Hello in this presentation we will discuss the balance sheet and income statement relationship. Objectives at the end of this we will be able to define the balance sheet and list its parts, define the income statement and list its parts and explain how the income statement relates to the balance sheet. When considering these concepts in terms of the balancing concept of the balance sheet in particular, we want to keep in mind the idea of the double entry accounting system. The double entry accounting system being the main system the main internal control, that we are always keeping in mind that internal control helping us to safeguard against making errors that’s our first line of defense against making errors is the double entry accounting system, which can be expressed in a few different ways.

00:48

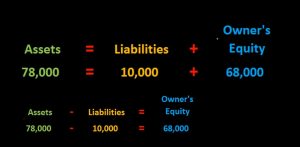

One, the accounting equation, two in terms of the balance sheet being in balance, and three in terms of total debits and credits. As we look at the financial statement, we are in essence Looking at that double entry accounting system in the format of the accounting equation, the accounting equation of assets equal liabilities plus equity. Remember that this equity section it could be named differently depending on the type of entity we are talking about.

01:17

If we’re the sole proprietor, for example, we will have owner’s equity, if it is a partnership, we will then have a two partners at least or more and we will have partners equity, and if we have a corporation, then we will have shareholders as the owners and therefore we will have shareholders equity, but the equity section as a whole in total will remain much the same in that it represents the book value or the value of the company on a book basis owed to the owners, whoever those owners may be, whether it be an individual owner, sole proprietor, partners, partnership or shareholders in a corporation. the accounting equation will be assets liabilities plus equity assets representing what is owned by the company.

02:06

Not all the assets, of course will be dollars, we’ll have a bunch of different type of asset accounts. But we will measure all those asset accounts in terms of total dollar. So we’re going to say $70,000 worth of assets, although, of course, is not all cash is equal to who that $78,000 worth of stuff is owed to either a third party vendor 10,000 in this case being owed to a third party vendor, the rest the 70,000 minus the 10 60,000 been owed to the owner, the owner so that means that if we rewrite this accounting equation, and another very useful format, would be subtracting at the liabilities from both side to leave us with assets minus liabilities equals equity.

02:55

If we look at this, it emphasizes the fact that the equity section represents The book value of the company represents total assets measured in terms of dollars minus total liabilities measured in terms of dollars, this is the net assets, another word for equity, the book value of the company can be thought that if we sold all the assets, we get $78,000. If we sold everything at the cost on the books, which is unlikely, but in theory, that would be the case and then we paid off the vendors, then we would have any other people that we owe in terms of third party liabilities, then the rest would be what would be owed to the company.

03:36

This format up here the accounting equation, that is what we will use in financial accounting, you want to keep this in mind, because it really gives us that balancing concept of this is what the company has as a separately as a separate entity, not necessarily a separate legal entity, as a corporation would be, but any type of business whether it be a sole proprietor, partnership or corporation will be thought From an accounting standpoint as a separate legal entity, and therefore that separate legal entity would have this much acids, all those assets to someone, either a third party vendor or the owner from a financial statement standpoint and from like a financial standpoint, if you talk to someone like a banker or someone that’s in finance, they will often consider this format of the accounting equation as the main one they will use because it really does emphasize the value of the company meaning the assets minus liabilities really emphasizes that bottom line number of the 68,000.

04:36

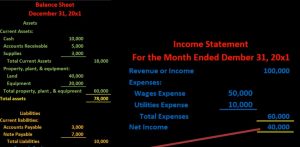

Now the reason the accounting equation is so important when we’re taking a look at the balance sheet and the income statement is of course, that the balance sheet is representative of the accounting equation or the accounting equation is represented within the balance sheet the major components of the balance sheet being assets than liabilities and equity. So therefore, how do we know we are in balance when Add a balance sheet, because the assets equal liabilities plus equity. That is the accounting equation. And therefore, when we say the balance sheet is in balance, we are in essence saying that the accounting equation is also in balance, it’s the same thing.

05:15

One key component to the balance sheet is it’s going to be presented as of a point in time, therefore, we’re only going to have one date on the balance sheet. It’s presented as of that point in time, we don’t need a range, we don’t need a beginning and an end, we just need one date. And oftentimes, it’s easier to look at the most common balance sheet account when considering that concept, a concept that seems simple, but it’s not as simple as it may seem, therefore, it’s not it’s useful to look at the main account of cash. And think about the idea of if we were to ask somebody how much cash they have. Could they tell us how much cash they have, as of this point in time, could they check their pockets and tell us they could, as opposed to if we were to ask somebody how How much they earn, they would then have to make an assumption they would have to say what do you mean? Do you mean a month? Do you mean a year? Do you mean a paycheck, they would need some type of timeframe.

