Hello in this presentation we’re going to take a look at financial statement relationships. In other words, how do these financial statements fit together? How do these financial statements represent the double entry accounting system in the format of the accounting equation that have assets equal liabilities plus equity? First, we’ll take a look at the balance sheet. Note that most textbooks will talk about this relationship and constructing the financial statements by first saying to construct the income statement, then the statement of equity and then the balance sheet. If you’re constructing things by hand with a paper and pencil, that does reduce the number of calculations that you would need to do, however, if you’re using something like Excel, then it’s a lot easier to sum up columns of numbers and it might be useful to take a look at the balance sheet. In any case, the relationships will be the same when we consider the relationships between the financial statements.

Posts with the Balance sheet tag

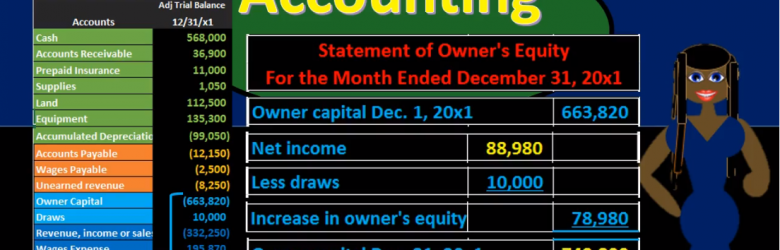

Statement of Equity From Trial Balance 17

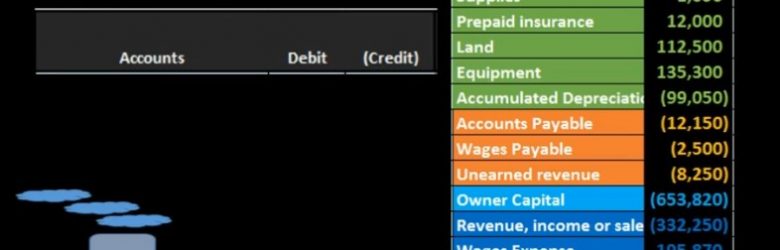

More in this presentation we will take a look at the statement of owner’s equity and see how to construct the statement of owner’s equity from the trial balance. When looking at the trial balance, we can see the accounts will be in order with the assets and then the liabilities, then the equity and then the revenue and expenses. The equity accounts being broken out here of owner capital and draws. But it’s a little deceiving to break out this equity section. Because the trial balance really is showing both a point in time the balance sheet account permanent accounts up top and timing accounts which are going to be the revenue accounts down below. When we think about the point in time for total equity as a whole. We’re really considering the entire blue area here. This is one of the most confusing concepts to really know when you’re looking at these financial statements.

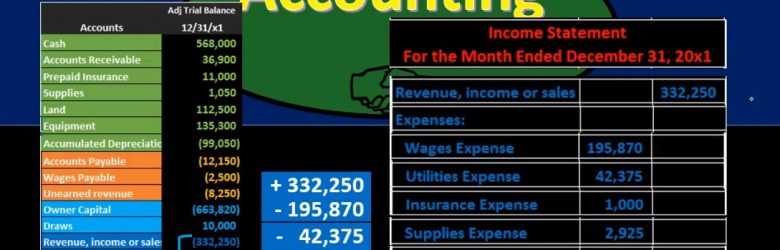

Income Statement from Trial Balance 16

Hello in this presentation we’re going to take a look at the creation of the income statement from the trial balance. First, we want to take a look at the trial balance and consider where the income statement accounts will be. When looking at the trial balance, it will be in order we have the assets in green, the liabilities in orange, the equity in light blue, and then the income statement accounts including revenue and expenses. That’s what we are concentrating here we’re looking at those income statement accounts. And that is what will be used in order to create the financial statements to create the income statement. Note that all the blue accounts represents the equity section. So the income statement really is going to be part of total equity. If we consider that on the balance sheet, then we’re really looking at a component of this capital account.

Balance Sheet Equity Section Creation from Trial Balance 15

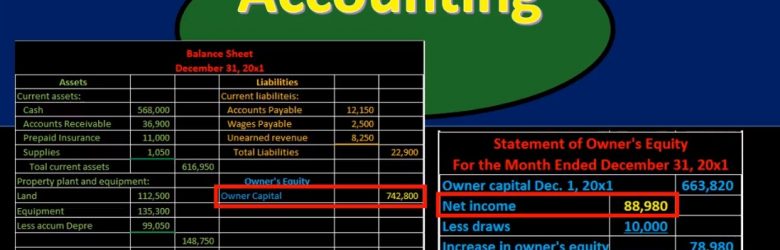

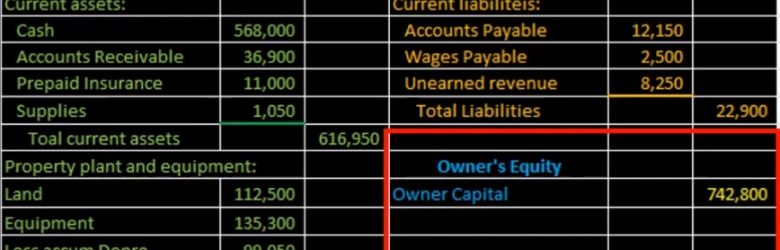

Hello in this lecture we’re going to be creating the equity section of the balance sheet. In prior lectures, we have taken a look at the current assets section, the property plant and equipment section and then the liability section. This will be rounding out the balance sheet where we will finally get to total assets being equal to total liabilities and equity represent in the double entry accounting system. In terms of the balance sheet in terms of the accounting equation, we of course, are pulling these numbers from the adjusted trial balance. the adjusted trial balance also represents the double entry accounting system. However, it represents that double entry accounting system in the format of the building blocks of debits and credits. All we’re doing is taking those building blocks in terms of debits and credits, rearranging them to the accounting equation, so that readers who don’t understand debits and credits can then read them. Now when we look at the equity section, this is a bit confusing when we convert from the trial balance to the equity section.

