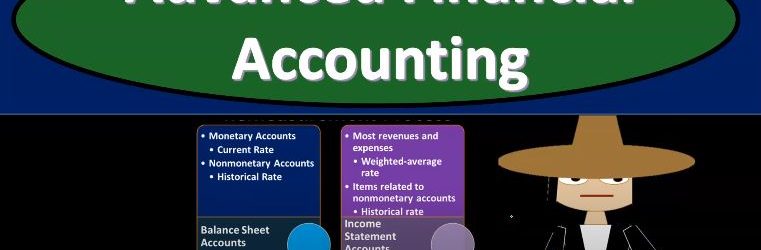

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss the remeasurement process for financial statements of a foreign subsidiary. Get ready to account with advanced financial accounting remeasurement financial statement of foreign subsidiary remeasurement overview so we’re going to go through the process of the remeasurement. As you think of the measurement process, you want to be comparing and contrasting it to the translation process. So you’re envisioning basically you got a parent company. The parent company has a subsidiary the subsidiary is a foreign subsidiary. The subsidiary then conducts their books. Typically we’re thinking in a foreign currency right, that subsidiary is conducting their books in a foreign currency. If we need to consolidate the subsidiary into the parents financial statements, the parent uses dollars to measure their books subsidiary uses a foreign currency on the bookkeeping side, how do we get them over $2 so we can do the consolidation process. two methods generally we can use a translation method or a remeasurement method, and we have to determine which method we’re going to use by determining what the functional currency is. And once we know what the functional currency is, then we can determine whether we need to use the translation method or the remeasurement method. And they’re going to be slightly different. Now note, there’s also a third kind of option where we might have to use translation and remeasurement if there was a situation where the foreign currency has the financial statements, and something other than the US dollars and then the functional currency was not the currency that their bookkeeping was in, and it’s not the US dollar.

Posts with the historical tag

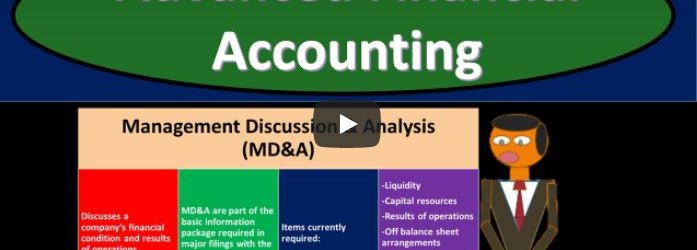

Disclosure Requirements

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss disclosure requirements get ready to account with advanced financial accounting disclosure requirements. We have the management discussion and analysis that’s often referred to as the M D and A discusses a company’s financial condition and results from operations. The MD and a are part of the basic information package required in major filing with the SEC, the Securities and Exchange Commission. Items currently required in the MD and a the management discussion and analysis include liquidity, capital resources, results of operations, off balance sheet arrangements, tabular disclosure of contractual obligations, disclosure requirements, pro forma disclosures, pro forma disclosures, financial presentations generally taking the form of summarized financial statements. demonstrate the effect of major transactions that happen after the end of the fiscal period or that happened during the year, but are not fully reflected in the company’s historical cost financial statements.