06:09

So therefore, when we look at this, the main accounts that can help us to determine what exactly is meant by just one date versus a date range, we look at cash, we can report cash as of one date, we cannot report revenue as of one date, we can’t report revenue as of December 31, that has no meaning. And you could say it’s revenue for the day, that happened to be December 31. But that’s not a point in time, you can’t say as of the end, this point in time, the end of December 31. In terms of revenue, what what that would be, you can say as of December 31, this exact point in time, you know, 12 o’clock midnight, this is how much cash we have.

06:51

So that’s going to be the major difference. When we consider the types of accounts in the balance sheet we have assets and when looking at What assets are, what liabilities are and what equity is, it’s important to keep the end goal in mind. And that is to generate revenue. So revenue is the goal of the business. Now, I know that many businesses will have different goals in terms of their mission statement. But revenue is the major major measurement used in order to see whether or not those goals are being achieved. So we want to consider from a financial standpoint, revenue being the major objective. Therefore, when considering the definition of assets, we’re really going to say, assets are there we have assets in order to help us generate revenue in the future. So these assets, all these assets are, in essence, a kind of investment. You can think of it as a kind of investment.

07:45

Why do we have the assets being owned by the company, because they’re going to be consumed in the future at some point in time, in order to help us generate revenue, which is the goal of the company. It’s often confused in that people think that The goal of the company is to is to just compile cash to just get mountains of cash and have cash be as high as possible for a couple different reasons. One is that I think cash is often confused with revenue as if they’re the same thing. But they’re going to be different things. And the other is that cash is so is such a liquid assets. It’s a highly valued asset. And therefore, it’s often thought that just compiling cash is the main goal. But that’s not really the case revenue generation is going to be the main goal. And we can consider what would happen if we had a lot of cash.

08:31

Why isn’t it the main goal to just compile cash? Note that if cash is really high, if we have a lot of cash, then the stock we can consider if we’re a corporation? The stockholders would then be asking, what are you going to do with that cash? Why do you have all this cash? If we’re just holding on to the cash, it’s not helping us generate revenue, the company should have a plan then to invest the cash at some point in the future in order to achieve the goal of revenue generation. If the company does not have a plan to invest that cash in order to achieve the goal of revenue generation, then the company should really give that cash to the owner so that the owner can use it for their personal resources to achieve their personal goals, whatever those personal goals may be

09:16

Therefore, it should be distributed from a sole proprietor and the term of draws to the owner or partnership in the term of draws, or in a corporation in the form of dividends. So that’s going to be the assets of cash. Then we have accounts receivable, supplies, other common current assets, and those are going to be things that again we are going to use or consume sometime in the future in order to help generate revenue, accounts receivable being what is owed to the company from customers, supplies being those types of assets that we expect to use soon through the consumption use in order to help generate revenue in the future. Also note that assets are typically going to be broken out between it Current Assets and property, plant and equipment, those current assets are going to be things that are going to be more liquid, meaning assets that are kind of closer to cash and things that we’re going to use relatively soon.

10:12

So we expect to use cash relatively soon, we expect accounts receivable to be converted to cash relatively soon, we expect for supplies to be consumed relatively soon. Note the format as well of the financial statement. Typically, we have the assets main category, we have a sub category represented by the name, then a colon, then the indentation. So it’s important to note that type of formatting because it’ll really help when you look at longer statements, more complex balance sheets, other types of financial statements. If you understand how the formatting is going to work, we can then see that the the numbers have been pulled into the inside column, and then are summed up in the outer column in terms of the subtotal of total current assets. We then have property, plant and equipment the next time subtotal a colon.

11:01

And we are then going to indent the two accounts there those been land and equipment 40,020 thousand respectively. The reason these are going to be broken out separately is because these are going to be more long term assets, these are going to be assets that we are not going to consume in the near future, they’re going to be consumed for a long period of time to help us generate revenue for a long period of time into the future. We’re then going to add those up to the subcategory in the outer column total property, plant and equipment 60,000.

