs are gonna be Somewhat standardized over over time. So they’ll usually be fairly easy to project out whether we’re talking about the income statement in terms of an expense format, or cash in terms of when we’re actually going to pay them. And then we got the interest expense. Now, this could vary a little bit depending on the type of loans that we have. Meaning we might make payments on the loan paying the interest every month, or we might make periodic payments, in which case, the amount that’s going to be on the income statement for interest expense will differ than the cash flow. For example, if we only pay interest expense on bonds twice a year semi annually, then on the income statement, we’re going to record the interest expense that has been accrued accrued every month, even though on a cash flow basis, we’re only going to record the cash that’s being paid when they’re actually paid.

10:48

So this is an area where we could have a difference between what would be on the income statement in terms of an expense, what would be on the cash flow statement in terms of when the cash is actually paid, then we have the taxes. Same kind of thing here. When we think about, say income taxes, we have to record the income taxes as we generate revenue on an accrual basis, even though we’re not going to pay them typically till a later time, possibly quarterly. So on an accrual basis, we’re going to record the expense as they are incurred, and on the income statement every month, then we’re going to have a tax expense related to what we think or estimate the tax payment will be. And then we’re going to pay them possibly quarterly or something like that. So on a cash flow basis, we’re not going to record the tax payments for income taxes until we pay them possibly on a quarterly basis. And that will differ than what we will see on the income statement, which will record expenses when they are incurred, which will be every month every time we generate revenue.

11:46

And then we have the dividends. So dividends represent us taking the earnings of the company and paying it to the owners in the form of dividends paying it to the stockholders, this is something that won’t be on the income statement at all. Because this doesn’t deal with the performance of the company this deals with whether or not we’re going to take the money that has been generated, pay it back out to the owners in the form of dividends, or possibly keep it in the company. But from a cash flow statement. This is going to be a cash flow, right. So if the dividends go out, cash went out, even though it’s not on the income statement, it is going to be a cash outflow. If you’re thinking about the the statement of cash flows, this would be like a financing type of activities, a cash outflow, that’s not really a performance type of thing that wouldn’t be on the income statement. Then we have the capital expenditures for property, plant and equipment.

12:38

So these are things that we’re going to, you know, buy a new piece of equipment or a new building or something like that, we might finance part of it, we might take out a loan, and we might pay cash for it. This is something that also will not be on the income statement won’t be on the income statement. Why? Because the income statement measures performance. And these are basically investments. Meaning if we buy something for like 300,000, like a building or equipment, it has not yet been used or not fully used. In any case, in order to help generate revenue. So on an accrual basis, we will then allocate the cost to the income statement in the time period that we estimate that it’s going to be used in order to generate revenue, and that’s going to be with the depreciation. Whereas on the cash basis, we’re going to record it when we pay if we paid 300,000 up front, we’re going to record the cash being paid up front.

13:23

So once again, we will have a difference between the cash flow and the and what’s going to happen on the income statement with regards to capital expenditures. And that’s going to be one of the things that we’re going to need to put together. I in order to make the the cash flow statement, we might need a whole nother schedule to just plan out what our capital expenditure budget will be. So then we have the accounts payable. So the other thing we want to consider out with account with cash payments is anything that’s going through the accounts payable. Now typically what goes through accounts payable will be things like if we purchase materials, if we make the if we make the products, our inventory, or if we purchase inventory and then sell it, then the purchases will typically go through accounts payable, but anything that goes through accounts payable will be similar to what we did with accounts receivable, we’re going to have to think about okay when you know when are we actually making the purchase,

14:20

say for materials or inventory, determine the purchases that we’re going to make on account meaning on like credit, meaning we got something and we didn’t pay for it, we’re going to pay for it in the in the future purchases going through the accounts payable, that’s the account that’s going to go through it’s an accrual account, often related to the materials purchases, this will typically especially in book problems and in practice be tied to the materials purchases or purchases of inventory of the company. Then we need to estimate when the cash payment related to these purchases will be made. So we got this kind of difference than what we’ll see in the income statement again. So like on the income statement, well, you know, if we purchase like inventory, then it would go on the books as an asset. It at the point in time that we purchased it. And then we would record it as an expense when we sell it in the form of cost of goods sold.

15:08

But even if you think about as purchasing something like an expense that we’re going to expense at the point in time that we purchased, like we pay for a service, and it went through accounts payable, even that we’d have to say, okay, we purchased it. And we record the expense when we when we purchased it if we consumed it at the same point in time on an accrual basis, and then we’d have to think about on a cash basis, when did we actually pay for it? And then we got to think about Okay, do we typically pay the accounts payable? How often do we turn it over?

15:35

Do we pay the accounts payable next month, sometime like 30 days after? Or two, how much do we think we’re going to pay two months after, like 60 days after so there’s going to be this lag effect in terms of when we make the purchase. So we’ll have to figure out what the purchasing budget will be. And then how much of those purchases we purchase on account as opposed to cash typically will purchase like all of our stuff on account if that’s the way we do it, and then we’ll pay them at some future point and we have to decide how, you know, when do we pay them after the purchase point because that’s what we need for the cash flow budget.