In this presentation, we will continue on with our statement of cash flows using the indirect method looking in on the change in accounts payable, we’re going to be using this information or a comparative balance sheet income statement and other information focusing primarily on comparative balance sheet creating a worksheet with it, looking like this. This basically being the comparative balance sheet. But in a post closing trial balance format, we have our two periods and the difference between those periods here. Our goal is to find a home for all of these differences. Once we do so we’ll end up with basically the change in cash. That being our bottom line that we’re looking for. We’ve gone through this information in terms of the cash flows from operations. We’re currently looking through the current assets, and now we’re moving on to the current liabilities. So we’ve looked at the accounts receivable, the inventory, prepaid expenses, we have these here. We’re moving on now to a liability and notice when we do that, when we’re working From the worksheet, we’re kind of skipping over some things here.

Posts with the prepaid expenses tag

Statement of Cash Flow Indirect Method Change in Prepaid Expense

In this presentation, we will continue with the statement of cash flows indirect method looking at the change in prepaid expenses, we’re going to be using this information, we’ve got the comparative balance sheet, we’ve got the income statement and some additional information, we will be working primarily with the difference in the comparative balance sheet with the use of a worksheet taking this information to create this worksheet. So this is just basically a comparative balance sheet that has been condensed down to something that looks like a post closing trial balance. We are constructing our cash flows from operations from it, we have all of our differences. We’re basically just finding a home for these differences. We know if we do so that if we find a home for all of these differences, then it’ll add up to that difference, the difference in cash, which is basically the bottom line of our cash flow statement, or that’s what we want to get to in terms of adding up the cash flows. So we’ve gotten so far We’re working on the cash flows from operations. And we’ve done the cash flows in terms of the accounts receivable, inventory. Now we’re on prepaid expenses. We’re just going through these.

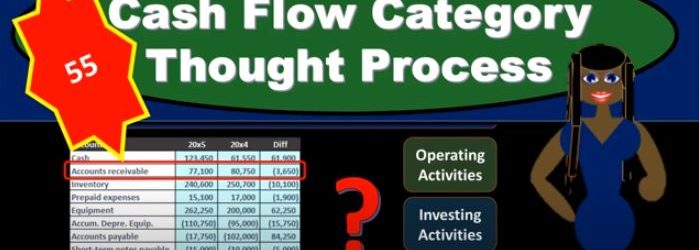

Cash Flow Category Thought Process

In this presentation, we will think about the thought process to know which category a cash flow should be entered into whether it should be operating, investing or financing activity. When putting together the statement of cash flows, we’re usually going to have a worksheet, which will typically have a comparison of balance sheet accounts. And we also might just have test questions that will ask us, where should this cash flow go? And that’s going to be a common kind of question that we’re going to have whether we build the entire cash flow statement from scratch, or whether we’re just asking test test questions and trying to know what types of Cash Flows we’re talking about. It’s also important for practice as well so that we can understand when we’re thinking about cash flows, where do they belong? What are these cash flows mean? What are they doing for us? What are they doing for the company? Are they part of the operations? Are they part of investing? Are they part of financing? If we look at a worksheet like this to build the statement of cash flow, typically we’re going to look at a balance sheet for two periods. So here our balance sheet for these two periods. And we’ll have the difference between the two periods in terms of the balance for these balance sheet accounts. So we’ve got cash, accounts receivable, inventory, prepaid expenses.

01:13

Now what we’re going to do is we’re going to take the change in cash, that’s going to be the end result on our statement of cash flows. And we’re going to kind of back in to that end result by looking at the change in the other balance sheet accounts and tried to figure out what’s causing this change. So we’re going to go through all the other balance sheet accounts, look through these changes. And we know that if we look if we add them all up, they add up to zero. Why? Because the debits and credits for one year, add up to zero the debits and credits for the other year add up to zero. In other words, the debits minus the credits equals zero. And therefore the difference between the two years debits and credits the change will add up to zero. So we know that’s the case and we know that if we add up then everything except cash Then the result will be the difference in cash. So that’s how we’re going to kind of work and put together our statement of cash flows. So what we need to do then is we’re going to take a look at these changes in receivables, changes in inventory changes in prepaid expenses, and then try to determine where does that change belong? Before we get into any other question is, is the change of inventory and operating, investing or financing activity? And is the change in long term notes payable? Is that going to be an operating investing or financing activity? Our goal here is to go through a thought process to see if we can think through more clearly which category these these should be belong to. So what’s the most common journal entry in this account? It’s going to be our first question.

