Advanced financial accounting PowerPoint presentation. In this presentation we will discuss sec structure and Regulatory Authority get ready to account with advanced financial accounting in sec structure and regulatory authority, Securities and Exchange Commission the SEC What is it? It’s an independent federal agency It was created in 1934. It’s going to regulate and it does regulate the securities markets, the SEC helps maintain an effective marketplace for companies issuing securities and for investors seeking capital investments. Now we’ll take a look at a brief history of leading up to the creation of the SEC and a little bit about the SEC itself. So if we have an understanding of the history, then it gives us a little bit better of an understanding of why the SEC does what it does today and how it how it was created or came to be. So in 1792, was when the New York Stock Exchange was created to function as a clearing house. For the securities trades between its invit its investors. So now we have the New York Stock Exchange that will function as the clearing house. But then in 1911, states started to pass, quote, blue sky laws in quotes to help regulate the offerings of securities by companies without a solid financial base. So in other words, they saw a need for regulation, now that you have the securities that are on the New York Stock Exchange and can then be offered basically, to more to the public, more people will have access to purchasing them and putting capital into the market, then there’s a lack of transparency, the people that are putting money in maybe doing it solely on speculation, and we don’t have the information to really support the claims possibly that could be made by the stocks that are that are being traded and therefore, you could have situations and did have situations where you had stocks that had no supporting you know, value or very little supporting value to them.

Posts with the issuing tag

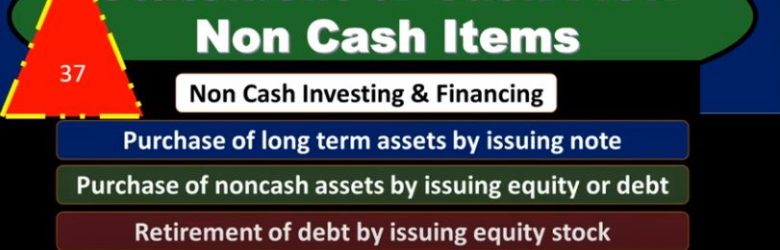

Statement of Cash Flow Non Cash Items

In this presentation, we will take a look at the statement of cash flows non cash items. First question, why would we be looking at non cash items when considering a statement of cash flows? We’re gonna go through a list of non cash items first and see if you can recognize a trend in these and why we might be linking them to a statement of cash flows discussion, then we will explain more fully on the idea of looking at non cash items when considering a statement of cash flows. So, some examples of non cash items would be the purchase of long term assets by issuing a note the purchase of non cash assets by issuing equity or debt, the retirement of debt by issuing equity stock, lease of assets in a capital lease transaction and exchange non cash asset for other non cash asset. Consider these examples and note some of the common features including the deal with investing and financing activities. and think through why we might be linking them to a statement of cash flows. We’ll go more fully through this by giving an example of the purchase of long term assets by issuing a note, an example that we can then apply out to the rest of these items. So what are we going to do with these non cash items, we’re going to report them at the bottom of the statement of cash flows or report them in a note related to the statement of cash flows. So we’re going to have to say in some format, or other, hey, look, these are some non cash items that we’re linking to, for some reason, the statement of cash flows.

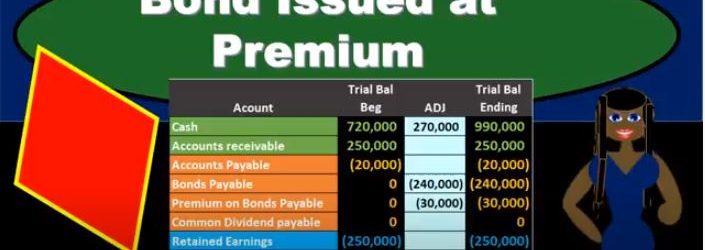

Bond Issued at Premium

In this presentation, we will take a look at the journal entries related to issuing a bond at a premium. When considering the journal entry for a bond, remember what can change and what is the same for a bond. When we think about a bond, it’s already been printed, we know the amount of the bond, the interest on the bond, the maturity date of the bond, these are already set. So if we’re making a negotiation with the bond after it had already been printed, then we can’t change the face amount. We can’t change the interest due dates. What can we change in order to negotiate and make a sales price on the bond, we can change the amount that we issue it for. So keep that in mind. Whenever you think about these bond problems. That’s the thing that’s going to differ from a bond to a note. The thing that changes when we want to loan is the interest rate. The thing that changes when we want to issue a bond that’s already been made is going to be the amount we receive For the bond being different than the face amount of the bond if there’s a difference in the market rate and the contract rate. So in this example, we’re saying that we issued a bond. Now note that when we think about the issuance of the bond, just like a note, we often have more information than we really need. And that can be a little bit confusing for us.