QuickBooks Online 2021 chart of accounts. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free test drive file, you can get to the test drive file by searching in your favorite browser browser for QuickBooks Online test drive the Craig’s design and landscaping services test drive file is what we are working with, we’re going to go into the chart of accounts. A couple ways we can go to get in there we saw last time Chart of Accounts is one of our major lists.

Posts with the subcategory tag

Income Statement Overview 220

Hello in this presentation we will discuss the income statement objectives. At the end of this presentation, we will be able to describe what an income statement is list the parts of the income statement and explain the reasons for an income statement. First, we’ll start off with a question we’ll which will explain the timing of the income statement or introduce us to an explanation of the timing of the income statement? And that is the question of asking somebody, how much do you make when we work through if we were to ask somebody how much they make? They would mentally make some type of assumption in order to answer that question, or they would ask you the question if they chose to answer at all. The question, What do you mean? Do you mean per month? Do you mean per year? Do you mean per week? And this is going to be something that needs to be answered in order to answer the question.

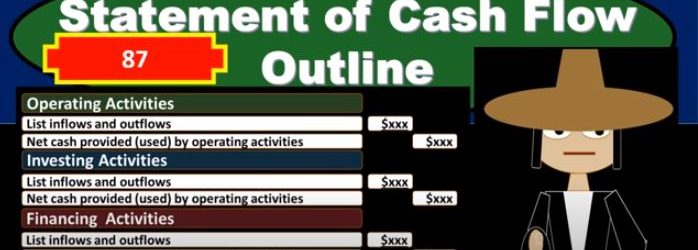

Statement of Cash Flow Outline

In this presentation, we will take a look at a basic outline for a statement of cash flows. In order to do this, we first want to give an idea of how the statement of cash flows will be generated. So we can think about these components of the statement of cash flows and where they come from. Typically, we will have a worksheet such as this that we will use in order to generate the statement of cash flows. That statement of cash flows, having three major components, operating activities, investing activities, and financing activities. Our goal here is going to be to fill out these three components and typically we will use a worksheet such as this on the left. The worksheet is just basically a comparative balance sheet that we have here that we’ve reformatted from a balance sheet to just a trial balance type format, a debit and credit type format. So you can see that we have our balance sheet accounts, and we are imbalanced by having the debits the positive and the credits be negative or debits. Minus the credits equaling zero, given it’s an indication that this period, the current period that we are working on, is in balance, the prior period, same thing. So we have two points in time for to balance sheet points the prior year, or period the prior year in this case and the current year. And then we just took the difference between these two columns. And if we have something that’s in balance, here, the debits minus the credits equals zero, something that’s in balance here, the debits minus the credits equals zero. And then we take the difference of each line item in these columns. And some of those differences, it too must add up to zero. So in essence, what we’re going to do in order to create the statement of cash flows is find a home for all these differences. And that’ll give us a cash flow, a concept of the cash flow statement. We’ll get into more detail on how to do that when we create the cash flow statement. But as we look at the outline, keep that in mind. So here’s going to be the basic outline for the state. cash flows, we’re going to have the operating activities. That’s going to include a list of inflows and outflows from the operating activities. And then we’re going to have the net cash provided by the operating activities. Now, this list of inflows and outflows for the operating activity will be the most extensive list because the operating activities are in relation to you can think of it as similar to the income statement.

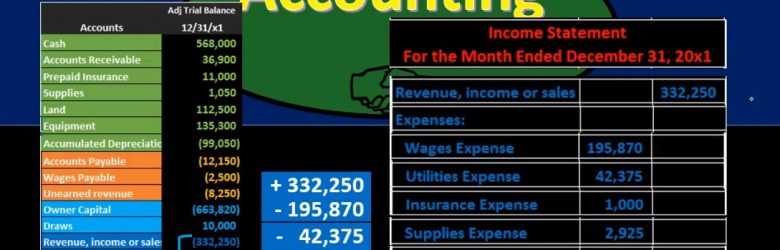

Income Statement from Trial Balance 16

Hello in this presentation we’re going to take a look at the creation of the income statement from the trial balance. First, we want to take a look at the trial balance and consider where the income statement accounts will be. When looking at the trial balance, it will be in order we have the assets in green, the liabilities in orange, the equity in light blue, and then the income statement accounts including revenue and expenses. That’s what we are concentrating here we’re looking at those income statement accounts. And that is what will be used in order to create the financial statements to create the income statement. Note that all the blue accounts represents the equity section. So the income statement really is going to be part of total equity. If we consider that on the balance sheet, then we’re really looking at a component of this capital account.

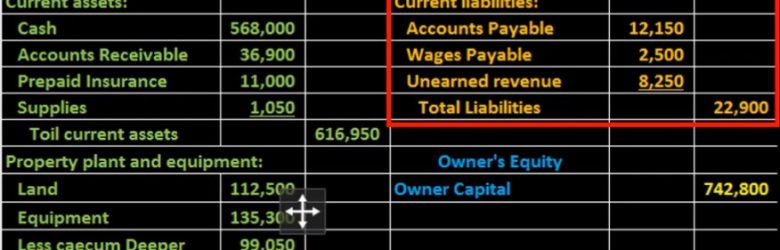

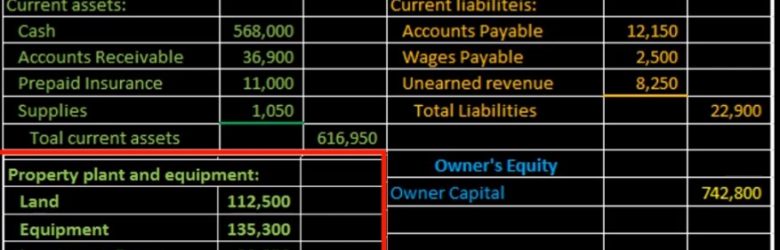

Balance Sheet Liability Section Creation From Trial Balance 14

Hello in this lecture we’re going to create the liability section of the balance sheet. In prior lectures, we have taken a look at the assets in terms of first current assets and then property, plant and equipment and given us the total assets at that time, then we are now going to move on to liabilities, and that will be part of the second part of the balance sheet meaning it’ll then sum up to total liabilities and owner’s equity. We are going to be taking this information of course from the adjusted trial balance the adjusted trial balance in the format of debits and credits, we are now formatting it in the format of the accounting equation. Still the double entry accounting system just in two different formats, just reshuffling the puzzles so that different readers can understand the financial statements even though they don’t understand debits and credits.

Balance Sheet Property Plant %26 Equipment From Trial Balance 13

Hello in this lecture we’re going to put together the section of the balance sheet of property plant and equipment from the trial balance property, plant and equipment will be part of the assets can be the subcategory of assets, we talked last time about the creation of the current assets. And now we’ll be moving on to property, plant and equipment, which will then sum up everything for total assets. We will be picking these numbers up from a trial balance. And once we have completed all the financial statements, what we’re basically doing is taking a debit and credit format from the trial balance, converting it to a plus and minus format in terms of the financial statements, assets, equal liabilities plus owner’s equity so that people can read it even if they don’t understand debits and credits. In this lecture, we’re focusing in on this section here, which will be a land equipment and each cumulated depreciation.