This presentation and we’re going to record and advanced payment or customer deposit. In other words, we’re going to get paid before we do the work or in our case, provide the inventory of a guitar. Let’s get into it with Intuit QuickBooks Online. So here we are in our get great guitars file. Let’s first take a look at the flowchart in the desktop version just to consider the normal flow and what we are going to be doing here.

00:24

So normally what happens is we do the work before possibly we do the work before we get paid. In that case, we have an invoice, then we get paid later. Then we go to the bank with that invoice or we get paid at the same point in time say someone comes into the shop we get paid as we give them the guitar in which case we have a sales receipt. We get paid at that point and then go and make a deposit. What happens However, in some cases, if we get paid in advance we get paid before we do the work more unusual.

00:53

However, it is normal in certain types of industries and it’s becoming more normal and many more types of industries as we have seen service type of industries such as if we have applications or something for computer applications, those types of things are things that we typically pay for in advance, and then get the service. If we have newspapers. Or if we are, if there’s a concert, we’re purchasing a concert ticket or something like that, the concert ticket, people throwing the concert event are getting paid before the concert happens.

01:22

So that’s a bit more unusual. But in certain industries, it happens a lot. And in other industries, such as our industry, we’re selling guitars, it could still take place in such a case where we want to get a customer deposit and advance payment on a service in the future. For example, if we’re going to sell it and expensive guitar, we need to purchase that guitar from the vendor because we don’t have it in our shop. We want to make sure that it’s going to be worthwhile to do so.

01:47

So our scenario here is going to be that we have a customer come into the shop, they’d like a particular guitar, we don’t have it. We’re going to say hey, we can order that for you. But in order for us to go through the trouble of doing so we would like to dance Payment just to make sure that you are committed to that order. Therefore, what happens in terms of our flow then is we basically have a payment, kind of, we’d receive payment first, then we’re going to we’re going to issue the invoice later at the second point.

02:15

So we have a kind of a reverse flow here, how are we going to record this reverse flow. Now in financial accounting, typically what would would be happening is you’d have to debit cash cash would be going up, and then the other side would be going into unearned revenue, which is a liability account. And so that’s, that’s one way we could do that. We could do that here. We’re going to do something slightly different However, because if we put something into a liability account, we can’t track it by customer as easily.

02:43

So what we want to do what we would like to do is be able to track this information by customer therefore be able to make a receive payment, record the deposit and then easily tie that deposit into the invoice that we will make a later when we actually get the guitar In order to do that we want to we want to use basically the accounts receivable account. So this is going to be a little bit different than financial accounting, it’s something that’s often is going to be used in practice, and we will adjust for it. So that will be on basically the financial accounting format with the adjusting journal entries at the end of the month or the year to properly reflect this.

03:20

So in other words, what we’re going to do is we got the money in advance, we’re going to record a receive payment, what does the receive payment do, it’s going to increase undeposited funds or checking account depending on how we have it set up, the other side is going to go to to the accounts receivable, it’s going to decrease the accounts receivable. Now when we decrease the accounts receivable nothing’s in it yet for this particular customer.

03:44

So it’s actually going to create a negative accounts receivable instead of what we should be doing in financial accounting a positive undeposited funds, so we have a negative asset instead of an A positive undeposited funds however, that makes it so we can track this information on the customer needs. tale reports, which is where we want it. And then once we make the invoice, it will then tie out and everything will be okay in terms of the accounts receivable will basically clear out and everything will be correct at that point in time. If at the end of the time period, the end of the month, we still have a negative receivable, then we can make an adjusting entry for it. And we’ll show an example of that when we do the adjusting entry process.

04:25

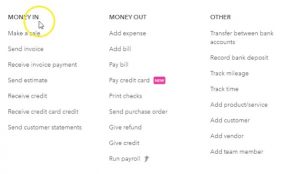

So let’s take a look at how this will look. If we go back to the QuickBooks Online then we’re going to say that we’re going to receive a payment in advance so we’re going to go to the drop down. We’re going to say we have money in we’re going to receive receive invoice payment even though we haven’t made this particular invoice so we’re going to receive an invoice payment for an invoice that is non existent at this point in time. The customer is going to be Anderson guitars, we’re going to type in Anderson guitars and that’s going to be our customer we’ve had in the past note it says here Anderson guitars payments doesn’t have an open invoice to go with it quickly. looks the same, hey, there’s no invoice for me to tie out here for a particular payment. And we’re going to say that’s okay because this is a deposit and advanced payment.

