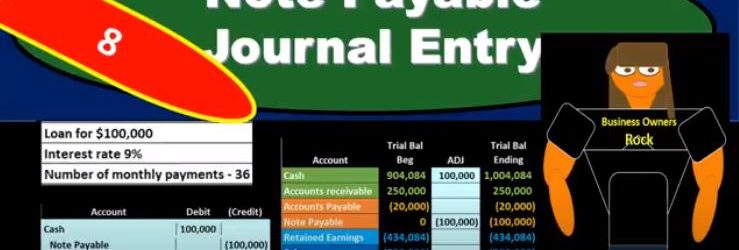

In this presentation, we will record the journal entry related to a note payable related to taking out a new loan from the bank. Here’s going to be our terms. We’re going to record that here in our general journal and then we’ll post that to our worksheet. The trial balances in order assets, liabilities, equity, income and expenses, we have the debits being non bracketed or positive and the credits being bracketed or negative debits minus the credits equaling zero net income currently at 700,000 income, not a loss, revenue minus expenses. The difficult thing in terms of a book problem, when we record the loan is typically that we have too much information and this is the difficult thing in practice as well. So once we have the terms of the loan, and we have the information, we’ve already taken the loan out, then it’s the question of well, how are we going to record this thing? How are we going to put it on the books and if we have this information here, if we have a loan for 100,000, the interest is 9%. And then the next number of payments that we’re going to have, we’re going to pay back our 36. Then how do we record this on the books? Well, first, we know that we can ask our question is cash affected? We’re going to say, Yeah, because we got a loan for 100,000. That’s why we got the loan.

01:14

So cash is a debit balance, it’s going to go up with a debit, so we’ll increase the cash. And then the other side of it is going to be something we owe back in the future. And that’s going to be note payable. And that’s as easy as it is to record the initial loan. The problem with this the thing it’s difficult in practice, and in the book question is that we’re often given, of course, the other information, like the interest in the number of payments, and possibly more information that can cloudy up the what we’re doing, and the reason these are needed, so that we calculate interest in the future, but they’re not really We don’t even need that information to record the initial loan. All we need to know is that we got cash and we owe it back in the future. And you might be asking, Well, what about the interest we owe interest in the future as well? We do, but we don’t know it yet. And that that’s the confusing thing interest, although we we will pay interest and we know exactly how much interest we’re going to pay in the future. We don’t owe it yet. Why don’t we owe it yet? Because we’re going to pay back more than 100,000. Why don’t we Why don’t we record something greater than 100,000? You might say, because we know we’re going to pay more than 100,000. And that’s because the interest is something that it’s like rent. So we’re paying rent on the use of this 100,000. And just like if we if we had a building that we rented, that we’re using for office space, we’re not even though we know we’re going to pay rent in the future. We’re not going to record the rent now. Because we haven’t incurred it until we use the building.

02:41

So the same things happening here. We know we’re going to pay interest in the future we’re no we know we’re going to pay more than 100,000 but it hasn’t happened yet. We haven’t used up we haven’t gotten the use of this hundred thousand and therefore haven’t incurred the expense of it yet. So the interest and is something we need to negotiate when making To turn off the loan, but once the loan has been made, and we’re just trying to record it, it’s not going to be in the initial recording. It will be there when we calculate the payments need and the amortization table. So the initial recording is pretty straightforward. We’re just going to say okay, cash is going to go up by 100,000. And then the notes payable is going to go up from zero in the credit direction to 100,000. So what we have here is the cash increasing the liability increasing, although we got cash, there’s no effect on net income because we haven’t incurred any expenses. We’re going to use that cash most likely to pay for expenses possibly or pay for other assets or pay off liabilities in order to help us to generate revenue in the future. But as of now, we’ve gotten we increase an asset and we increase the liability