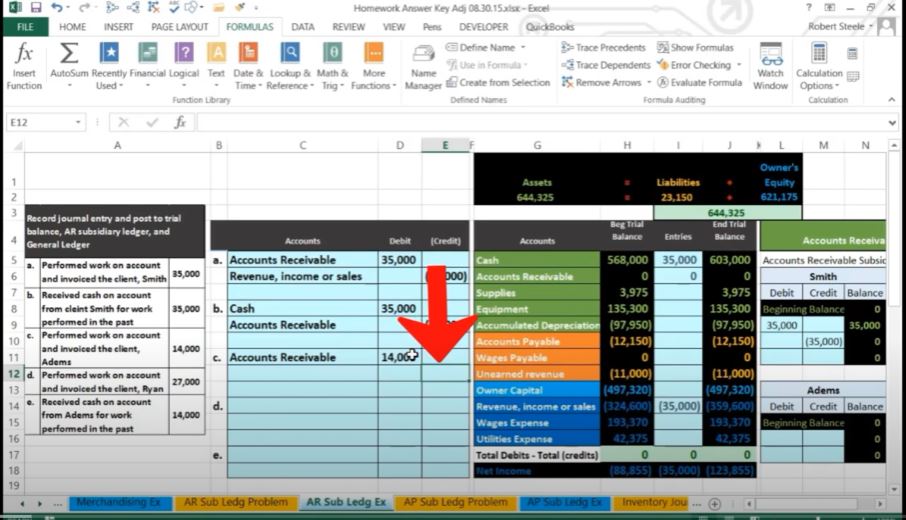

In this blog post, we will discuss the process of posting journal entries to various accounts in the accounting system. Specifically, we will focus on transactions involving accounts receivable, revenue, and cash.

Transaction 1: Debiting Accounts Receivable and Crediting Revenue

- Amount: $14,000

- When we debit an account with $14,000, we also need to credit another account with $14,000.

- We format the cell with brackets to indicate a debit. This transaction represents revenue earned.

- People are going to pay us $14,000 in the future for services or products we’ve provided. This is recognized in the revenue section.

- Revenue accounts have a credit balance and only go up, so we credit the revenue account. Let’s post this.

Transaction 2: Posting Transaction 1

- Debit: Accounts Receivable

- Credit: Revenue

- Update the trial balance by debiting Accounts Receivable and crediting Revenue, which results in a $14,000 increase in Accounts Receivable and a $14,000 increase in Revenue.

Transaction 3: Debiting Accounts Receivable and Crediting Revenue Again

- Amount: $27,000

- We debit Accounts Receivable with $27,000, representing money people owe us.

- Revenue accounts, which only go up, need to be credited to reflect the increase in revenue.

- This is another example of earning revenue and receiving cash later. Let’s post this transaction.

Transaction 4: Posting Transaction 3

- Debit: Accounts Receivable

- Credit: Revenue

- Update the trial balance by debiting Accounts Receivable and crediting Revenue, resulting in a $27,000 increase in Accounts Receivable and a $27,000 increase in Revenue.

Transaction 5: Receiving Cash from Adams

- Amount: $14,000

- In this case, cash is affected as we receive payment from a customer, Adams.

- Debiting cash means we increase the cash account.

- To balance the transaction, we credit Accounts Receivable because we are reducing the amount Adams owes us.

- The goal is to show the exchange of Accounts Receivable for cash.

Transaction 6: Posting Transaction 5

- Debit: Cash

- Credit: Accounts Receivable

- Update the trial balance by debiting Cash and crediting Accounts Receivable, which results in a $14,000 increase in Cash and a $14,000 decrease in Accounts Receivable.

Subsidiary Ledger and General Ledger

- We maintain a subsidiary ledger for individual customer accounts like Adams and Ryan to track their outstanding balances.

- The general ledger records all activity in the accounts by date, providing a comprehensive overview of financial transactions.

In summary, posting journal entries is an essential step in accounting, allowing us to maintain accurate records and track financial transactions for the business. It helps us understand who owes us money, how much, and how our accounts change over time.