QuickBooks Online 2021 receive payment form. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our Google search page, we’re going to be searching for QuickBooks Online test drive, then we’re going to be selecting QuickBooks Online test drive from Intuit. We are not a robot, but we would like to be and we’re hoping QuickBooks can help us out with that process. Continuing on. Here we are in Craig’s design and landscaping services test file, we’re going to go to our new tab on the left hand side.

Posts with the checking account tag

Donation & Purchase of Furniture 155

And I’m going to say it’s going to be unrestricted. And then we don’t need anything here, the debit amount is going to be that 11 five, I believe is what we’re working with here. 11, five, yes, 11 500. We don’t need any any other categorization here. So we look good, the other side is going to be going out of that new account, we set up in the expenses, pp and e 8100. It’s also it’s going to be the fun should be unrestricted, I’m going to say unrestricted here, unrestricted. And then that’s going to be the credit of 11 500. Now, if you’re not good with with the debits and credits, obviously, if you went the wrong way, what would happen you’d see this account be doubled. And in that would be wrong way, right. And then you just switch the debits and credits, and you’d be back on so the total debits add up to the total credits, this is going to be our transaction.

Statement of Cash Flows Introduction

In this presentation, we will introduce the financial statement of statement of cash flows. When thinking about the statement of cash flows, we want to compare and contrast the reasons for it to what the other financial statements are providing us what information in other words, are we going to get from the statement of cash flows that’s not on the other financial statements, those being the balance sheet, the income statement, the statement of equity, we’re mainly comparing against the income statement, because the statement of cash flows going to give us some similar information. It’s going to give us information over time, what’s happening over time, unlike the balance sheet, which is going to have a point in time. So we’re still looking at at timing what is what is going on over time. That’s typically our income statement, which measures performance. The major goal of the income statement is to measure performance, how have we done how much work have we done, revenue minus expenses, revenue being recognized when we earn the work when we’ve done the job expenses when we We’ve incurred something in order to help generate in the same time period. And that’s going to be the net income. What that doesn’t do, however, is measure cash flow. And when we first learn about the income statement, that’s going to be a real big distinction we want to look at, we want to say, okay, the income statements on an accrual basis.

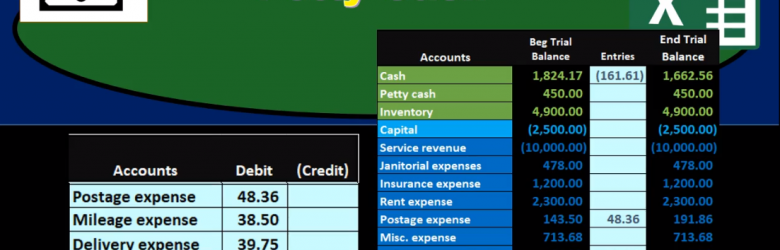

Petty Cash

In this presentation we will talk about how to set up and record a petty cash fund. Setting up a petty cash fund seems like an easy thing to do to have a minimal amount of cash that we can have expenditures for small purchases for however, it can be a little bit tricky to set up the petty cash fund and there is kind of a shortcut to recording transactions for the petty cash fund. So we’ll go over the process of setting up the petty cash fund recording the initial investment in the petty cash fund and then recording the activity from the petty cash fund. Now the objective of course in this will be to have not just the checking account where we need authorization in order to take money out of the checking account, we would typically want anything going out of the checking account to be by electronic fund transfer or by cheque so that we have a clear paper trail of what is going on the petty cash However, if we just have some small items that we need to take care of with cash and as to convenient to have small items with cash to be paid.

Enter Bills & Pay Bills 8.70

In this presentation, we will enter bills and then to pay bills. In other words, we’re going to be entering some of the standard kind of bills, we would have monthly, like a phone bill and the utility bill, this time entering them in as bills and then going through and paying them all at one time with the pay bills feature. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re first going to take a look at the flowchart which is going to be on the desktop version just to get an idea of what we will be doing, we’re going to be entering the standard kind of bills like the phone bill and utility bill and so on and so forth.

Customer Payment & Deposit 8.55

In this presentation, we will record the customer payment for invoices that had been issued in the past, then we’ll take that money and put it into the bank recording a deposit with it. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re first going to take a look at a flowchart on the desktop version real quick to see what our objective is, we’re going to be entering a receive payment. So in the past, we had entered and invoice and that increased the accounts receivable and the bill that’s basically a bill to the customer. Now we got the money.

Short Term Investment Deposit 8.10

This presentation and we’re going to record a deposit related to selling a short term investment. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re going to be opening up our reports. First, we’re going to go be go down on the left hand side, we’re going to be opening up the balance sheet report. So we’ll open up the old balance sheet. And then we’re going to change the dates up tops, I’m going to scroll up top and change those dates from a one a 120 to 1230 120, we’re going to go ahead and run that report. I’m going to duplicate this tab, I’m going to right click on the tab up top, duplicating it, put it to the right, then I’m going to go back to the left we’re going to do the same from the profit loss report.

Make Loan Payments 8.05

In this presentation, we will make loan payments with the help and the use of an amortization schedule. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file, we’re going to start off by opening up our reports down below, we’re going to be opening up three reports. This time, we’re going to be opening up the balance sheet report, our favorite report the balance sheet reports, we’re going to scroll back up top, change the dates from 1120 to 1231 to zero, then we’re going to go ahead and run that report. Then I’m going to go back up top and duplicate the tabs. I’m going to right click on the tab, I’m going to duplicate that tab. Going back to the left and we’re going to do this again. We’re going to go back down to the reports down below. We’re going to be opening up the profit and loss our second favorite report the profit and loss, the p&l the income statement, we’re going to be changing the dates up top again.

Pay Employees Part 2 7.71

This presentation and we’re going to continue on with part two of entering the payroll information into our system within QuickBooks Online. Here we are in our get great guitar system. Last time we entered our information, we’re imagining we have payroll or paychecks, basically giving us this register information. And that register information we’re going to enter into the system.