In this presentation, we will introduce the concept of notes payable as a way to finance a business. Most people are more familiar with notes payable than bonds payable, the note payable basically just being a loan from the bank. Typically, the bond payable is a little more confusing just because we don’t see it as often, especially as a financing option. From the business perspective, we often see it more as an investing or type of investment. But from a loan perspective, it’s very similar in that we’re going to receive money to finance the business if we were to issue a bond, or if we’re taking a loan from the bank. And then of course, we’re going to pay back that money. The difference between the note and the bond is that one the note is something we typically take from the bank. Whereas a bond is something we can issue to individuals so a bond we could have more options in terms of issuing the bonds than we do for a loan. Typically when we have a loan, we typically are Gonna have less resources, we can take a loan from the bank. When we pay back the bond, we often think of the bond as two separate things. And we set it up as two separate things, meaning we have the principal of the bond that we’re going to pay back at the end. And then we have the interest payments, which are kind of like the rent on the money that we’re getting, we’re getting this money, we’re gonna have to pay rent on it, just like we would pay rent if we had got the use of any physical thing.

Posts with the confusing tag

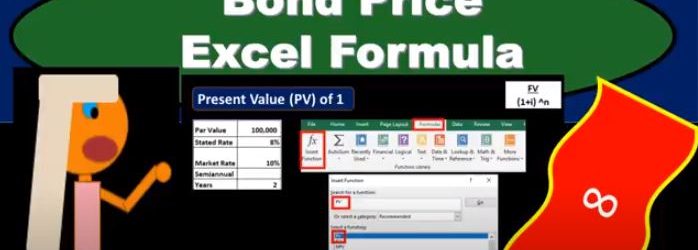

Bond Price Excel Formula

In this presentation, we will calculate the bond price explaining how this can be done using present value formulas within Excel. Remember that the bonds is going to be a great tool for both accounting and finance to describe the present value calculation. So that’s why it’s going to be used. Oftentimes It has two cash flows related to it, one’s going to be the face amount of the bond that’s going to be due at the end of the term of the bond. In our case, it’s going to be two years semiannual or four time periods. And the other is the flow of interest. So bonds are a great example because they have the two types of present value problems that we need in one area. So even if you’re not in an area where you’re dealing with bonds all the time, they’re still going to be used and useful to understand present value types of calculations. So here we’ve got the bond is going to have one cash flow of 100,000 at the end of four periods or two years, and we need to figure out what the present value is in order to price it back here at your at time period zero. And then we have these four payments in terms of the annuity 4000. And we need to take those and present value them, we could take each period and present value each payment and present value it. But the easier thing to do is to present value, an annuity when it’s applicable and present value, the one amount when it’s applicable. And therefore think of that about these as two basically separate cash flows that we’re going to have to present value separately. So we can do this multiple different ways. And it just depends on what you’re what tools you have. And where you are, in order to know how to do it. What you want to know is just that there’s different tools to do it. Anytime someone uses a different tool. What are they doing the same thing? And and when can you apply these tools and what’s actually happening here. So that’s what’s actually happening. We’re present valuing this information.