QuickBooks Online 2021 that balance sheet report overview. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive file, which you can find by searching in your favorite browser for QuickBooks Online at test drive are in Craig’s design and landscaping services practice file, we’re going to go down to the balance sheet by going to the reports down below, the balance sheet should be one of your favorite reports one of two favorite reports, not a matter of opinion, if it’s not one of your favorite reports, then your favorite thing is wrong, because it should be one of them. So we’re going to be opening up the balance sheet.

Posts with the financial accounting tag

Subsidiary Purchases Shares from Parent

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss a consolidation process where we have a subsidiary that purchases shares from the parent. So what’s going to be the effect on the consolidation process? When we have a subsidiary that purchases shares from a parent get ready to account with advanced financial accounting. We are talking about a situation here where this subsidiary is purchasing shares from the parent what’s the effect on the consolidation process? In the past, the parent has often recognized a gain or loss on the difference between the selling price and the change in the carrying amount of its investment. So in the past, it’s often been recorded as a gain or loss on parent companies that difference as a gain or loss on the parent company’s income statement.

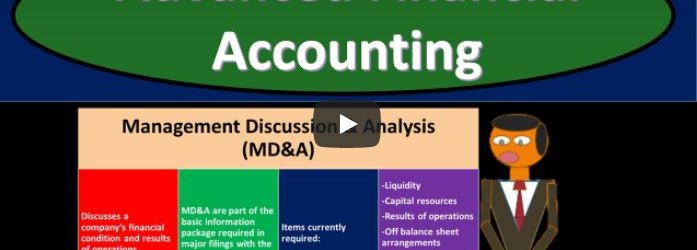

Disclosure Requirements

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss disclosure requirements get ready to account with advanced financial accounting disclosure requirements. We have the management discussion and analysis that’s often referred to as the M D and A discusses a company’s financial condition and results from operations. The MD and a are part of the basic information package required in major filing with the SEC, the Securities and Exchange Commission. Items currently required in the MD and a the management discussion and analysis include liquidity, capital resources, results of operations, off balance sheet arrangements, tabular disclosure of contractual obligations, disclosure requirements, pro forma disclosures, pro forma disclosures, financial presentations generally taking the form of summarized financial statements. demonstrate the effect of major transactions that happen after the end of the fiscal period or that happened during the year, but are not fully reflected in the company’s historical cost financial statements.

Other Intangibles

In this presentation we can continue on discussing acquisitions, this time talking about other intangibles other intangibles other than goodwill, get ready to account with advanced financial accounting. We are talking here about intangibles that must be recognized separately. So in prior presentations, we talked about an acquisition process and the recording of goodwill and the calculation of goodwill. Through that process, you’ll remember that we talked about the revaluation we had to reevaluate the assets and liability of the company that’s been acquired to their their value and then consider that or compare that, to the consideration that’s being given we can think about goodwill. Now in that process, however, we might have some other intangibles that need to be valued at that time as well, other than just simply the goodwill. So for example, we might have marketing related intangibles things like Internet domains and trademarks. So instead of just basically lumping everything into goodwill, we got to say okay, all right. They’re going to be marketing related intangibles like the internet domains and the trademarks that we need to apply some of that intangible amounts to we need to value in essence, those things as well breaking them out from just basically a kind of a lump sum valuation of goodwill.

Unearned Revenue Adjusting Entry 10.45

This presentation and we will enter and adjusting entry related to unearned revenue. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file. Let’s open up our reports by going to the reports on the left hand side, we’re going to be opening up our balance sheet First, the balance sheet, the favorite record, we’re going to go back up top, we’re going to be changing the dates up top that being from a 10120 to the cutoff date of Oh to 29 to zero, we’re going to run that report, we’re going to right click on the tab up top so we can duplicate that report.

Advanced Payment From Customer 8.30

This presentation and we’re going to record and advanced payment or customer deposit. In other words, we’re going to get paid before we do the work or in our case, provide the inventory of a guitar. Let’s get into it with Intuit QuickBooks Online. So here we are in our get great guitars file. Let’s first take a look at the flowchart in the desktop version just to consider the normal flow and what we are going to be doing here.

