Advanced financial accounting PowerPoint presentation. In this presentation we will discuss the remeasurement process for financial statements of a foreign subsidiary. Get ready to account with advanced financial accounting remeasurement financial statement of foreign subsidiary remeasurement overview so we’re going to go through the process of the remeasurement. As you think of the measurement process, you want to be comparing and contrasting it to the translation process. So you’re envisioning basically you got a parent company. The parent company has a subsidiary the subsidiary is a foreign subsidiary. The subsidiary then conducts their books. Typically we’re thinking in a foreign currency right, that subsidiary is conducting their books in a foreign currency. If we need to consolidate the subsidiary into the parents financial statements, the parent uses dollars to measure their books subsidiary uses a foreign currency on the bookkeeping side, how do we get them over $2 so we can do the consolidation process. two methods generally we can use a translation method or a remeasurement method, and we have to determine which method we’re going to use by determining what the functional currency is. And once we know what the functional currency is, then we can determine whether we need to use the translation method or the remeasurement method. And they’re going to be slightly different. Now note, there’s also a third kind of option where we might have to use translation and remeasurement if there was a situation where the foreign currency has the financial statements, and something other than the US dollars and then the functional currency was not the currency that their bookkeeping was in, and it’s not the US dollar.

Posts with the other comprehensive income tag

Translate Financial Statements of Foreign Subsidiary

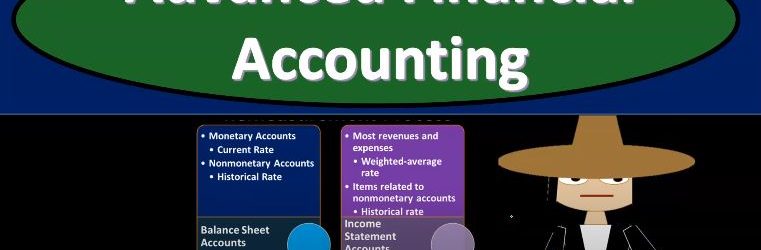

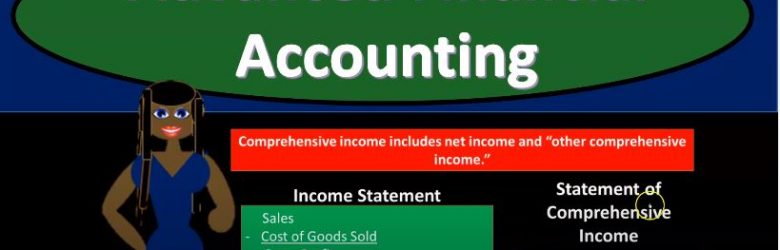

Advanced financial accounting PowerPoint presentation. In this presentation, we will discuss translate financial statements of foreign subsidiary, get ready to account with advanced financial accounting, translate financial statements of foreign subsidiary. So we’ll go through the general process of the translation process for the revenue and expenses, the average exchange rate for the period covered by the statement is the rate that is generally going to be used. And again, this would make sense, because if we’re talking about the revenue and expenses, we can’t really pick one rate, because that is a statement of how the performance did over time from beginning to the end. And therefore we need to use some kind of rate that would be representative and it wouldn’t really make sense to use the rate at the end of the timeframe but possibly some average of it. So a single material transaction is translated using the rate in effect on the translation date. So then there could be an argument that could be made we could say okay, so We’re not going to use just one rate, like at the end of the time period like we’re using on the balance sheet generally, because that would make more sense on the balance sheet because it’s reported as of a point in time. But on the income statement, yeah, it makes more sense for us to use some rate that’s kind of reflective of the timeframe. So possibly we’ll use an average rate. But what if we have this really material type of transaction that’s really large transaction, maybe in that case, we should we should deviate from just an average rate and use the rate as of that point in time or like a historical rate at that point in time. assets, liabilities and equity. So now we’re talking about the balance sheet. So for the most part on the balance sheet, you would think all right, it would make more sense then for us to be using the current exchange rate, which would be as of the date of the balance sheet date. So which says as of the end of the time period, if we’re talking for the for 1231 income statements or financial statements for the year ended 1231 then we’re talking 1231. The end of the time period is when all the balance sheet accounts are reporting as Oh, As of that point in time, and therefore, for the most part, you would think that the current exchange rate, the rate as of that point in time would work. However, you can also think that the historical exchange rate might be used for some items, some, again, some kind of large items power, possibly for the property, plant and equipment.

Forward Exchange Financial Instruments

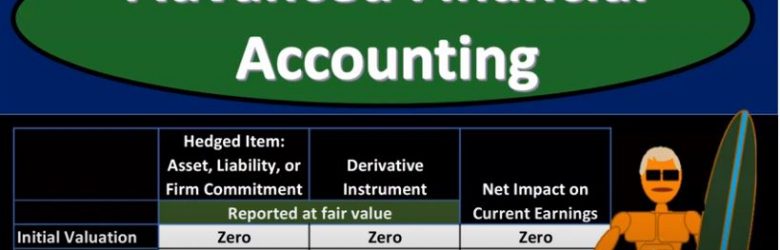

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss forward exchange of financial instruments get ready to account with advanced financial accounting, forward exchange financial instruments let’s start off with some definitions starting off with financial instrument itself will be either cash evidence of ownership or a contract that imposes on one entity on contractual obligation to deliver cash or another instrument and conveys to the second entity, the contractual right to receive cash or another financial instrument. That of course, being the most complex component here. So let’s read that one more time. The financial instrument a contract that imposes on one entity a contractual obligation to deliver either cash or another instrument and conveys to the second party the second party in this item, the second entity, the contractual right to of course, receive the cash or another financial instrument derivative. So a derivative, financial instrument or other contract whose value is derived from some other item that has a value that varies over time. So let’s think about that one more time again, derivative financial instruments or other contracts whose value is derived from, they’re going to get the value from some other item that has a value. That is that varies over time, meaning of course, that it will be changing over time. So let’s think about the derivative characteristics. And then we’ll apply these to the component of what we’re considering here. foreign currency and foreign currency transactions in terms of typically foreign currency type hedge transactions.