Hello in this lecture we will discuss the accounting building blocks and the double entry accounting system. At the end of this we will be able to define and describe the double entry accounting system, write down the accounting equation and define each individual part of it, define and describe debits and credits, define a balance sheet and list its parts define an income statement list its parts and explain the relationship between the balance sheet and the income statement. Okay, so starting off every business and accounting software uses the double entry accounting system. So the double entry accounting system, it’s kind of like the math behind the calculator, every software is going to use it. In order to understand what the system is doing, we need to understand the double entry accounting system.

Posts with the balance tag

Accounts Receivable AR Subsidiary Ledger Explained

Hello, in this lecture we’re going to talk about the accounts receivable subsidiary ledger, the subsidiary ledger being the ledger that will be backing up the account of accounts receivable showing on the trial balance with 27,000. In it, in this case, accounts receivable being that accounts that represents what is owed to us. If we were the owner of the company, we might ask our accounting department, how much money do people owe us? In this case, it would be 27,000 would be the reply. Next follow up question would most likely be who owes us that money? And have we called them when are we going to get paid that money? In order to answer that question, we cannot look at the normal backup balance for all accounts that being the general ledger accounts. If we look at the GL we do get some detail in terms of the activity that has happened. However, that activity is not going to be in terms of who owes us the money. It’s in terms of date.

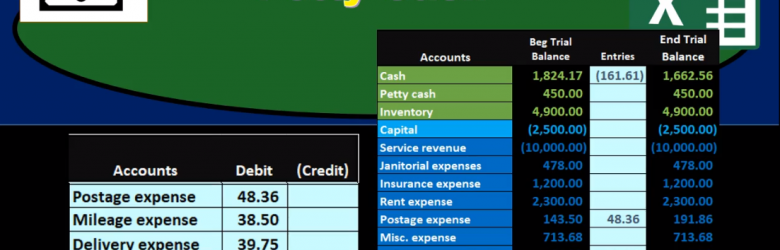

Petty Cash

In this presentation we will talk about how to set up and record a petty cash fund. Setting up a petty cash fund seems like an easy thing to do to have a minimal amount of cash that we can have expenditures for small purchases for however, it can be a little bit tricky to set up the petty cash fund and there is kind of a shortcut to recording transactions for the petty cash fund. So we’ll go over the process of setting up the petty cash fund recording the initial investment in the petty cash fund and then recording the activity from the petty cash fund. Now the objective of course in this will be to have not just the checking account where we need authorization in order to take money out of the checking account, we would typically want anything going out of the checking account to be by electronic fund transfer or by cheque so that we have a clear paper trail of what is going on the petty cash However, if we just have some small items that we need to take care of with cash and as to convenient to have small items with cash to be paid.

Bank Reconciliation-Accounting%2C Financial

Hello, in this lecture, we’ll discuss a bank reconciliation. At the end of this, we will be able to describe what a bank reconciliation is perform a bank reconciliation, make a needed adjustments to our books in the reconciliation process, as well as record those adjustments. So this is going to start off the bank reconciliation process. We’ll start off with, of course, the bank statement. So the bank statement is going to come from the bank, generally, it happens at the end of the month, although we could get it electronically at any timeframe. But typically, it’s still good to get it as of the end of the month so that we can have a set timeframe as to when we’re going to reconcile our account and deal with the timing differences at that time. So this bank statement coming from the bank is going to be as of the end of February in this case, and we’ll have a typical information on a bank statement, which will be that we will have the beginning balance, and then we’re going to have the additions to it generally our deposits and then we’re going to have the corrections to it.

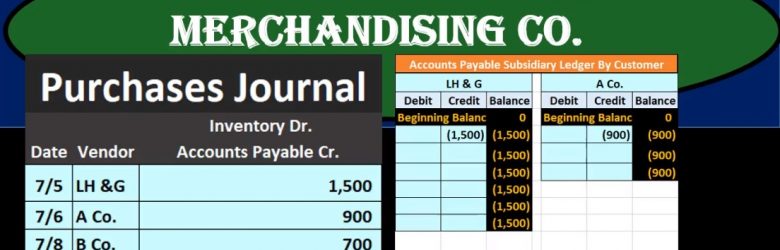

Purchase Journal Merchandising Co.

