This presentation and we’re going to record a sales receipt and deposit. In other words, we’re going to imagine there’s a sale that takes place, we’re going to make that sale, record that sale with the sales receipt and then go to the bank with that deposit, deposit that into the bank and record that deposit as well into our system. Let’s get into it with Intuit QuickBooks Online.

00:19

Here we are in our get great guitars file, we’re first going to jump over to our flowchart and the desktop version just to get an idea of where we are at. We have seen this this type of forms in the past now we’re just going to do them both in a little bit quicker fashion. So we have the sales receipt, we’re imagining we’re into the store, therefore someone’s going to purchase something in the store we’re going to give them the sales receipt as opposed to an invoice.

00:43

The sales receipt basically skipping these two these two components of an invoice and then receive payment going right to basically the receive payment recording the sale. Then we’re going to go to the to the deposit and record that deposit. When we have the sales receipt incomes going to go up undeposited funds going to go up recording the deposit, then checking account goes up on deposit funds go down. Let’s take a look at it back to our QuickBooks Online.

01:08

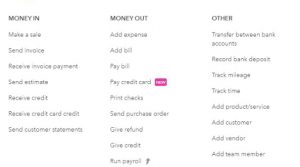

We’re going to say the plus button here we’re imagining someone’s in the store making some type of purchase within it. We’re going to say we go to the sale first top button in our drop down screen, because that’s the most important item, we got a sale. And then we’re going to say this is going to be Garcia guitar. As I could select the drop down, or I can type in Garcia, guitar. We don’t have Garcia guitar in there yet. So we’re going to add Garcia guitar, I’m going to select tab in order to do so go into we should be collecting the Garcias contact information and whatnot and asking them to sign up to our newsletter and whatnot. But we’re just going to say for the purposes of this problem, to save just the name to populate our sales receipt. That’s what we need to complete it.

01:50

We don’t have the email here we’re going to then go down to I’m going to say that the date will be the 14th. So we’ll keep that there. Notice it’s populating the number of automatic For us, we’re going to let the system do that the location, I will keep there the payment method, I’m going to say it’s going to be cash, the reference number, I’m not going to have one, and then it’s going to be going into undeposited funds.

02:13

Now we’re imagining we’re in the store, we’re getting the deposits that and then we’re going to be going to the bank with them and putting those deposits into the bank. And they bought one of our LP guitars. So it’s those LPs, like our main guitars that we sell a lot of the LP so we’re going to say it’s going to be the LP, and that’s the one we’re going to sell quantity one of those there should be a sales tax that should be populating for us there and then if we see down below, if we see down below, we have our Indian transaction here totally after the sales tax of the 547 50.

02:48

Again, this is California sales tax calculated automatically if you just want to force it to work this problem you need some type of sales tax, and you could adjust the number here if you if you need to adjust it just for the problem sake To the 4750, just to tie in exactly to what we have, what’s going to happen when we do this? Well, it’s a sales receipt, therefore, something’s going to be happening to cash, either checking accounts going to be going up or undeposited funds.

03:10

In our case, the undeposited funds are going to be going up by the full amount of the 547 50, including the sales tax, other side is going to be going up to sales, sales is going to be increasing by the 500, not including the sales tax, that’s the amount we get to keep the difference sales tax 4750 is going to be going to a liability to basically sales tax payable.

03:31

Also, inventories going to be going down by an amount not on the form here at all, because it’s being driven by the item number, not something we want to show the customer but something we want driven by this form the sales receipt, I believe it’s 400, we would have to check the product in order to do that, or the forms in terms of the weighted average method for inventory to see what it is but and then the cost of goods sold is going to go up in the expense side of things as well for that same amount that the inventory Gonna go down by as well.

04:02

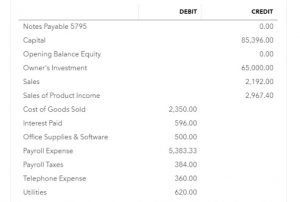

So let’s record it and check that out, we’re going to say Save and Close. And let’s just open up our trial balance. We’ve seen this before. So we’re just going to do this quickly on the trial balance rather than go into the balance sheet and income statement. And so we’ll go to the reports, we’re going to open up the trusty TB by typing in trial balance up top trial, there we have, all I need to do is type in trial. That’s all I do. And then I see the trial balance pops up down below it, there it is, and we’re going to scroll up top, we’re going to change the dates from one or one to zero to 1231 to zero, we’ll run that report. Then I’m going to go back up and right click on the tab up top and duplicate that tab.

04:40

So now it’s on the right with the trial balance. Then we’ll close up the hamburger to give us a little bit more space and stop it from tempting us, making us hungry, and we’re going to be back up to 125 125. Alright, so now we’re going to say that undeposited funds should have increased their undeposited funds if we go into that, we’re going to scroll down and say, where’s that item, there’s the sales receipt, Garcia, there it is, that’s for the full amount of the 547 50. Then I’m going to go back up top, the other side, I would typically think on the income statement in sales of some kind.