Financial Accounting 3 – Accounting Concepts Continued

Financial Accounting 3 – Accounting Concepts Continued More Info: Financial Accounting # 1 Link – Accounting equation, debits & credits, adjusting entries, closing process, & inventory transactions. https://youtu.be/slbij2ovIf8 Financial Accounting #2 – Inventory Flow (FIFO, LIFO. . . ), Subsidiary Ledgers (AR AP), Cash & Bank Reconciliations, Allowance method (AR), Depreciation https://youtu.be/B8R7i_GhX-0 Links to points in presentation. Payroll 1:28 Payroll Introduction 7:31 Regular & Overtime Pay Calculation 12:42 20 Federal Income Tax FIT 18:59 Payroll Legislation 27:49 Payroll Consideration and Tax Forms 44:08 Payroll Periods and Time Frames 51:13 New Employee Tax Forms & Contractor vs Employee 1:08:28 Federal Income Tax FIT – Percent Method 1:16:11 Federal Income Contributions Act (FICA) 1:24:17 Social Security Tax Calculation 1:30:27 FUTA, SUTA Workers Compensation 1:35:20 Medicare Tax Calculation 1:38:51 Federal Unemployment Tax Act Calculation 1:40:26 Payroll Ethics & Practices 1:51:02 Employer Taxes Calculation 1:58:21 Employer Responsibilities and Processes 2:06:12 Payroll Expense Journal Entry 2:16:52 Payroll Tax Expense Journal Entry 2:25:09 Pay Payroll Tax Expense Journal Entry 2:34:00 Form 941 2:48:29 Payroll Controls and Documentation 2:56:41 Form 940 3:08:16 Form W-3 & W-2 3:20:13 Reconciling Year End Payroll Forms 3:29:32 Minimum Wage & Nonexempt Employees 3:35:05 Payroll Calculations 3:37:51 Overtime Calculation 3:50:45 Payroll Register 4:00:26 Fringe Benefits 4:06:34 Federal Income Tax (FIT) 4:11:56 Other Deductions & Payment Methods 4:20:04 Taxes Employer Employee 4:29:25 FICA Employer 4:34:22 Federal & State Unemployment Tax Partnerships 4:43:41 Partnerships Introduction 5:04:33 Partnership Set Up New Partnership 5:15:48 Partnership Income Allocation 5:35:52 Partnership Withdraws 5:45:55 Partnership Closing Process 5:58:15 Partnership Partner Leaves Partnership Cash Equal to Capital Account 6:01:58 Partnership Partner Leaves Partnership Cash less then Capital Account 6:09:20 Partner Leaves Partnership Cash Greater then Capital Account 6:15:45 Add New Partnership – Cash More Then Capital Account 6:25:08 Add New Partner – Cash Less Then Capital Account 6:40:34 partner sells partnership interest to a new Partner 6:50:39 Partner sells partnership interest – Cash Received Less Then Capital 6:56:14 Partner sells partnership interest – Cash Received Greater Than Capital 7:03:14 Partnership Liquidation Gain on sale of Assets 7:20:08 Partnerships Liquidation Loss on sale of Assets 7:34:05 Partnership Liquidation Partner Pays Partnership for Negative Capital Account 7:53:29 Partnership Liquidation Partner Does Not Pays Partnership for Negative Capital Account Corporations 8:13:35 Corporation Introduction 8:41:09 Stock for Cash 8:54:05 Issuing Stock for Non-Cash Asset 9:04:42 Dividends Overview 9:15:10 Cash Dividends 9:24:57 Stock Dividends & Stock Split 9:35:33 Preferred Stock Introduction 9:41:48 Preferred Stock Example 9:51:19 Treasury Stock 10:08:49 Statement of Retained Earnings 10:21:46 Corporations Statement of Stockholders Equity 10:45:47 Corporation Closing Process 11:01:35 Corporations Earning Per Share Because it’s fun. This may not be the first thing that enters everyone’s mind when asked this question, but hear me out, make an honest effort to learn the first two chapters, and then make your decision as to the validity of the statement that accounting is fun. There are, of course, many practical reasons to learn accounting including: • Accounting has been described as the language of business. Whether we work for a company or own a business accounting helps us understand the business. It can help us see the big picture. • Accounting principles are applicable to our personal finances. Whether we have a large or small amount of resources we still need to manage our personal finances. • Accounting helps with investing. When investing for things like retirement we may consider investing in stocks and bonds. Accounting helps understand the financial statements of companies to make better investment decisions. Other reasons for learning accounting, which may not be so evident, are that accounting develops critical thinking, logic, and practical decision making skills. These skills can be applied to all areas of life. Accounting also provides the same kind of a sense of satisfaction we receive when we complete a puzzle, master a new musical pattern, or play a game of checkers. We get that same shot of dopamine when we can say we figured it out and “it’s in balance”. Accounting is comparable to setting up and playing a checker game. Checkers are set up on a spreadsheet, in accordance to a set of rules, and we move the pieces in accordance to a set of rules. Once these rules are leaned the game can be enjoyable. Accounting will have a similar set of rules, a similar board, and yes, once the rules are learned, it can be enjoyable. Items needed for setting up and

U.S. consumer spending posts small gain

U.S. consumer spending posts small gain. https://t.co/r3gp8Jitzd pic.twitter.com/mDkdWMHQBA

— CFO (@cfo) April 15, 2017

http://www.youtube.com/c/AccountingInstructionHelpHowToBobSteele

https://www.facebook.com/pg/AccountingInstructionhelp/videos/?ref=page_internal

What’s the #tax cost of doing business in your state? Check out Location Matters, our interactive guide

#TBT: What's the #tax cost of doing business in your state? Check out Location Matters, our interactive guide https://t.co/IGn9Ppxivx pic.twitter.com/xjOeOcDGYC

— Tax Foundation (@taxfoundation) April 6, 2017