In this presentation we will take a look at the purchases journal for a merchandising company. Purchases journal will be used when we make purchases for a type of system that will typically more be more of a manual system as opposed to an automated system. However, it is useful to know this in order to have an automated system because the automated system will generate reports that will be similar to a purchase journal and because it’s good to know how different system works to know what are similar what’s different, so that we better understand whatever system we are using. The purchases journal may better be described as the purchase journal on account. So that’s going to be the major point meaning if we make purchases for something that in cash if we spent cash to make the purchase then it will not go in the purchases journal even though we made a purchase because it will go into cash payments journal. So this is really kind of a short name. The accounts payable journal might be a better name for it or the purchases journal on account, but purchases journal is typically the term that will be used.

Accounts Payable AP Subsidiary Ledger 6

Hello. In this lecture we’re going to talk about the accounts payable subsidiary ledger accounts payable subsidiary ledger will be backing up the accounts payable account on the trial balance or the balance sheet. As we can see in the example here we have a balance of 1640 in accounts payable. If an owner asks the question of how much money do we owe to vendors? The answer would then be 1006 40, which we can see on the balance sheet or the trial balance. But the next question that will follow will be who do we owe that money to? And how do is it which of these vendors should we be paying? First? In order to answer that question, we may try to go to the detailed account, which is the general ledger. Typically every account is backed up by the general ledger, we can see that we have the same balance here and we can see that we have activity however, the activity is in order by date. And that’s not really helpful for us to determine who exactly we still owe at this point in time. In order to determine who we owe, we need to organize this information.

Accounts Receivable AR Subsidiary Ledger Explained 5

Hello, in this lecture we’re going to talk about the accounts receivable subsidiary ledger, the subsidiary ledger being the ledger that will be backing up the account of accounts receivable showing on the trial balance with 27,000. In it, in this case, accounts receivable being that accounts that represents what is owed to us. If we were the owner of the company, we might ask our accounting department, how much money do people owe us? In this case, it would be 27,000 would be the reply. Next follow up question would most likely be who owes us that money? And have we called them when are we going to get paid that money? In order to answer that question, we cannot look at the normal backup balance for all accounts that being the general ledger accounts. If we look at the GL we do get some detail in terms of the activity that has happened. However, that activity is not going to be in terms of who owes us the money. It’s in terms of date.

General Ledger 245

Hello, in this presentation we will discuss the general ledger. At the end of this, we will be able to define what the general ledger is. We’ll list components of the general ledger and explain how the general ledger is used. When looking at transactions in terms of journal entries and posting those journal entries in track prior presentations, we were posting those journal entries mainly to a worksheet in order to see a quick computation over the beginning balance and what is happening to that balance, posting it to a format of a trial balance than an adjusting column and then an adjusted trial balance. Note, however, that we typically think of the journal entries being posted to a general ledger. The general ledger can be very complex when we look at it which is why it is often useful to not look at it when we first start posting the transactions but to see that how those transactions affect interest Visual accounts.

Accounts Payable Journal Entries 240

Hello in this presentation we will be recording a business transactions related to accounts payable or the purchases cycle recording these transactions with debits and credits. At the end of this we will be able to list transactions involving accounts payable, record transactions involving accounts payable using debits and credits and explain the effect of transactions on assets, liabilities, equity, revenue, expenses and net income. We’re going to be recording these transactions up here in the left hand side in accordance with our thought process. We will then be posting these not to the general ledger but to a worksheet format so that we can see a quick calculation as to what is the impact or effect on the individual accounts as well as the effect on the account groups as a whole. Remember that all the groups for the accounts will always be listed in order when you’re looking at a trial balance. Which is why I recommend looking at a trial balance.

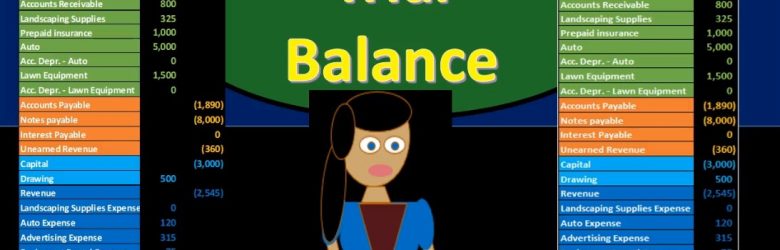

Trial Balance 220

Hello in this presentation we will be discussing a trial balance objectives at the end of this, we will be able to define a trial balance list components of a trial balance and explain how a trial balance is used. When considering the trial balance, we first want to think about where the trial balance falls within the construction of the financial statements. In other words, what processes go before the trial balance, what goes after the trial balance, where’s the trial balance fit into our process? Remember, the ending goal, the ending process of the accounting been to compile the data in such a way to create the finance financial statements. Those financial statements have been the end product. Typically if we’re thinking about a linear process, then we’re thinking about all the transactions that would happen during the month.