Balance Sheet Liability Section Creation From Trial Balance 14

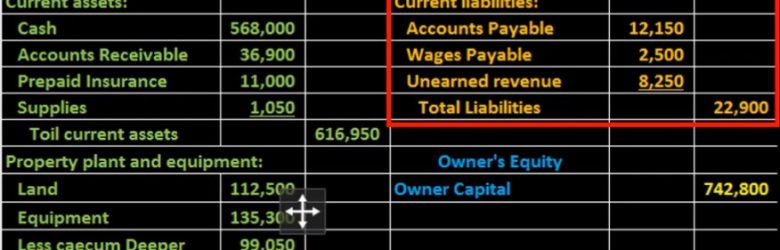

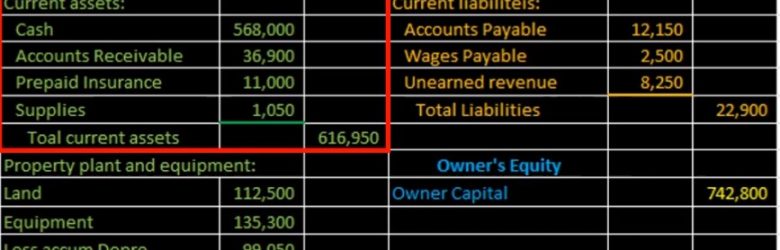

Hello in this lecture we’re going to create the liability section of the balance sheet. In prior lectures, we have taken a look at the assets in terms of first current assets and then property, plant and equipment and given us the total assets at that time, then we are now going to move on to liabilities, and that will be part of the second part of the balance sheet meaning it’ll then sum up to total liabilities and owner’s equity. We are going to be taking this information of course from the adjusted trial balance the adjusted trial balance in the format of debits and credits, we are now formatting it in the format of the accounting equation. Still the double entry accounting system just in two different formats, just reshuffling the puzzles so that different readers can understand the financial statements even though they don’t understand debits and credits.

Balance Sheet Current Assets from Trial Balance 12

Hello in this lecture, we’re going to create the current asset section of the balance sheet, we’re going to create this current asset section from a trial balance, we’re going to piece together the financial statements piece by piece as we go through a series of lectures, the trial balance being here at this is going to be the adjusted trial balance. And what will happen is we will then find a home for all of the accounts on the financial statements. Once we then do that, that means that we have then converted this from the double entry accounting system being in the format of debits minus credits equaling zero or debits equaling the credits to the assets equals liabilities plus the owner’s equity, basically the accounting equation, which is reflected on the balance sheet. So we’re going to start off by doing the current assets section, which will just be this part we’re going to find a home for these first few accounts.

Adjusting Entry Insurance 9

Hello in this lecture, we’re going to record the adjusting entry related to insurance, we’re going to record the transaction up here on the left hand side and then post that to the trial balance on the right hand side, the trial balance being in the format of assets in green liabilities in orange. Then we have the equity section in light blue and the income statement, including revenue and expenses in the darker blue. We will start off by just identifying the accounts that will be affected and then talk about why they will be affected. So we know that we have the adjusting entries. Remember that adjusting entries should be kept separate in your head in that they do have the same characteristics of having debits and credits in at least two accounts affected however, they’re also all as of the end of the time period, either the end of the month or the end of the year.

Debits & Credits 205

Hello in this presentation we will discuss debits and credits. Objectives at the end of this we will be able to define debits and credits list account normal balances and explain how debits and credits work. First we want to take a look at the double entry accounting system and recognize that the double entry accounting system can be represented in multiple different ways including as we have seen before the accounting equation meaning that assets equal liabilities plus equity, we can record transactions using this accounting equation as we have done in the past. That accounting equation is the basis behind the balance sheet where we have the assets liabilities and equity representing the fact that the balance sheet then would be in balance.

Statement of Owner’s Equity 131

Hello in this presentation we will describe the statement of equity objectives, we will be able to at the end of this describe the statement of owner’s equity, list the components of the statement of owner’s equity and explain the reasons for a statement of owner’s equity. When we consider the statement of owner’s equity, we are like the income statement and unlike the balance sheet, talking about a timeframe, meaning we have a beginning and end point, unlike the income statement, the beginning point is not zero meaning we are going to start at the beginning point of the net value or the equity section of the prior balance.

Income Statement 130

Hello in this presentation we will discuss the income statement objectives. At the end of this presentation, we will be able to describe what an income statement is list the parts of the income statement and explain the reasons for an income statement. First, we’ll start off with a question will which will explain the timing of the income statement or introduce us to an explanation of the timing of the income statement? And that is the question of asking somebody, how much do you make when we were to if we were to ask somebody how much they make, they would mentally make some type of assumption in order to answer that question, or they would ask you the question if they chose to answer at all.