QuickBooks Online 2021 track and pay invoices from customer center. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice file, we’re going to be recording a customer payment. Before we do so let’s duplicate the tab up top right clicking on the tab up top and duplicate.

Posts with the paid tag

Reports Overview 1.92

QuickBooks Online 2021. That reports overview, let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive file, which you can find by searching in your favorite browser. For QuickBooks Online test drive, we are in Craig’s design and landscaping services practice file, looking at the reports, which will be on the left hand side. So we’re gonna go down to the reports on the left hand side, up top, you have the standard, we have the custom reports, we have the Manage reports. Then down below, you’ve got your favorite reports up top, the favorite reports can be brought up top by selecting the star next to any of the reports, you can see this balance sheet was brought up top with the little star there.

Receive Payment on Invoices 7.25

QuickBooks Online 2021 receive payments on invoices. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitar practice problem in prior presentations, we entered a few invoices. Now we’re going to go over the process of receiving the payment on the invoices. Let’s first open up our reports the reports balance sheet income statement and the trial balance. Going up top, we’re going to duplicate some tabs right clicking on the tab duplicate, we’re going to do it again right click and duplicate, right click Duplicate.

Purchase Depreciable Asset & Make Investment in Securities 7.10

QuickBooks Online 2021. Purchase depreciable asset and make investment in securities. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice file, we’re going to be opening up our balance sheet income statement and trial balance we’re going to do so by adding three new tabs up top, I’m going to right click on the tab up top duplicate, going to do it again, right click on the tab up top duplicate, and then right click on the tab up top one more time and duplicate again, the one on the far right, this is where I’m going to open up the trial balance.

Account & Settings – Billing & Subscription, Usage & Sales Tabs 6.20

QuickBooks Online 2021 account and settings, billing and subscription usage and sales tabs. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our get great guitars practice file, we’re going to be continuing on with what would be similar to the preferences in the desktop version by going to the cog up top, we’re going to go into your company column on the left side, look at the account and settings. Last time, we took a look at the account and settings for the company information.

Vendor Center Expenses or Vendor Tab 1.17

QuickBooks Online 2021 vendor center or expenses or vendor tab. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our Google search page, we’re searching for QuickBooks Online at test drive, we’re going to open up the test drive from Intuit verify that we are not a robot.

Customer Center Or Sales Tab 1.32

QuickBooks Online 2021 customer center or sales tab. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our Google search page, we’re going to be searching for QuickBooks Online at test drive, then we’re going to be selecting QuickBooks Online test drive from Intuit, we’re gonna be verifying that we’re not a robot, even though I’m not totally sure at this point, I mean, how would you even know really, if you were a robot or not? I mean, if you think about it, it’s kind of it’s kind of a deep question.

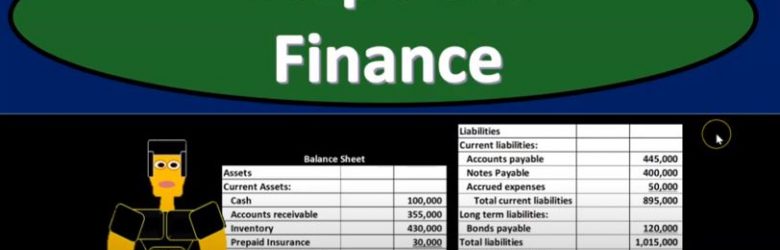

Balance Sheet Continued 215

Corporate Finance PowerPoint presentation. In this presentation, we will go into more detail about the balance sheet. Get ready, it’s time to take your chance with corporate finance, balance sheet continued. Remember when we’re thinking about the financial statements, we can break them out to two separate objectives. If we’re considering this from an investor standpoint, that is, where does the company stand at a point in time, and what’s the likelihood or their earnings potential in the future, which we will typically based on past performance, therefore, you’re going to have the timing statement and the point in time type of statement. So when we think about the balance sheet, that’s going to be the point in time type of statements. So if you’re looking at the financial statements for the year ended December 31, the balance sheet will be as of the end of the period, in this case, December 31, as opposed to the timing statements, which are going to be the income statement being the primary statement that should come to mind measuring performance, which will be as of January through December 31 measure and how well we did for that range of time. So our focus over here is going to be on the balance sheet.

Consolidation & Preferred Stock

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss the consolidation process when there is a preferred stock involved, get ready to account with advanced financial accounting. We’re talking about a situation here where we have preferred stock in the subsidiary and a consolidation process we’re doing the consolidation subsidiary has some preferred stock, you’ll recall that the characteristics of preferred stock generally means that in general, they have preference with regards to dividends and distribution of acids in liquidation over common shareholders. So therefore, when when a distribution happens if there’s going to be dividend distributions, for example, the preferred stockholders will typically get paid first, and we got to consider how that will be impacted or affected within our consolidation process.

Subsidiary Sells Additional Shares to Parent

Advanced financial accounting PowerPoint presentation in this presentation will discuss a consolidation process where we have a parent subsidiary relationship and the subsidiary sells additional shares to the parent. So we have a situation where we have the subsidiary selling additional shares to the parent, what’s going to be the effect on the Consolidated Financial Statements get ready to account with advanced financial accounting. We’re talking about a situation here where the subsidiary is going to sell additional shares to the parent and the price is going to be equal to the book value of the existing shares. In that case, it’s going to increase the parents ownership percent, because the parent now has more stocks and no one else got more stocks. Therefore, their percent ownership is increasing. The increase in the parents investment accounts will equal the increase in the stockholders equity of the subsidiary the book value of the non controlling interest is not changed and the normal consolidation entries will be made based on the parents and new ownership percent. So obviously when we do The consolidation entries, we’re going to be basing them on the new ownership percent, that’s going to be the more simple kind of situation where we have the price equal to the book value. What if there’s a sale of additional shares to the parent at an amount of different than the book value, so we still have shares going from the subsidiary to the parent, but now the amount is different than the book value. This increases the carrying amount of the parents investment by the fair value of the consideration. So in other words, the carrying amount of the parents investment in the subsidiary is going to go up by that what was paid for it that consideration given whether that be cash at the fair value of something other than cash. At consolidation, the amount of a non controlling interest needs to be adjusted to reflect the change in its interest in the subsidiary.