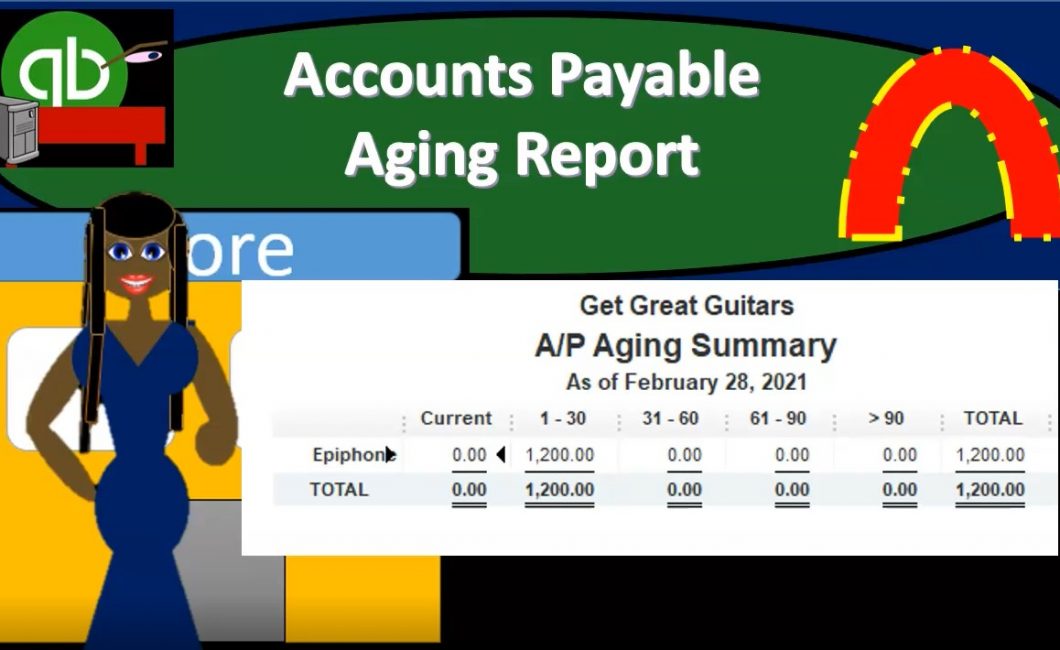

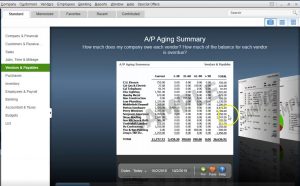

This presentation we will generate analyze a print and export to Excel and accounts payable aging report within QuickBooks Pro 2020, QuickBooks desktop 2020. We are in our get great guitars file we currently have the open windows open, you can open the open windows by selecting the view drop down up top and choosing the open windows a list. We’re now going to be considering an AP or accounts payable aging report.

0:27

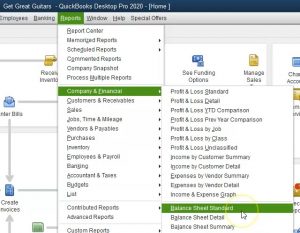

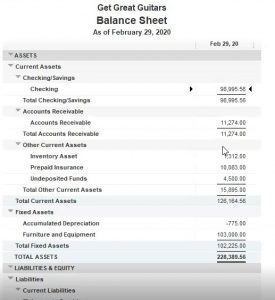

Whenever we think about anything except the major financial statement reports, the balance sheet and the profit and loss, we want to consider how this report will be supporting either the balance sheet or the profit and loss this one being accounts payable related, therefore it will be supporting an account the accounts payable account on the balance sheet. Let’s first then open up the balance sheet.

0:47

If we go to the reports drop down, we’re going to go to the company and financial we’re going to go down to the balance sheet standard report. Within the balance sheet standard report we’re going to change the date to Oh to 29 to zero recall the this is a report as of a point in time, we’re now going to be considering the liability account our liability account of accounts payable. What does that account represent? It represents the amount that we owe to other people third parties to as QuickBooks calls them vendors, this is what we owe to vendors. So that’s who we purchased from either services or possibly inventory to the vendors.

