QuickBooks Online 2021 purchase order and new inventory item. In other words, we’re going to add a new inventory item as we create a purchase order. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice file, we’re going to be entering a purchase order as we do so we’re going to add a new inventory item and add a new vendor.

Posts with the order tag

Enter Purchase Order P.O. 7.17

QuickBooks Online 2021, enter purchase order, or P OE. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice file, we’ll be entering a purchase order, we’re not going to be opening up the financial statements because if I opened this plus button or the New button, unlike any of the other forms here in the customers, vendors or employee cycles, the purchase order does not have an impact on the financial statements. In order to see that, let’s review it with our flowchart which is on the desktop version.

Bank Feeds .25

QuickBooks Online 2021 Bank feeds. Let’s get into it with Intuit QuickBooks Online 2021. Here we are online in our Google search engine. We’re typing in the QuickBooks Online test drive to get to our QuickBooks Online at Test Drive File, we’re going to be clicking on QuickBooks Online at test tribe, verifying that we are not a computer here, and then continue. Here we are in the Craig’s design and landscaping services practice file, we’re going to be touching in on the bank feeds. And the first thing we want to note is that we will be going into bank feeds in more detail, but it will be after the primary practice problem where we will focus specifically on bank feeds.

Degree of Operating Leverage 515

Corporate Finance PowerPoint presentation. In this presentation, we will discuss the degree of operating leverage, get ready, it’s time to take your chance with corporate finance, degree of operating leverage. Now remember, when you hear this term leverage, there’s two things that pop into your mind that generally categories of leverage. The first one is probably related to debt debt leverage or financial leverage. And the other related to the cost structure, the one that we’re going to be focusing in on here, the structure between variable costs and fixed costs. So what’s going to be the structure of the variable cost fixed costs, that’s kind of what we’re measuring here, with the degree of operating leverage the fixed costs being the thing that’s going to have more leverage related to it.

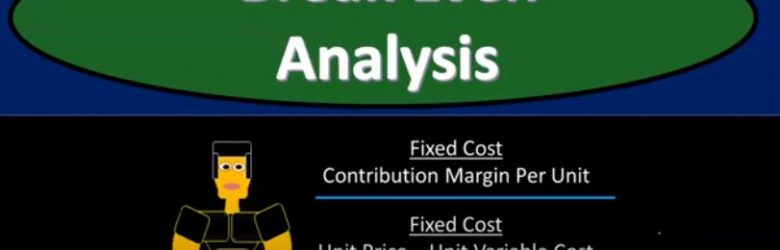

Break Even Analysis 510

Corporate Finance PowerPoint presentation. In this presentation, we will discuss breakeven analysis, get ready, it’s time to take your chance with corporate finance. Break Even analysis includes our fundamental tools for making projections and predictions into the future. Now note, when we think about breakeven analysis, the fundamental calculation within a breakeven analysis will be the break even point. But when we hear breakeven analysis in general, you can think of it that as a more broad kind of perspective, to use some of these tools in order to think about projections into the future. So when you hear breakeven analysis, you’re typically thinking kind of projections, budgeting, future based analysis, as opposed to some financial accounting, which is typically going to be based on the past prior performance.

Percent of Sales Method 425

Corporate Finance PowerPoint presentation. In this presentation we will discuss the percent of sales method, the percent of sales method been a tool that can help us with our projections out into the future help us to think about where we will stand, think about what our balance sheet accounts will be in the future. If we, if we estimate some type of growth into the future also help us to determine whether or not we may need additional funding to support our growth plans that we have set in place. Get ready, it’s time to take your chance with corporate finance percent of sales method. Now this method can be a little bit confusing when you first look at it in the calculation or formula for it can be a little bit intimidating as well, I highly recommend to get a better understanding of this formula and how to apply it to go through the practice problems, we will have practice problems related to this formula in terms of Excel problems, as well as working through the practice problems and presentations in one note.

Pro Forma Income Statement 410

Corporate Finance PowerPoint presentation. In this presentation, we will discuss the pro forma income statement, get ready, it’s time to take your chance with corporate finance pro forma income statement. Let’s first take a step back and think about the pro forma financial statements in general, remembering the fact that we got to do them in some type of order in order to do them in a logical fashion. And that would mean that we would first need the sales projection information, the production plan, we can use those in order to create the pro forma income statement.

Income Statement Overview 220

Hello in this presentation we will discuss the income statement objectives. At the end of this presentation, we will be able to describe what an income statement is list the parts of the income statement and explain the reasons for an income statement. First, we’ll start off with a question we’ll which will explain the timing of the income statement or introduce us to an explanation of the timing of the income statement? And that is the question of asking somebody, how much do you make when we work through if we were to ask somebody how much they make? They would mentally make some type of assumption in order to answer that question, or they would ask you the question if they chose to answer at all. The question, What do you mean? Do you mean per month? Do you mean per year? Do you mean per week? And this is going to be something that needs to be answered in order to answer the question.

Closing Process Step 1 of 4 – Journal Entry 1 of 4

Hello, in this lecture, we’re going to talk about the closing process step one of the step four process. Last time, we talked about the objectives of the closing process, which in essence was to close out the temporary accounts, all the accounts from the draws, and the revenue and expenses on down to zero. Putting that balance into the capital account, we talked about how we were going to do that, we’re going to do a four step process, including closeout, the income to the income summary, and then close out the expenses to the income summary. And then we’re going to close out the entire income summary to the capital account. And finally closeout draws to the capital account. We’re going to start off with step one of those four step processes. In order to do this. We are adding this new account you’ve probably been wondering, income summary account, what is that? Where did it come from? Why is it there? The income summary can be called a clearing account, meaning it’s going to start at zero and it’s going to end at zero right when we’re done with this four step process which we’re going to do basically at the same point. Time.

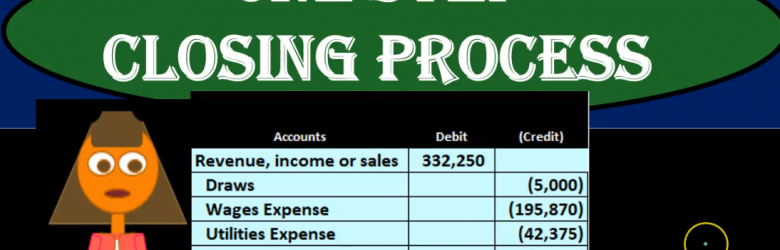

One Step Closing Process

Hello in this presentation, we will be looking at a one step closing process. In other words, we will be closing out temporary accounts using one journal entry. There’s a few different ways that we can perform the closing process. And there’s benefits and cons to each way of doing it. The one step closing process is the simplest way to do it. And it’s also a way that we can imagine what is happening within the closing process as easily as possible a skill useful when considering what’s happening from time period to time period, and how the financial statements are working. So here we’re going to look at a one step closing process. Remember what the closing process is, it’s going to be a process at the end of the time period that we will be performing.