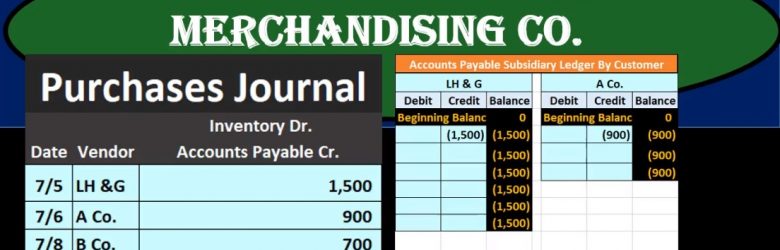

In this presentation we will take a look at the purchases journal for a merchandising company. Purchases journal will be used when we make purchases for a type of system that will typically more be more of a manual system as opposed to an automated system. However, it is useful to know this in order to have an automated system because the automated system will generate reports that will be similar to a purchase journal and because it’s good to know how different system works to know what are similar what’s different, so that we better understand whatever system we are using. The purchases journal may better be described as the purchase journal on account. So that’s going to be the major point meaning if we make purchases for something that in cash if we spent cash to make the purchase then it will not go in the purchases journal even though we made a purchase because it will go into cash payments journal. So this is really kind of a short name. The accounts payable journal might be a better name for it or the purchases journal on account, but purchases journal is typically the term that will be used.

Posts with the vendor tag

Accounts Payable AP Subsidiary Ledger 6

Hello. In this lecture we’re going to talk about the accounts payable subsidiary ledger accounts payable subsidiary ledger will be backing up the accounts payable account on the trial balance or the balance sheet. As we can see in the example here we have a balance of 1640 in accounts payable. If an owner asks the question of how much money do we owe to vendors? The answer would then be 1006 40, which we can see on the balance sheet or the trial balance. But the next question that will follow will be who do we owe that money to? And how do is it which of these vendors should we be paying? First? In order to answer that question, we may try to go to the detailed account, which is the general ledger. Typically every account is backed up by the general ledger, we can see that we have the same balance here and we can see that we have activity however, the activity is in order by date. And that’s not really helpful for us to determine who exactly we still owe at this point in time. In order to determine who we owe, we need to organize this information.

Receive Inventory Requested With P.O. Enter Bill 8.20

In this presentation, we’re going to record the receipt of inventory with a bill. In other words, in prior presentations, we entered a purchase order requesting inventory. Now we’re going to receive that inventory along with the bill and enter that into the system. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars practice problem. Let’s first take a look at our flow chart. So we’re going to go down to QuickBooks desktop.