11:36

Next, we’ll just add up those outer columns, we’re going to add up the total current assets and the total property, plant and equipment and that will give us the total assets total assets in this case being 78,000. We then have the liabilities components, those being something that’s going to be owed to a third party liabilities are going to be something that we owe due to a past transaction so sometimes happened in the past. And that resulted in us owing something in the future, we will have a similar breakout in terms of current liabilities and long term liabilities. This balance sheet only has current liabilities. When that is the case, then we’re still going to write the subcategory to show our reader it’s a it’s a current liability subcategory. With the colon, we are then going to indent the subcategory, bring those into the inner column, and then and then total it in the outer column.

12:30

Note that the total however, doesn’t say total current assets, but says total. I mean it doesn’t say total current liabilities. It says total liabilities, and that’s telling the reader they’re all current liability. So they’re in the current liability section. And because there are no long term liabilities, we’re just going to credit total liabilities here and show our reader that they are both current and the total liabilities. Current Liabilities mean that represents the fact that a vote liabilities will be due within a year’s time period. So they’re going to be due relatively soon within a year’s time period. Why is that important? Because we want to be able to make sure that we have current assets that are available in order to pay off those current liabilities.

13:17

So it’s important for us to be able to compare and contrast the current liabilities and the current assets and assess whether or not we are able to pay off those current obligations that will be soon to need paying off. We then have the owner’s equity section. Again, this is as a sole proprietor would be owner’s equity, if it’s a partnership, it would be partnerships equity, and if it was a corporation, it would be shareholders equity, but in total, the equity section is going to be much the same. We might have some different type of subcategories within the equity section. But the total equity section represents that book value of the company.

13:54

You can think of the equity section as actually kind of like the bottom line, the main number of the balance sheet, if you will. Want to pick one number to represent the balance sheet? Where does somebody stand at a point in time, it’s really the equity section number, because that represents assets minus liabilities that represents that book value of the company that represents if we sold the company and sold all of the assets and got the cash of 78,000 and then paid off the 10,000 A liabilities that represents how much cash would go to the owners, whoever those owners may be, whether it be sole proprietor, or partners or shareholders, then we can see that the liabilities plus the owner’s capital, the owner’s equity will be total liabilities and owner’s equity. Therefore, the accounting equation is represented as assets equaling total liabilities plus equity.

14:47

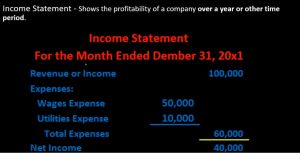

Note that some balances may be in a vertical format here as shown here or some balance sheets may pull this information and represent that on the right hand side. So we have asked On the left hand side and liabilities and equity on the right hand side. Any format that will be used, however, will represent the accounting equation within the balance sheet as assets equals liabilities plus equity. Next we have the income statement, the income statement being represented as of a time frame in this case for the month ended December 31. Note that the income statement you do need to have a beginning and an ending date. Therefore, we don’t just represent as we did on the balance sheet at one point in time, we don’t just say income statement, December 31.

15:39

We say income statement for the month ended in this case or the year ended if it were representing a full year. The reason we need to do that is we can think about that in the terms of our questions as to the main income statement accounts of revenue. If we were to say that someone earns $100,000 and ask the question Is that a lot of money? It’s probably the case that someone would say that’s pretty good amount of money making the assumption that the hundred thousand is represented as 100,000 earned over a year’s time period. But note that we have to make that assumption we got to make the assumption, what are we talking about? Are we talking about 100,000? a year 100,000 a week 100,000 a month 100,000, a two week pay period? And we need to answer that question before we can determine whether or not 100,000 is a lot of money. The idea of the income statement then, is a timing statement. It’s an action statement.

16:37

Unlike the balance sheet, which is as of a point in time, and you can think of it kind of like a balance sheet in terms of language, foreign terminology, the balance sheet, it’s kind of like a noun. It’s just it’s just is what it is. It’s the name of something. The income statement. It’s more like a verb in that kind of context and that the income statement is action. You know, the revenue is something that’s happening over a time period revenue represents Action, in this case over the month, how much has been generated or earned over the month, whereas the balance sheet just represents what is their cash, for example, the main balance sheet account is just is what it is, as of the point in time. It’s not like a dynamic thing. This is kind of something you can imagine moving from from January to December up from zero to 100,000.