1:23

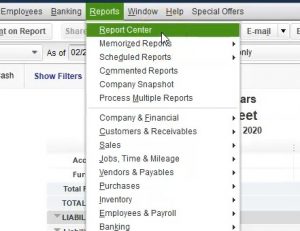

The next question, of course, with relation to the accounts payable is, who do we owe, who do we owe? Right? We know how much we owe in total. But who do we owe because we’re gonna have to be writing a check to them at some point in the future. In order to see who we owe, then we can do a similar report as we saw with the accounts receivable, but instead of breaking it out with customer or by customer now breaking it out by vendor, those who we owe rather than those who owe us, we also might want to know whether the amount we owe is is current or the amounts that we owe our current or past due, so that we can see which ones we want to pay or which are the most immediate concerns for us to pay. In order to do that, we’ll take a look at the accounts payable or AP aging report, we can find that report by selecting that reports drop down up top, we can go to the vendors and payable and look at the agent summary reports. Or if this isn’t as familiar report, we can go into the report center.

2:21

Now note that the accounts payable aging report is going to be a major report for many type of companies. Many type of companies may have someone that manages accounts payable for the the entire cycle like we could have multiple people that are managed basically accounts payable in a large type of company. So this could be a very important report, as is the receivable aging report.

2:41

So if we go down, then we want to be taking a look at the vendors and payables we’re going to be considering the accounts payable aging report. Now just note in this view, I’m going to switch this view so we could see it a little bit more detail. This would be a more detailed agent report where we have a lot of vendors involved here, the we will be looking at we don’t have many vendors involved. So just note that this could be a very detailed report, the example that we have is just going to have basically one vendor in it that is a payable at this point of time. So it really just depends on the type of organization you are in. But note that this can be a very large and significant report.

3:17

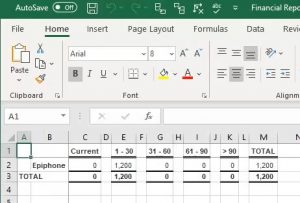

For an accounts payable department to be running, I’m going to go ahead and run this report, we’re going to change the date up top 202 29 to zero. Recalling once again, that this report is as of a point in time. So we don’t need a date range, we don’t need a date range in order to tell us how the thing is working. It’s as of this point as of to 29. Where do we stand who do we owe and how past do are the amounts that we owe to them. We have a similar type of setup with the accounts receivable report, we have the total on the right now obviously, we only have the one vendor here.

3:53

So this is going to be fairly simplified report and that it would be just basically more vendors just as we saw with the receivables report, but this will give us the idea of it, we’ve got the total on the right that total venture tie out to the balance sheet. If we go back to the balance sheet, then we see the balance sheet here, then we know now who we owe because the accounts payable, aging is broken out by vendor back to the accounts payable aging. There it is we own Epiphone, that’s who we buy our inventory from, then we want to know will help us do is the amount that we owe, it’s not current, therefore it’s past due, it’s only one to 30 days past you. However, we had the similar kind of breakout one to 3031 to 6061 to 90 and over 90 days past due. If I double click on this to zoom in to it, we see the bill that has created it if I open up the bill,

4:44

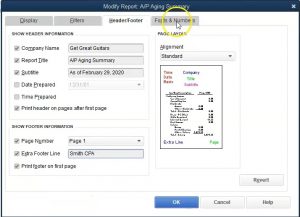

we’re then going to see the bill, the bill is the major form or driving form that will increase the accounts payable accounts. closing this back out. closing this back out, we’re not going to format this at a bit. So we’re going to go back up top to the customized reports, we’re going to do some of our your type of format and we’re going to go to the header and footer, remove the date and the time, we don’t have an accrual basis because this is actually an accrual account.