05:18

So that’s going to be down below on the trial balance. So down here, here, sales, here’s the sale of product and income. Selecting that item, it’s going to go up not by the full amount, but only for the amount we get to keep the amount of our sales price the 500. So there’s the 500. The difference between the two, scrolling back up is going to be in a payable account. So that’s going to be in sales, tax payable, some type of liability, which is going to be in the middle here. It’s an order assets, liability, equity, income and expense, the where the liability, they call it, they named it by the vendor, that’s who we pay.

05:49

So I’m paying in California for the sales tax. So that’s where the difference should be. Then we also know that the inventory will go down. So here’s the inventory up top it should be decreasing. So if I go into the inventory and scroll down, there’s the sales receipt. Here’s the sales receipt. And it’s going down by 400. Where did that number come from? Is that number on the sales receipt, let’s go into the sales receipt and see if it’s on there. And it’s not on the sales receipt. No, we’re found on the sales receipt. However, it is driven by the sales receipt by this item number by the by the information we put in when we created the item number.

06:27

So I’m going to go back up, close this back out, go back up top back to our trial balance report. holding down control, I’m going to zoom back in a bit again, back to the one to five, and then the other sides on the income statement, or P and L and the cost of goods sold. So here’s the cost of goods sold. And if we select that, that amount is going to be going up by the 400 for the expense there. So there’s the 400 better as well. What’s the effect on the income statement? Well, it went up I’m the sales item and then the expense went up. And the difference between the way that sales item went up and the expense went up is the net increase in net income.

07:10

So now we’re going to go over and make the deposit. Now we have what’s going to happen when we do that? Well, undeposited funds represents us holding on to some kind of cash or cheque or something in our hands, and we want to put it in the bank so that so it’s going to go out of the undeposited funds, and the checking account then should be increasing. So let’s do that. We’re going to go back to the left hand side, we’re going to go to the plus I’m going to go I’m scrolling or holding down control and scrolling down to get back down to 100%. So my deposit form doesn’t get, you know, funny and scrunched up or anything.

07:38

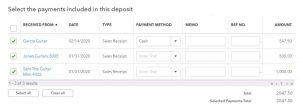

So I’m going to then go new, we’re going to go to the other section, and we’re looking for the bank deposit, which they’re calling at this point, record bank deposit. When we open that up, then the actual form will of course, simply be called the bank deposit. It’s going to be going into the checking account. So that’s what we want up top. We’re going to make this deposit as we’re going to keep the 14th As of the deposit, there’s our Garcia being pulled over, so it went into undeposited funds. Now it’s being shown in this first section as opposed to the second section that we saw on prior presentations where we would just simply be adding an account.

08:14

These items up top will be linking the sales receipts or the in the voices. This is the sales receipt that we just made. So there’s the sales receipt, we made these two sales receipts in the past last month. And we haven’t made the deposit yet for some reason we were kind of holding on to them. And, and those went to the to the jobs or projects.

08:33

So that means that the total is going to add up to the 2047 50. That’s the total amount what’s going to happen when we record this well, the bank account checking accounts going to go up by the full amount 2047 50 undeposited funds will be going down. But however when we see the detail and undeposited funds will be the seen a view able to see the detail for these three items, as opposed to the general ledger or the transaction detail for the bank account. We’re it will group as one deposit, because that’s what’s going to show on the bank statement hopefully allowing an easier connection between the bank statement and our books.

09:10

Let’s check it out. We’re going to say save and close so we can check it out. And then we’re going to go to the trial balance, I’m going to refresh it this time, we’re going to select the reef or the URL, hit enter to refresh. Now our report is much fresher. I’m going to close up the hamburger on the left, I’m going to hold down Control and scroll up a bit to 125. Then let’s go into the checking account to see if we can see that deposit. Scrolling back down, there’s the deposit on to 14 scrolling to the right.

09:40

There’s the full amount notice adding all of them up when account of 2047 50. Hopefully that’s the amount that shows up on the bank statement so that we can tie those two amounts out. Going back up top going back to our TB trial balance trusty TB, scrolling down to the undeposited funds, it’s now at zero but the zero still shows up Because we had activity in this time period, if we go into that zero using the auto zoom function, scrolling back down, we’re going to see that that deposit on to 14. But note, we have like three deposits on to 14. And we didn’t make three deposits, we made one deposit.

10:16

Yeah, but it has three items in it. And QuickBooks is going to break those out, because look how nice it is for us to be able to tick and tie out the deposits the increases in the decreases. If I was to go into any one of those three deposited deposits, then it would show that they actually were deposited at the same point in time and therefore the amount on the cash side of things will be the 2047 50. Or the amount that’s actually going to be in the bank statement, hopefully, will be the 2047 50 as opposed to the three separate deposits here.

10:50

So I’m going to close this back out. We’re going to go back up top to the to the TV. So we’ll scroll back up top. This is where we’re at so far. Once again, we’re going to be printing out the trial balance. for you so you can kind of check it out. Check your numbers at the end of each section.