Hello in this presentation we will discuss the post closing trial balance and financial statements. When considering the financial statement relationship to the trial balance, we typically think of the adjusted trial balance that being used to create the financial statement. It’s important to note, however, that any trial balance that we use can be generated into financial statements. It’s just that the adjusted trial balance is the one that we have totally completed and prepared and ready. In order to create the financial statements to be as correct as possible as of the date we want them, which is usually the end of the month or the end of the year. Note that the names of the unadjusted trial balance the adjusted trial balance and the post closing trial balance are really a convention they’re all basically trial balances.

00:49

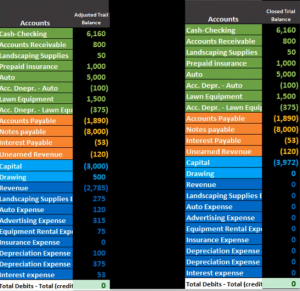

The name of adjusted or unadjusted or post closing has to do with when we have generated the trial balance. So the unadjusted trial balance happened before We made the adjustments, the adjusted trial balance is happening right before we make the financial statements. And then the post closing trial balance is what’s happening after we do the adjusting journal entries, we typically only see the financial statements made from the adjusted trial balance. But sometimes it’s useful to go through this process of creating the financial statements from a post closing trial balance just to see what those differences are, and to get a better understanding of those differences. So we can see here that the adjusted trial balance has balances in the assets, liabilities, equity, revenue and expense accounts. The post closing trial balance has the same amounts for assets and liabilities.

01:41

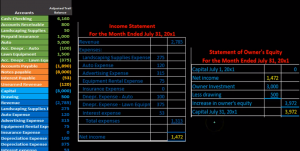

However, the equity section here includes something different and all the temporary accounts including all income statement account and draws have now been zero and closed out to the capital account. So this portion on down is different. And that’s because the temporary accounts are now gone. If we were to create the financial statements as we have seen from the adjusted trial balance, and then we’ll compare that to creating financial statements from the post closing, we’ll see what this looks like from a debit and credit as it’s shown here to a plus and minus format as shown on the financial statements. So here’s the adjusted trial balance. Here’s our normal process of changing the adjusted trial balance from the debit and credit to the financial statements. Here’s the balance sheet. We’re just pulling these numbers over into the balance sheet.

02:33

We are in balance. Note that this number represents all of the blue accounts here basically, put together into one number into this capital account. All the other accounts on the balance sheet have been pulled from the assets and liabilities and put into the respective categories on the balance sheet. If we look at the income statement and the statement of equity, those are the accounts that deal with time So the income statement is dealing with these accounts here.

03:03

So we got revenue, and the expenses put from a debit and credit format to a plus and minus format resulting in bottom line number of net income shown here, same as this number here, then we have the statement of equity statement of owner’s equity is going to take into account those last two accounts here, one, the capital account, the main account or main equity account, and then the drawings account the other timing account that we’re going to need to close out in the closing process. So we’ve got zero for the beginning balance, we’ve got the net income drawn from the income statement, which is also just all of these accounts. And then we have the owner investment in this case, which isn’t included here. That’s the investment from the owner, less draws, which is there.

03:53

That gives us our change in the balance that went from zero up to three Thousand 975 to 3009 75. That’s the normal process. If we see the same thing with the post closing trial balance, just to have the comparison. Again, note that we don’t typically do this, we’re not going to make the financial statements from the post closing, although we could. Because anything that’s in balance here, anything with the debits and credits can be generated into the financial statements. The post closing happens right after we make the closing entries, and therefore the timing accounts are all at zero because we’re looking to go to the next month or the next year and count up from zero. So the permanent accounts notes are all here. So the permanent accounts the balance sheet, same thing we have the exact same balance sheet, we have all the assets are still here.

04:46

All the liabilities are still here, just being drawn from the post closing trial balance. And we have the capital account is the same number as well. The capital account last time being the sum of all these numbers. And it’s still being the sum of all these numbers on the post closing except these are all zero. Now, these are all zero, and they’ve been closed out to this capital account, which we can see is this number on the balance sheet. Now when we look at the detail However, in the statement of income statement in the statement of owner’s equity, we have none in essence. So note the detail is now gone because we have no income statement accounts or statement of equity accounts at this point in time. So this is just to show that we can create the financial statements from a post closing trial balance, we just won’t have any information in the timing accounts, and that being the income statement and the statement of owner’s equity. It’s important to note when we look at the statement of owner’s equity created from the adjusted trial balance, this is from the adjusted trial balance. We see that we have the numbers of 3009 72 that’s what’s gonna be on the post closing trial balance. Well after we do the closing entry, why? Because we closed out all the temporary accounts to that equity account. And therefore we’re left with this one number basically representing all equity accounts, including income statement accounts and equity accounts, which are temporary accounts being crunched into one equity number.