5:09

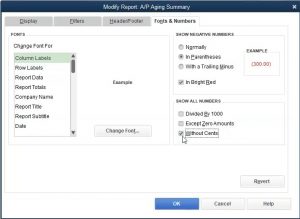

So it has to be an accrual basis. In essence, because we’re looking at an accrual account, then we’re going to go down to the extra footer type Smith, CPA, and that’s going to be our mock CPA firm, then we’ll go to the fonts and numbers within the fonts and numbers, we’re going to make any negative number have parentheses, I don’t think there are any, but if there are will make them with parentheses, and we will make them red.

5:30

And we’re going to remove the sense remove the pennies, remove the change with the without sense, then we’re going to say Okay, there we have it, that’s going to be our report, we’re going to then print this as a PDF file, we’re going to export it to our existing Excel workbook. And then we’ll make that workbook create a PDF file with all the reports that we have created thus far. So we’re going to go to the print up top. This time, I’m just going to use these Save as PDF format. We’re then going to locate where we want to put it, I’m going to put the box right under neither here, I’m going to go into the financial reports, I’m going to then name this file, the AP, notice I can’t have a dash usually in a Windows based program. So I’m just going to say AP, and just going to say aging 2020.

6:16

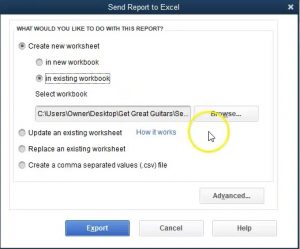

There we have that. Now I’m going to export it to excel, we’re going to do that by selecting the Excel drop down, we’re going to create a new worksheet worksheet, we’re going to put that worksheet into an existing workbook browsing for that workbook. There’s the workbook, we want double clicking on it and export.

6:37

Here we have it, we’re going to do some of our normal type of formatting, I’m going to go all the way to the left, because I’m going to have that new sheet that popped up, I’m going to click on that new sheet right click on it, I’m going to delete that instructional sheet and delete that we don’t want that I’m going to go all the way to the right now, I’m going to grab that sheet that we just picked up, I’m going to left click on it and then drag it to the right.

6:57

So that it’s going to be the latest sheet that we have, then we’re then going to go to the Page Layout View, within the Page Layout View, we’re going to adjust the freeze paint. So we’re going to do that by going to the View tab up top windows group remove the splits. So we’re going to remove the splits there, then we can name it while we’re here, I’m going to double click on the sheet name, I’m going to call it an AP a gene, APA gene, let’s call it that.

7:25

Then I’m going to go back to the normal view, we’re now going to create the PDF file with all the reports in it thus far. So we’re going to go to the File tab up top to do that, we’re going to go down to the printing tab within the printing tab, I went to the sharing tab. That’s not what I wanted, I’m going to go to the File tab. Once again, we’re going to go to the printing tab, then we’re going to make the front the entire workbook, then we’re going to see that it does it so does do so we have 16 pages, if we scroll through the 16 pages, they look like they should be good.

7:57

It’s taken a little bit more scrolling than it used to these days because it has a lot of pages that are involved because we got 16 now, but it looks like they’re all formatted on the same page no amounts that are off on the side. And we finally get our last report here, which is the AP aging report. That one looks good. All right, we’re going to print it to the to the cute PDF printer. So I’m going to go to the cute PDF printer to print it as a PDF will then say print.

8:29

And then we’re going to locate where we want to print it. And so we’re going to be putting it in the if I go to section one through four, that’s the one I’m going to go to the financial reports overwrite that and say save Yes. Then I’m going to open up and see where that was put. It’s in section one through four.

8:50

This I’m going to delete now because we’ve adjusted it. And then in the files, we can either add all this if we’re going to give this to an email to somebody, which is a lot of things. Or we can take that file and zip it by right clicking and zipping the file. And that will allow us to put it into one email in a zip format. Or we can send the Excel file or we can send the PDF file that we have created from the Excel file having all the documents in one sheet, including the balance sheet the profit and loss, the comparative balance sheet, the summary balance sheet, the income statement, the comparative profit and loss, the vertical analysis, profit and loss and then the graph sales graphs expense graphs, then the sales by customer summary and the sales by item summary the accounts receivable aging report and finally the accounts payable aging report.