QuickBooks Online 2021. Now, report formatting basics. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive file, which you can find by searching in your favorite browser. For QuickBooks Online test drive, we’re in Craig’s design and landscaping services practice file, we’re going to practice formatting of reports and customization of reports from the basic or standard reports, we will do so with the balance sheet report.

Posts with the basis tag

Statement of Cash Flows 4.05

QuickBooks Online 2021 that statement of cash flows. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our QuickBooks Online test drive file, which you can find by searching in your favorite browser for QuickBooks Online test drive or in Craig’s design and landscaping services, we’re going to go down to the reports down below, opening up the other report, that’s going to be a financial statement report, but not really our two favorite ones, the two favorites being the balance sheet and income statement, the other financial report being the statement of cash flows, so we’re going to be opening up the statement of cash flows, I’m going to right click on the statement of cash flows.

Report Formatting Basics 2.15

QuickBooks Online 2021. Now, report formatting basics. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive file, which you can find by searching in your favorite browser. For QuickBooks Online test drive, we’re in Craig’s design and landscaping services practice file, we’re going to practice formatting of reports and customization of reports from the basic or standard reports, we will do so with the balance sheet report. But many of these things can be done to many other types of reports as well.

Statement of Cash Flows 235

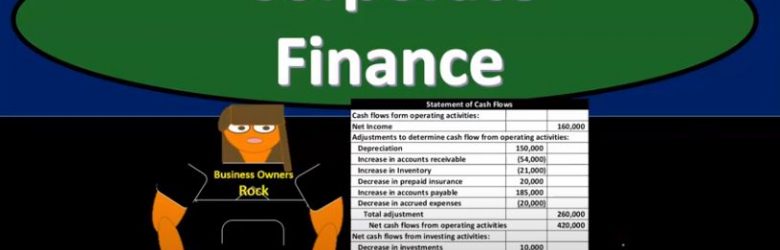

Corporate Finance PowerPoint presentation. In this presentation, we will discuss Statement of Cash Flows Get ready, it’s time to take your chance with corporate finance statement of cash flows. So remember when we’re thinking about the financial statements, we can think about them as answering two major questions to users of the financial statements. For examples, if we’re thinking about investing to the company in some type of way, and are using the financial statements to help us make a decision with regards to that, we want to know where does the company stand at this point in time, what’s basically their worth at this point in time. For that we get help from the balance sheet, which is going to give us the assets liabilities, equity, assets, minus liabilities equals equity, which is basically the book value as of a point in time.

Depreciable Asset Transfer

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss the depreciable asset transfer. In other words, a transfer intercompany transfer with the context of our consolidation process. In essence, a transfer from parent to subsidiary or subsidiary to parent get ready to account with advanced financial accounting. In prior presentations, we talked about the transfer of land and we talked about the transfer of inventory. So the depreciable assets are going to be similar to the transfer of land but now we’ve got that added depreciation we’re going to have to deal with so it’s going to be similar to the transfer of land except that depreciation adds a level of complexity because we are now dealing with an asset that has a change in value over time.

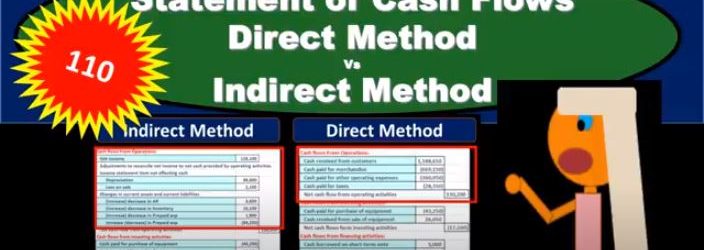

Statement of Cash Flows Direct Method Vs Indirect Method

In this presentation, we will compare and contrast the direct method versus the indirect method for the statement of cash flows. It’s important to note that when we’re comparing the direct and indirect methods, we’re really only talking about the top part, the operating activities portion of the statement of cash flows. In other words, the investing activities and financing activities and in result will remain the same, we’re going to end up with the same result, which of course, will be the Indian cash that we can tie out to the balance sheet. And we’ll have the change of cash here, which is really kind of the what we’re looking for in the statement of cash flows. What’s going to differ is the operating activities, why are they going to differ? Why would we have the operating activities differ? Remember that the operating activities have to do with kind of the income statement you can think of it basically as the income statement being reformatted to a cash flow statement versus an accrual statement. So the income statement that we use is on an accrual basis, and we recognize that Revenue when it’s earned rather than when cash is received expenses when expenses are incurred rather than when cash is paid, that’s gonna be on an accrual basis.