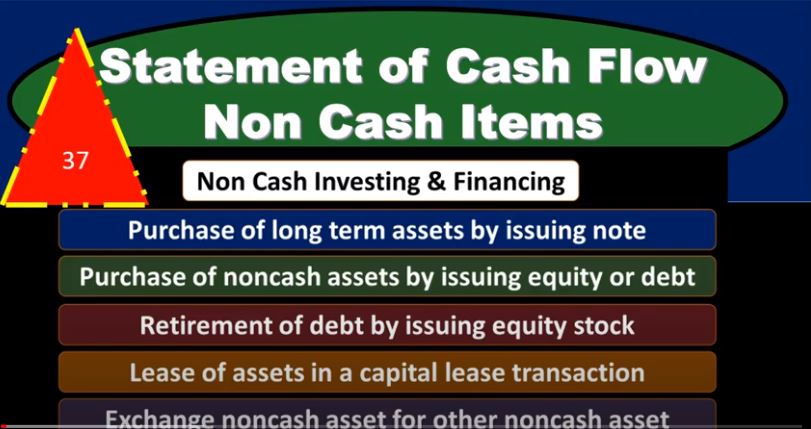

In this presentation, we will take a look at the statement of cash flows non cash items. First question, why would we be looking at non cash items when considering a statement of cash flows? We’re gonna go through a list of non cash items first and see if you can recognize a trend in these and why we might be linking them to a statement of cash flows discussion, then we will explain more fully on the idea of looking at non cash items when considering a statement of cash flows. So, some examples of non cash items would be the purchase of long term assets by issuing a note the purchase of non cash assets by issuing equity or debt, the retirement of debt by issuing equity stock, lease of assets in a capital lease transaction and exchange non cash asset for other non cash asset. Consider these examples and note some of the common features including the deal with investing and financing activities. and think through why we might be linking them to a statement of cash flows. We’ll go more fully through this by giving an example of the purchase of long term assets by issuing a note, an example that we can then apply out to the rest of these items. So what are we going to do with these non cash items, we’re going to report them at the bottom of the statement of cash flows or report them in a note related to the statement of cash flows. So we’re going to have to say in some format, or other, hey, look, these are some non cash items that we’re linking to, for some reason, the statement of cash flows.

01:33

So they’re going to be important things that we want to disclose to the reader of the financial statements either in connection directly to the statement of cash flows, or to a note to the financial statements that will be in reference to the statement of cash flows. So that goes back to the question again, as to why these non cash things would be linked to the statement of cash flows. Why don’t we just put them in a different note? Why are they somehow tied to the statement of cash flows and given An example of why that kind of makes sense. Let’s take a look at one of these items, that would be a non cash item that we would need to report, we’re going to purchase long term asset by issuing a note. Let’s think about the journal entry related to that, we’re going to say that the equipment would go up, we would debit the equipment if we did this, and then we would credit the note payable. So no cash is taking place here, there’s no cash happening. So it would not be a cash item, we wouldn’t be reporting it on the investing activities or the operating activities or the financing activities. But we can also think of this as kind of two things that really happened we kind of cut out the middleman we kind of cut out cash as the middle transaction here. You can consider this as two transactions that could have taken place. And the same end of the same result, which would be that we had cash if we got cash goes up because we took out a loan. So we could take out a loan and then pay for the equipment and we would end up in the same plays. So if we took out a loan, we would increase the liability as we did here, we would debit cash, but then we would just turn around and take that cash and pay for the equipment with it. So then we would debit equipment and pay cash.

03:14

So note, what we did here is we just this transaction that would deal with cash as the medium of exchange for this transaction, we just kind of cut out the middle person, we cut out the cash and went directly to this transaction here. So you can see if this is why they’re related in some format to the cash flow statement, we’re basically saying it’s a transaction that would have had cash as an exchange, but the cash was removed and we did some type of other exchange. These transactions will typically be including financing and investing type activities, meaning they’re going to be dealing with notes payable, bonds payable purchase of things like equipment, and no cash will be exchanged, but because of this relationship, we still want to disclose them in relation to a cash flow statement. So never We can see this transaction. Let’s see if we can apply that to some of the other examples we have. So we’ve got cash purchase for long term asset by issuing the note. Again, you can kind of break that journal entry that you would think of when you issue a note if we bought something, and you’d issued note into two journal entries dealing with cash receiving cash and then paying cash. Another example would be the purchase of non cash assets by issuing equity or debt. So if we bought some type of non cash asset, didn’t pay cash, but we issued equity or debt. You can think of that same type of transaction.

04:35

If we broke that up into two transaction we issued, we got the debt, got the cash and then paid for the non cash items. So if you can think about being able to break these things up into two transactions of getting a loan or getting equity, issuing stock, getting money and then buying the non cash, purchase for cash, then that’s probably an item that we would need to report here. If we have a retirement of debt by issuing equity stock, you can think of that is a same the same kind of thing that’s going on here, we could have had the issuing of stock gotten cash use that cash to retire the debt. Instead, we just retired retired the debt with the stock. We have the example of a leased asset and a capital lease transaction. That’s basically the same thing as a purchase on financing a capital lease. A capitalist is structured as a lease, but really, it’s a purchase that we financed in form substance over form or in substance and substance, it’s really a purchase that was made. And then we financed that purchase. So that’s going to be a similar example a similar example as we have up here with the purchase of long term assets by issuing a note and then we have the exchange of non cash assets for another non cash asset. And again, that would just be an exchange that would happen we we gave one asset and received another, you can again think of that as well. What if we, you know, gave the asset got cash they gave the asset cash and you know we exchanged for cash. So, anything that you can kind of break out you can think Well, basically we eliminated the sale and then and then the cash transaction that’s going to be one of those types of issues that may be needed to be reported as non cash items related to the statement of cash flows.