QuickBooks Online 2021 that statement of cash flows. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our QuickBooks Online test drive file, which you can find by searching in your favorite browser for QuickBooks Online test drive or in Craig’s design and landscaping services, we’re going to go down to the reports down below, opening up the other report, that’s going to be a financial statement report, but not really our two favorite ones, the two favorites being the balance sheet and income statement, the other financial report being the statement of cash flows, so we’re going to be opening up the statement of cash flows, I’m going to right click on the statement of cash flows.

Posts with the Statement of Cash Flows tag

Statement of Cash Flows 235

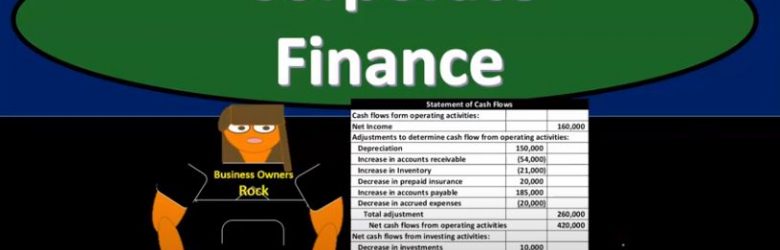

Corporate Finance PowerPoint presentation. In this presentation, we will discuss Statement of Cash Flows Get ready, it’s time to take your chance with corporate finance statement of cash flows. So remember when we’re thinking about the financial statements, we can think about them as answering two major questions to users of the financial statements. For examples, if we’re thinking about investing to the company in some type of way, and are using the financial statements to help us make a decision with regards to that, we want to know where does the company stand at this point in time, what’s basically their worth at this point in time. For that we get help from the balance sheet, which is going to give us the assets liabilities, equity, assets, minus liabilities equals equity, which is basically the book value as of a point in time.

Statement of Cash Flow Indirect Method Cash & Net Income

We will start to put together a statement of cash flows using the indirect method. We have constructed a worksheet from a comparative balance sheet showing balance sheet accounts for the current period, the prior period and the difference or change between the two. Our next step is to allocate these changes in balance sheet account from the worksheet to the statement of cash flows, finding the correct section of either operating activities, investing activities, or financing activities. The starting point is often the most confusing. The end result of our cash flow statement is basically the change in cash. We start the cash flows from operations section with net income but we would like to think about net income as a change in balance sheet accounts. Net income will be part of the change in retained earnings.

For more accounting information see accounting website.

Statement of Cash Flows – Tools Needed For Completion

Statement of cash flows – Tools needed for completion will talk about the tools we will need to complete a statement of cash flows. The statement of cash flows will generally be the last financial statement we will prepare. In other words, we will prepare the balance sheet, income statement, and statement of equity before the statement of cash flows. The primary tool financial statement we will use will be the balance sheet. We will need a comparative balance sheet or a balance sheet showing the current period and the prior period. From this balance comparative balance sheet will generally create a worksheet showing us the changes from year to year. We will also need the income statement. When using the indirect method the income statement will be necessary to verify some balances. We will also need additional information which is often given in a book problem. In practice we would need the general ledger for some accounts and access to supporting documents for some transactions.

For more accounting information see website.

Statement of Cash Flows-Indirect Method-Change In Accounts Payable

Statement of cash flows using the indirect method and concentrating on the change in accounts payable. The indirect method will differ from the direct method by starting with net income and entering adjustments to arrive at cash flows from operations. The indirect method reconciles net income to cash flows from operations by analyzing the changes in balance sheets accounts, in current assets and current liabilities. When considering these changes we can learn a rule that helps us construct the statement of cash flows and it is also useful to understand the reasoning behind the rule.

For more accounting information see website.

Statement of Cash Flow Investing Activities -Cash Paid for Equipment

Statement of cash flows investing activities will look at cash flows related to investing activities. Investing activities will include cash flows from investments like stocks and bonds but also includes investments in long term assets like property plant and equipment. Cash outflows and cash inflows for property plant and equipment will be included in the investing activities section. Because equipment is often financed when purchased we often need to look at the detail of the transaction to complete the investing activities section.

For more accounting information see accounting website.

Statement of Cash Flows Strategy – Cash Flow Thought Process

Statement of cash flows strategy will go over how we can think about cash flows. The most obvious and direct way to think about cash flows is to think about the change in cash over a time period. To analyze a change in cash we can go to the general ledger to look at the detail of activity that happen for a period of time. The general ledger will show transactions related to cash by date. Although this method makes the most since is does have problems. The cash account will have a lot of transactions in the general ledger, more them most any other account. It may be difficult to re-categorize each transaction. We can also think about the cash flow using the accounting equation, and this is often the approach we will use in practice.

For more accounting information see website.

Statement of Cash Flows-Direct Method vs Indirect Method

Statement of cash flows direct method vs indirect method will compare and contrast the direct method and indirect method forms of the cash flow statement. When comparing the direct and indirect method we are focusing in on the cash flows from operation section of the statement of cash flows as opposed to the financing or investing sections. In other words, the financing and investing sections will remain the same under either method. The direct method can be thought of as reworking the income statement line by line, adjusting each line from an accrual basis to a cash basis. The direct method makes intuitive seance and and is easy to explain to readers but is the less used method. One reason is that the indirect method is often required even if the direct method is used. The indirect method provides a kind of reconciliation between net income on an accrual method and net income on a cash method or cash provided by operating activities. The bottom line should be the same using either the direct or indirect method.

For more accounting information see website.