In this presentation we will take a look at the purchases journal for a merchandising company. Purchases journal will be used when we make purchases for a type of system that will typically more be more of a manual system as opposed to an automated system. However, it is useful to know this in order to have an automated system because the automated system will generate reports that will be similar to a purchase journal and because it’s good to know how different system works to know what are similar what’s different, so that we better understand whatever system we are using. The purchases journal may better be described as the purchase journal on account. So that’s going to be the major point meaning if we make purchases for something that in cash if we spent cash to make the purchase then it will not go in the purchases journal even though we made a purchase because it will go into cash payments journal. So this is really kind of a short name. The accounts payable journal might be a better name for it or the purchases journal on account, but purchases journal is typically the term that will be used.

01:07

Now we’re going to make a purchase journal for a merchandising company and limit this to a very specific type of purchase, which really is when this system would work best. Because if we purchase a lot of different things on account, like we pay expenses and utility bills, and you know, the gasoline bill and whatnot on expense on account and we put it into accounts payable, then it gets a little bit messy because we don’t have these separate columns that we could break out, we end up putting a lot into other and this system doesn’t work quite as well. However, if all of our purchases are for something like in the case of a merchandising company inventory, then this system works great because we can just record this one line item for the entire time period, whether that be the day, the week or the month. In our case, it will be for the month and then some At the end of the time period and post it with one journal entry rather than recording multiple journal entries, so we’re going to go through just a couple of these, this will look a little bit repetitive here because we will be dealing with the same type of transaction.

02:12

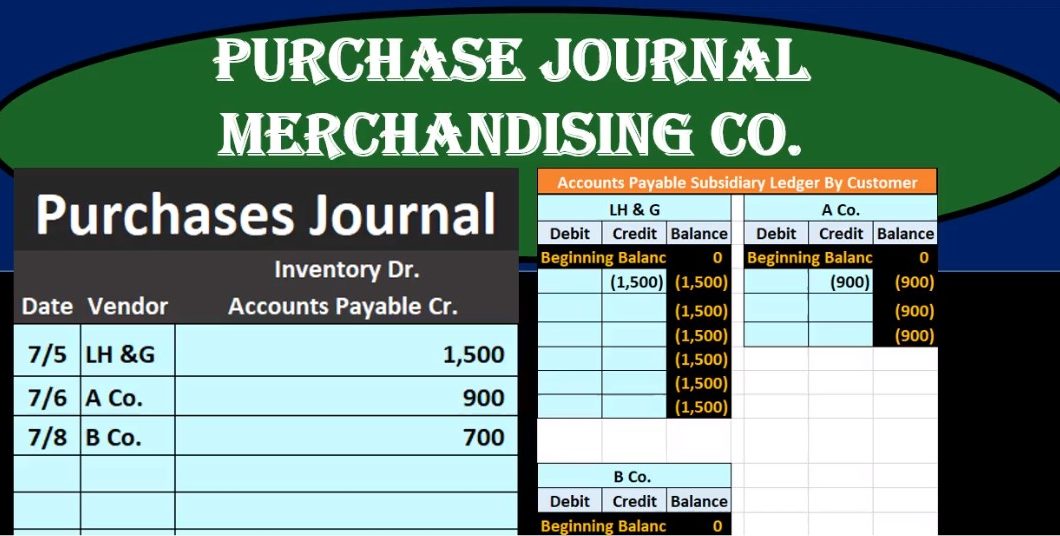

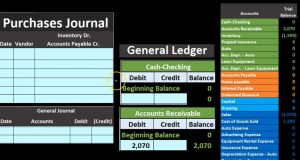

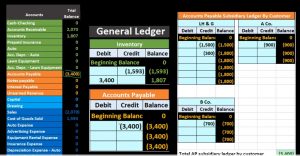

Assuming that under the merchandising company, we will be debiting inventory and crediting the payable for each transaction for the purchase journal. Then, at the end of the month, we’re going to make the journal the general journal entry, which will be the debit to inventory and credit to accounts payable, but not for each transaction for the entire month. Then we’re going to post that to the general ledger. This is just an example of some accounts within the general ledger. And then we will have the trial balance that will be generated we’ll see what the effect is on the trial balance at the end of the month. Note that our numbers will not quite be right until the end of the month because we won’t be recording them to the general ledger. We won’t be generating the financial statements in the system until the And the time period, in our case, the end of the month, first purchase seven five, we’re going to say l, h and G we made a purchase. And that’s for 1500.

