QuickBooks Online 2021 pay bill that was created from a purchase order or P OE. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars to practice file, we’re going to open up a new tab to the right and make the trial balance on it.

Posts with the expenses tag

Profit & Loss, P&L, Income Statement Overview 3.10

QuickBooks Online 2021 Profit and Loss P and L income statement overview. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive practice file, which you can find by searching in your favorite browser. For QuickBooks Online test drive, we’re in Craig’s design and landscaping services practice file, we’re going to go into the profit and loss or income statement by going to the reports down below, we’re going to be opening up the standard profit and loss which should be in your favorites because it is a favorite report, profit and loss report, otherwise known as an income statement, sometimes called or referred to, in short as the P and L,

Vendor Center Expenses or Vendor Tab 1.17

QuickBooks Online 2021 vendor center or expenses or vendor tab. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our Google search page, we’re searching for QuickBooks Online at test drive, we’re going to open up the test drive from Intuit verify that we are not a robot.

Purchase Order Form – P.O. 1.24

QuickBooks Online 2021 purchase order form otherwise known as a p OE form, let’s get into it with Intuit QuickBooks Online 2021. Here we are in our Google search page, we’re going to be searching for QuickBooks Online test drive, then we’re going to select the QuickBooks Online at test drive for Intuit. Once again, it’s going to ask us if we’re a robot. I’m starting to think I am a robot. You know, Wildwood asked me this so many times, but I’m gonna say no anyways, even though I’m starting to think maybe maybe I am a robot.

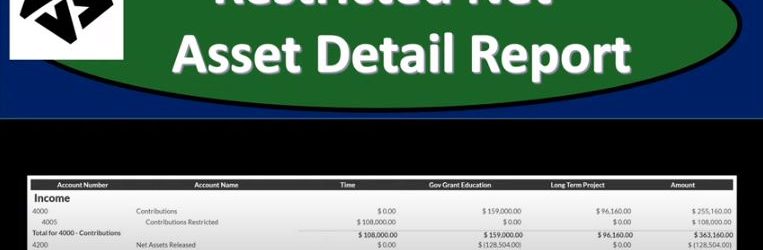

Restricted Net Asset Detail Report 190

This presentation we will generate, analyze, print and export to an Excel a restricted net asset detailed report and get ready because here we go with aplos. Here we are in our not for profit organization dashboard, let’s head on over to Excel to see what our objective will be. We’re currently in the 10th, tab, tab number 10. And last time and a few prior presentations, we’ve been creating the statement of activities, including three columns, two columns, for width restrictions, without restrictions, we then broke out the width restriction column out into the expenses by both function and by their nature.

Expenses by Nature & Function 187

In this presentation, we will generate, analyze, print and export to Excel a report that will show the expenses both by their nature and by their function. Get ready, because here we go with aplos. Here we are in our not for profit organization dashboard. Let’s first take a look at our Excel sheet to see what our objective will be. We’re over here on tab 10. You’ll recall last time that we made the statement of activities. So the statement of activities in essence, the income statement being broken out by two columns, and a total column, those with restrictions and without restrictions. And now we’re concentrating on those expenses, which we want to break out both by nature and function, which we could do on the statement of activities.

Allocate Expenses to Categories Part 2 171

https://youtu.be/H1D3e6dKlTI?list=PL60SIT917rv6ERsGZxM9V_IZLVybpgfNU

This presentation, we’re going to continue on allocating our expenses by category by function, including by program, admin, and fundraising with the use of our tax feature within our accounting software, get ready to go with aplos. Here we are in our not for profit organization dashboard, we’re going to go on over to our Excel file to see what our objective will be. We’re continuing on with the allocation of our expenses, you’ll recall the objective being that normally we have our expenses broken out in the statement of activities here. And we need to break them out both by function and what they’re used for by nature and by function.

Allocate Expenses to Categories Par 1 170

https://youtu.be/F4FtVtXckPo?list=PL60SIT917rv6ERsGZxM9V_IZLVybpgfNU

This presentation and we’re going to start breaking out our expenses by nature. In other words of what the expenses are used for with the use of the tags, the categories being the education, the community service, the administrative and the fundraising for that 4020 2020. Being the allocation percentages, we will be using, get ready, because here we go with abalos. Here we are in our not for profit organization dashboard, we’re going to be heading on over to Excel to see what our objective will be.

Salaries Expense 145

In this presentation, we will record a transaction related to salaries expense into our accounting system. Get ready, because here we go with aplos. Here we are in our not for profit organization dashboard, we’re going to jump on over to our Excel file to see what our objective will be here, we’re going to be in tab number six, tab number six, where we have our transaction. Here we are in our not for profit organization dashboard, we’re going to be jumping on over to Excel to see what our objective will be, we’re going to be in tab number six. So we’re in tab number six, we’re going to be recording the salaries expense.

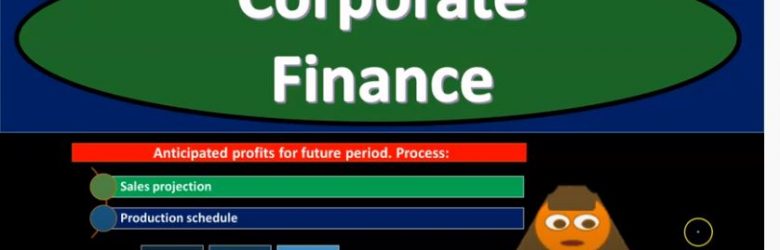

Pro Forma Income Statement 410

Corporate Finance PowerPoint presentation. In this presentation, we will discuss the pro forma income statement, get ready, it’s time to take your chance with corporate finance pro forma income statement. Let’s first take a step back and think about the pro forma financial statements in general, remembering the fact that we got to do them in some type of order in order to do them in a logical fashion. And that would mean that we would first need the sales projection information, the production plan, we can use those in order to create the pro forma income statement.