Advanced financial accounting. In this presentation we’re going to discuss intercompany transactions. So typically we have a situation where where we have a parent subsidiary relationship or thinking about a consolidation type of process within it. And then we have those intercompany transactions between the companies that need to be consolidated between parent and subsidiary, get ready to account with advanced financial accounting intercompany transactions, the intercompany transactions we’ll be focusing in on here and working some practice problems in on will include the intercompany receivables and payables need to be eliminated for consolidated financial statements.

Posts with the sense tag

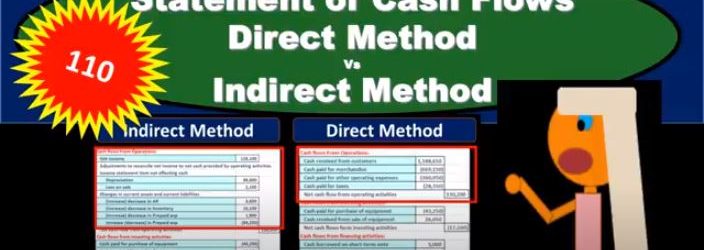

Statement of Cash Flows Direct Method Vs Indirect Method

In this presentation, we will compare and contrast the direct method versus the indirect method for the statement of cash flows. It’s important to note that when we’re comparing the direct and indirect methods, we’re really only talking about the top part, the operating activities portion of the statement of cash flows. In other words, the investing activities and financing activities and in result will remain the same, we’re going to end up with the same result, which of course, will be the Indian cash that we can tie out to the balance sheet. And we’ll have the change of cash here, which is really kind of the what we’re looking for in the statement of cash flows. What’s going to differ is the operating activities, why are they going to differ? Why would we have the operating activities differ? Remember that the operating activities have to do with kind of the income statement you can think of it basically as the income statement being reformatted to a cash flow statement versus an accrual statement. So the income statement that we use is on an accrual basis, and we recognize that Revenue when it’s earned rather than when cash is received expenses when expenses are incurred rather than when cash is paid, that’s gonna be on an accrual basis.