02:48

Whatever account they’re given us here, we’re going to say it let’s think about the most common journal entry that’s related to this account, there’s typically going to be one or two journal entries that are going to be very common and we want just right down first, once we know the most common journal entry, then we’re going to ask is an income statement account involved? So when we think about whatever account we’re dealing with, we’d write down the journal entry and say, Okay, is there an income statement account involved? Is there a revenue account or an expense account involved? If the answer is yes, then it’s probably the change that we’re dealing with is probably something that should be in the operating activities. Because remember, the operating activities is kind of like the income statement on a cash basis. So if we’re dealing with something that’s this change has something to do with the income statement, then it’s going to be something on the operating activities. Typically, if the journal entry has nothing to do with the income statement, there’s no revenue or expense accounts involved in the normal journal entries related to these accounts, then we’re going to ask the question, are we purchasing or selling an asset? Because it’s so if it’s not operating, this means that it’s not operating therefore, We’re trying to see if it’s going to be investing activity. And that typically means we’re purchasing or selling an asset. If it has to do with, for example, property, plant and equipment, or some other type of investment, then it’s going to be an investing activity. And then if it’s not, then it’s going to be financing. And of course, financing is going to be dealing with notes, something that we’re dealing with that doesn’t deal with operating activities in terms of the income statement, no revenue and expenses, and typically doesn’t have assets involved either, because what we’re doing is funding the company. So that’s typically going to be something that deals with cash and subtype of liability or the equity section. So this is going to be our thought process if we go through each of those line items, and think about each account on the balance sheet.

04:46

And then try to go through this thought process and think okay, which category are we going to be putting this change to? Now, this looks a little less intuitive than we might think at first glance here because no one We’re doing we’re looking at the balance sheet accounts. And we’re trying to see what category these things are going to fit into. And remember that the operating activities I’m keep on comparing that to the income statement. And you might be thinking, well, these are all balance sheet accounts. Why do you keep mentioning the income statement. And note, what we’re doing here is we’re really kind of backing into the activity is happening by looking at the change in two points in time. So we’re kind of still looking at the income statement activity type of accounts, we’re looking at change, we’re looking at activity, even though we’re doing that by looking at the change in two points in time to balance sheet accounts, which are points in time. So when we look at the change in accounts receivable for example, if we go through our thought process, we’re going to say okay, accounts receivable was at 80,007 50. In the prior year, end of the current year, it’s at 77,100.

05:51

That means it went down by 3650. So our goal here is just to determine which category That change belongs to it’s an operating, investing or financing. And if we think about that, then we could think Well, what’s the normal journal entry related to accounts receivable? We’re going to have a debit to accounts receivable and a credit to sales. That’s going to be our normal journal entry that we’ll have related to accounts receivable. And we can see there that sales is an income statement account. So we know that it is an income statement account involved, we’re going to say yes, therefore, it’s an operating activity. So note what we’re doing here, we’re looking at the change in a balance sheet account. We’re looking at the change in the balance sheet account, then ask yourself, what’s the normal journal entry related to this account? And if we think about the normal journal entry related to accounts receivable, that’s a sale of something on account. So accounts receivable goes up when we make a sale on account, and we credit revenue and revenue is clearly an income statement account. So this Change, then that’s what we’re going to think through, we’re going to say that change looks like it belongs somewhere in the operating activities. Because we’re dealing, we’re really kind of backing into sales. That’s what we’re really looking at. And we’re going to do that by writing down the journal entry. Let’s look at another account. We’re going to pick equipment now. So we’re just going to go through all these changes. And we just got to find a home for all these changes.

07:21

When we when we make the statement of cash flows. We got to find a home for them in either operating, investing or financing. And we’ll end up with the change in cash, which is kind of like the bottom line. The bottom line will be cashed at the end of the day. So we’re going to find a home for the equipment. Where’s that going to go that change? Well, if we think about the journal entry for equipment, then if we buy equipment, we’re going to debit equipment, and credit cash and possibly credit like a note payable, some type of financing. But if we pay cash for it, this would be the most simplified journal entry. Even if we had a note there’d be no Part of it that would be on the income statement, one asset went up, the other asset is going down. So therefore, is the is an income statement account involved? No. So we’re purchasing or weren’t, so it’s not going to be an operating activity. And then the next question is, are we purchasing or selling an asset? In this case, yeah, we’re purchasing an asset. And that means that it’s going to be an investing activity. So and this was the confusing thing for me when I first started learning this thing, because investing activities, I had a different conception of what investing is to invest in something like any asset any anything we purchase in the business that we’re not consuming now is an investment to the future. In terms of the cash flow statement, we’re trying to spend our cash in order to put our money somewhere that’s going to help us make money in the future. That’s going to be some type of investment. So in this case, it’s going to be an investing activity.

Types of Adjusting Journal Entries Adjusting Journal Entry 2

Hello in this presentation we’re going to talk about types of adjusting journal entries. When considering adjusting journal entries we want to know where we are at within the accounting process within the accounting cycle. all the entries the normal adjusting entries have been done the bills have been paid the invoices have been entered for the month we have reconciled the bank accounts. Now we are considering the adjusting process. Those adjusting journal entries are needed in order to make the adjusted trial balance so that we can create the financial statements from them. The adjusting journal entries being used to be as close to an accrual basis as possible. those categories of adjusting journal entries, which will then have more types of adjusting entries within each category will include prepaid expense, unearned revenue, accrued expenses and accrued revenue. Let’s consider each of these we have the types of adjusting entries first type prepaid account expenses. prepaid expenses are items paid in advance.