05:07

So the date is going to be the 16th. I’m going to select this and say plus plus to the 16th. And the payment method, I’m going to say is just going to be, let’s say a check, and then we’ll have the check number. And then it’s going to go into undeposited funds, just like it normally would. However, there’s no invoice down here to check off, so there’s no invoice we’re tying it to, I’m just simply going to put the amount and the amount is going to be for 250. That’s not the full amount of that guitar that guitar is going to cost more than that we just want the down payment on the guitar to make it worth our while to make sure that we’re committed to the purchase of the guitar.

05:43

So what’s this going to do them well to receive payment therefore the receive payments going to increase some kind of cash in our case undeposited funds, the other side decreases accounts receivable, which is fine except there’s no there’s no timeout other invoice that ties out to it at this point. What’s this going to look like? Let’s check it out. We’re gonna say Save and Close. And it says, we’ll save this payment as a credit to your customers since you don’t select an invoice. If you want to record payment without an invoice, use the sales receipt. And then Omen say okay, save as a credit. That looks good. Now let’s open up our trial balance, I’m going to go to the reports down below, and we’re going to open up our trusty trial balance, I’m going to type in trial bounced to search for it and open that up.

06:30

Then we’ll change the dates up top. So I’m going to scroll back up top, changing those dates from a one on one to zero to 1231 to zero, then I’m going to run that report. We’re then going to duplicate the tab up top right clicking on it and duplicating it. Now I’m going to close the hamburger I’m going to hold down Control of scroll up a little bit so what to 125 so we can see this thing. Then we’re down here in undeposited funds. There’s the undeposited funds, it went up by the 250 as would be expected from a sale receipt, there’s the sales receipt. So that looks good. There’s the 250. Scrolling back up top, we’re going to go back to our prior report. And then we’re going to say that we had the accounts receivable went down. With the sales receipts.

07:14

Let’s go to the AR accounts receivable, it is going down because we have the payment of the 250. That makes sense. Scrolling back up top, the only problem is that 250 doesn’t tie out to anything in terms of an invoice to see that. Let’s go to the customer balance Detail Report. Going to go back to the reports on the left, we’re going to go to the reports down below. We’re looking for a customer balance detail. I’m going to hold down Control and scroll back a little bit to get back to 100. We’re looking for the reports that people owe us so I’m going to go back down who owes you that’s what I’m looking for. We want the customer balance detail report which I think I passed.

07:54

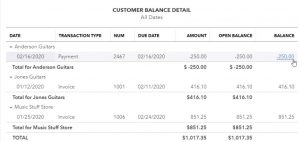

There it is customer balance Detail Report. Let’s open that one up and I’m going to scroll Back up top gonna change the dates to or all dates will work. I’m going to hold down Control and scroll up and we’ll close the hamburger. And then we’re looking for the Anderson guitar. So here’s Anderson guitars, notice that they have a negative balance and Anderson guitars, that’s unusual because accounts receivable should only reflect people owing us money or not owing us any money at all, and in which case they’d have a zero balance.

08:28

So note that the total and accounts receivable is right or is positive, it’s 1017 35. But there we have a particular customer in here that has a zero as a negative balance which should be a liability. In other words, what should be happening for financial accounting is we should have the 101 7.35 plus the 250. This recorded at 1002 6735, and a liability called undeposited called revenue or something like that of the 250. However, if we did that, we could do that with a journal entry or something like that. However, if we did that, we wouldn’t be able to tie as easily the customer information out, we couldn’t run this report as easily tying out the customer information, and we couldn’t as easily record an invoice that would not match out that liability.

09:23

So what we’re going to do what is often done is put in practice is when we get that advance payment, we take that deposit, we put it in as a receipt, which ends up as a negative receivable. And then later on we’re going to when we when we get the guitar sell them to them making an invoice will make the invoice which will then match out against this receivable making a positive balance in accounts receivable. At that point in time, the receivable will be correct, and will be in balance and everything will be fine.

09:49

So it’s just a timing difference, where the little problem is now if we happen to have financial statements to be reported at the end of the month, quarter or year, where we were Then we can always go in and just do an adjusting journal entry. In other words, if I had to make financial statements at the end of the month and I want to make them on an accrual method, then I could go into here and say, Okay, I see this negative 250 that should actually be a liability, make an adjusting journal entry for it, so that the financial statements are correct for the bank or whoever needs them at the end of the time period, and then reverse it for the for the next time period.

10:24

So logistically, it works in this format. So this format really works logistically, but they’ll be it’ll be not exactly right, from an accrual standpoint with regards to the assets and the liabilities, and, but it’ll be okay once we actually create the invoice and if there is that timing difference at the month end or year end, we can always make an adjusting entry as we will see when we get to the adjusting entry process.