QuickBooks Online 2021 deposits, recording deposits that are going through the sales receipt form and the receive payments form and going through undeposited funds. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars a practice file, we’re going to be recording deposits. Before we do so let’s open up some of our reports being the balance sheet income statement trial balance, going up top to the tab, right clicking on the tab and duplicating the tab, we’re going to do it two more times. Right clicking on the tab again, duplicating the tab one more time right clicking on the tab and duplicate the tab, we’re then going to be opening up the trial balance in the tab to the far right by going to the reports on the left hand side.

Posts with the closing tag

Closing Entries 175

https://youtu.be/OdjLcvkWPfY?list=PL60SIT917rv6ERsGZxM9V_IZLVybpgfNU

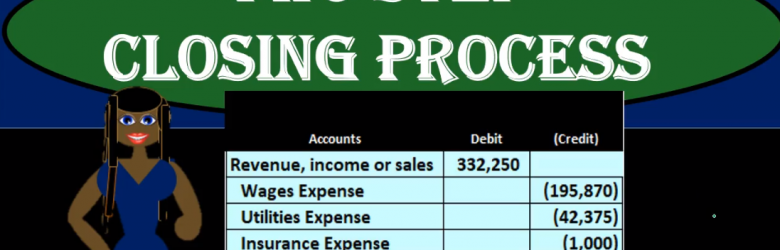

This presentation, we’re going to discuss the closing process for our accounting system. Get ready, because here we go with aplos. Here we are in our not for profit organization dashboard, let’s head on over to our Excel file to see what our objective will be, you’ll recall, we’re going to be in tab 10. By the way, we’re over here in tab 10. You’ll recall that we’ve been looking at each transaction with the accounts that will be affected, posting those over to our Excel worksheet to see the effect on the trial balance on the accounts. Now, we did this in terms of posting to our first trial balance up top and so row one. And then we said, okay, what if we break this information out, and I want to break this information out by not just the expenses by their nature, but by their function. Now, in aplos, we have a nice system to do that we’re going to use the phones and the classes, or the funds and the tax to do that here.

Post Closing Trial Balance & financial statements

Hello in this presentation we will discuss the post closing trial balance and financial statements. When considering the financial statement relationship to the trial balance, we typically think of the adjusted trial balance that being used to create the financial statement. It’s important to note, however, that any trial balance that we use can be generated into financial statements. It’s just that the adjusted trial balance is the one that we have totally completed and prepared and ready. In order to create the financial statements to be as correct as possible as of the date we want them, which is usually the end of the month or the end of the year. Note that the names of the unadjusted trial balance the adjusted trial balance and the post closing trial balance are really a convention they’re all basically trial balances.

Closing Process Step 4 of 4 Closing Journal Entry Draws or Withdraws

Hello in this lecture we’re going to continue on with the closing process with step four, the final step of the process which will be to close out the draws. Remember that the objective is to have the adjusted trial balance be converted to the post closing trial balance. adjusted trial balance is what we use to create the financial statements. And the difference between the adjusted trial balance and the post closing trial balance will be that we want to have all temporary accounts including draws revenue and expense accounts to be converted to zero and have all that be in the owner capital account meaning the owner capital account will now be including all these accounts underneath it crunched into basically one number, we’re going to do that with a four step process.

Closing Entries Journal Entry 3 of 4 Step 3 Income summary

Hello in this lecture, we’re going to talk about the closing process step three of the four step closing process, which will include the close of the income summary to the capital account. Remember that our objective is to close out all the temporary accounts, which are all the accounts below capital, including drawers, and the income statement accounts of revenue and expenses. So we want the adjusted trial balance to be converted to the post, post closing trial balance, which means that everything from capital on down will be zero. The way we do that is the four steps and that includes step one we did in a prior video closeout income to the income summary. Step two was to close out expenses to the income summary. Step three is what we’re going to do now close out the income summary now having net income in it to the capital account, then we’re finally going to close out the draws to the capital account.

Two Step Closing Process

Hello in this presentation we will take a look at a two step closing process. In other words, we will perform the closing process using two journal entries. There’s a couple different ways we can see the closing process, each of them having a pros and cons. The two step process is nice because it allows us to see net income broken out and being closed out directly to the capital account, followed by draws, which is similar to what we see when we actually do the statement of equity, meaning that when we do the statement of owner’s equity, we start with beginning balance and then we increase it by net income and decrease it by drawers or dividends. Because this process is similar to that process, it’s often easy to remember it’s the easiest for me to remember in any case, so we will take a look at the two step closing process.

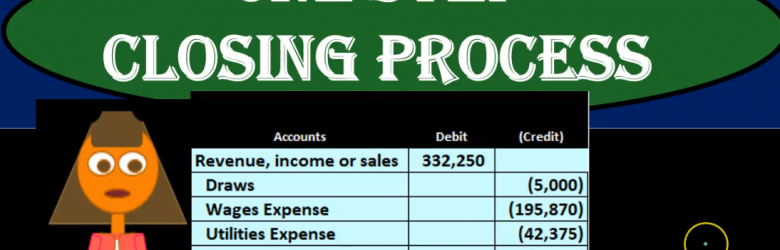

One Step Closing Process

Hello in this presentation, we will be looking at a one step closing process. In other words, we will be closing out temporary accounts using one journal entry. There’s a few different ways that we can perform the closing process. And there’s benefits and cons to each way of doing it. The one step closing process is the simplest way to do it. And it’s also a way that we can imagine what is happening within the closing process as easily as possible a skill useful when considering what’s happening from time period to time period, and how the financial statements are working. So here we’re going to look at a one step closing process. Remember what the closing process is, it’s going to be a process at the end of the time period that we will be performing.