03:10

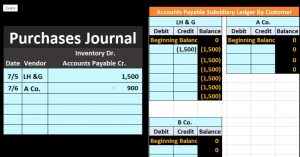

So we’re going to say in this case, we’re going to say it’s inventory that we’re purchasing, we’re always purchasing inventory, we’re using the accounts payable account to purchase inventory. So the journal entry is a debit to inventory, credit to payable because we have not yet paid it. And it’s nice and easy. Here we just got one number that can represent those two items. And this type of setup works great when this is the system being used. So then we’re going to post this not to the general ledger yet, we will post it to the general ledger, but not to till the end of the time period. In our case, the end of the month. We will post here instead, as we go to the accounts payable subsidiary ledger, the subsidiary ledger being broken out by who we owe by vendor. And so we might as well record that as we go because we’re gonna have to record it time by time line by line. So we will record This in the l, h and G credit side and increase 1500 to the subsidiary ledger.

04:08

So we’re just recording that over. We’re going to do this once again, we got a company this is another vendor we purchased from and we purchased 900 worth of inventory. This represents a debit to inventory and a credit to accounts payable for $900. We’re going to post that not to the general ledger, but to the subsidiary ledger for accounts payable. So here it is in the subsidiary ledger credit side, we bring that over 900 and in the subsidiary ledger. Next we’re going to do this again, we’re going to say be company, we purchased $700 worth from the company and it is going to be posted. So that means we’re going to debit accounts receivable, debit inventory and credit accounts payable. We’re going to post that not to the general ledger, but to the subsidiary ledger for the company that’s been a vendor. So the 700 we’re going to bring down here, the company We now owe the company 700. So that’s going to be a repetitive type of process. We’re going to have one more here, l, h and G. Once again, we purchased another 300.

05:11

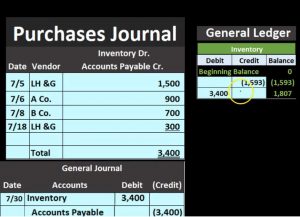

And that’s debit to inventory credit payable represented here by the 300. Just that one line item that being posted, then to the subsidiary ledger, not to the general ledger, we will be posting to the general ledger shortly, changing the balance from 1500 up by 300 to 1800 that we owe to Lh mg, we can then total this up. So the 1005 plus 900 plus 700 plus 300 gives us a total of 3400. So 3400 is the total. Now it’s the end of the month, and we can use that total then to record the general journal. So note the saving of time here, only one journal entry instead of in our case four, and depending on the process, if we’re buying inventory constantly throughout the month, this could save a lot of time and In a manual system, so now we’re going to record it just like it says up here, but not for each transaction instead for the total of the transactions. So we’re going to debit inventory. Remember, inventory is a debit balance account, we’re going to make it to go up by doing the same thing to it, which is a debit, because we’re buying inventory. And then we’re going to credit accounts payable.

06:20

Accounts Payable is a liability, liabilities, our credit balance accounts, we need to make it go up the bad things going up, we owe more money. Therefore we do the same thing to it, in this case, another credit, then we’re going to post this to the general ledger. So the general ledger inventory is going to go up. I’m sorry, yeah, inventories can go up. So it was at a credit of 1005 93. Now it was at a credit because we recorded the sales journal before the purchases journal. So it shouldn’t be the case that it’s not the case that inventory should ever be negative. If it is something’s wrong because inventory is an asset account, and it shouldn’t go negative. But as we record these transactions as we go when we, we might end up recording the sales journal before the purchase journal, and therefore we have a credit and then we’ll debit it out 3400 flipping the sign, so 1005 93 plus 3400. This negative plus that’s positive gives us a debit balance of 1000 807.

07:25

Then on the accounts payable side, we got the accounts payable here being posted there to the accounts payable general ledger, taking the balance from zero up by 3400 to 3400. Once we have all the general ledger, we’re just going to show those two ledger accounts that will be effective through this process. We then make the trial balance and we’ll see these ending balances on the trial balance. So here’s the 1000 807 in inventory general ledger. Here’s the 1000 807 in inventory trial balance. Here’s the 3400 accounts payable general ledger. Here’s the 3004 Hundred accounts payable, trial balance. Then we want to just make a comparison of the trial balance General Ledger and accounts payable subsidiary ledger. Note that we’re working here when dealing with the purchases journal accounts payable that being a primary account we are dealing with when we are using the purchases journal. This number here represents the fact that we owe vendors 3400, but it doesn’t tell us who we owe, we don’t know who to write the checks to therefore, this account down here in the general ledger gives us typically more detail. But in this case, of course, this only represents the number from the end of the month because we didn’t record the detail in the general ledger.

08:41

It has been recorded in the accounts payable journal so it’s on the in the purchases journal. So here’s the detail if we want to see it by date, but it’s not going to give us an easy breakout and by who owes us the money. We don’t want to see it listed by date. We want to see it listed by vendor. So here’s the same information by vendor, the accounts per se payable subsidiary ledger In other words, so l h and G owes us or we owe them 1800 a company we owe them 900 v company we owe them 700. If we add those up that adds up to 3400 which of course is matching what is on the accounts payable, General Ledger as well as the trial balance.