17:24

We have revenue going to be our main generating revenue account, note that revenue typically only goes up in that means that we are going to get revenue from customers, they pay us we don’t generally pay the customers. Now we may have a problem or something that would happen, in which case we would incur an expense and have to pay the customers for some expense that happened. But normally, the revenue is only going to go in one direction it’s going to go up. Then we have the expenses here. Those are things that are weak aren’t to consume, in order to help us to generate revenue within the same time period. So I examples in this case are going to be wages expense, utilities expense, we are typically going to have a lot of different types of expenses as well we can imagine, all the things that we are going to pay out are going to be the types of expenses. And note that there’s typically going to be more expenses than revenue type accounts. reason for that is because of specialization.

18:22

Meaning, when we’re thinking about revenue generation, what is the company going to do? What is the business going to do in order to generate revenue, they are going to focus in on those things, they do well, and that’s the things that they are going to do. Typically, those things are going to be one or two things. When considering the things that we need to spend money on in order to help us generate revenue. We’re going to spend money on everything else, everything else that we need to help us generate, that we’re going to spend money on therefore, there are going to be more Expense Type accounts, then there will be revenue type accounts. However, the hope is that the Expense Type accounts will be Less and dollar amount, then the revenue type accounts. And therefore in this format, we didn’t need a subcategory for revenue.

19:08

Note, we don’t have a subcategory revenue, and then revenue, because there’s only one account. Therefore, we’re just going to put revenue on the books on the on the statement and represent the number on the right hand side and not have any sub category pulled into the left hand side. The expenses then will have expenses colon, and then we’re going to sub categorize those expenses and dent those expenses, pull the numbers into the inner column, and then we’re going to pull the total out into the outer column the 50 plus the 10 being the 60,000 of expenses. Bottom line on the income statement will of course be net income represented calculated as revenue minus expenses.

19:51

So 100,000 revenue minus the 60,000 expenses, gives us in this case that net income of 40,000 note that When we look at the income statement, we don’t see anything representing the accounting equation on the income statement meaning when we were looking at the balance sheet, we said the balance sheet was everything in terms of the accounting equation in terms of a double entry accounting system in that the balance sheet has all components of the accounting equation within the balance sheet of assets equals liabilities plus equity. When considering the income statement, we don’t see directly assets, liabilities, or equity.

20:30

So the question we need to understand we need to be able to explain then is how is the income statement related to the double entry accounting system? If we don’t see assets, liabilities or equity within the income statement, and how is it just going to be attacked on is it another statement that’s just kind of tacked on as more added information to the balance sheet and the double entry accounting system? Or is the income statement somehow part of both the accounting equation, the balance sheet somehow and the double entry accounting system that’s the question we want to be able to understand? The answer is that we’re going to say that the income statement is part of, in essence, the equity section, meaning, remember that this equity section represents the book value or the bottom line, if you want one number to represent the balance sheet, it is the equity here. And that’s because it represents the book value, in essence, the value of the company.

21:23

If we were to liquidate the company, we believe we would have at this point in time 68,000 assets minus liabilities of that 68,000. So if we were going to say what is the value of the company right now, the closest indication that we have in terms of the balance sheet is that 68,000 that’s where the balance sheet really stands at this point time, that’s what the value of the company is as reported by the balance sheet as of December 31. Now if we want to know the history on how we got to that point in time, that just tells us where we stand. Typically if we are making decisions on whether or not to invest in this company, or whether or not to give a loan to this company, we want to know where the company stands.

22:07

And we also want to know how they have been performing over a certain time period, the performance being something that will give an indication as to how they will perform in the future. Therefore, that’s going to be the income statement, the income statement, it’s going to be telling the story, how did we get from, you know, to this number, going back certain point in time in history, in this case, one month, we’re going to say, how do we get to that 68,000? Well, let’s take a look at last month. Let’s go back let’s tell the story of last month last month, we earned 100,000 of revenue minus the 60,000 of expenses, giving us net income of 40,000. That is what contributed in part to the 68,000 equity section. Now, if we want to know more of the story, we would have to go back two months we’d have to go back a year and tell more of the story.

22:57

And of course we might have a corporation that’s been in business for a long period of time, and we could go back all the way back in history to tell the full story. However, if we are making decisions from this point forward, we’re really concerned normally with the last few years of performance, we’re trying to see a trend and trying to see whether or not that trend will continue into the future. So generally, we’re going to say this is where we stand and we want to look back a month or a year or a few years to see what has happened in order to contribute to this point in time that we are now standing. We are now able to define the balance sheet and list its parts define the income statement and list its parts and explain how the income statement relates to the balance sheet.