In this comprehensive presentation, we will delve into the intricacies of auditing prepaid expenses, with a primary focus on the audit process related to prepaid insurance. Prepaid expenses, categorized under other assets, pose unique challenges in the audit process due to the nature of payment preceding the receipt of benefits.

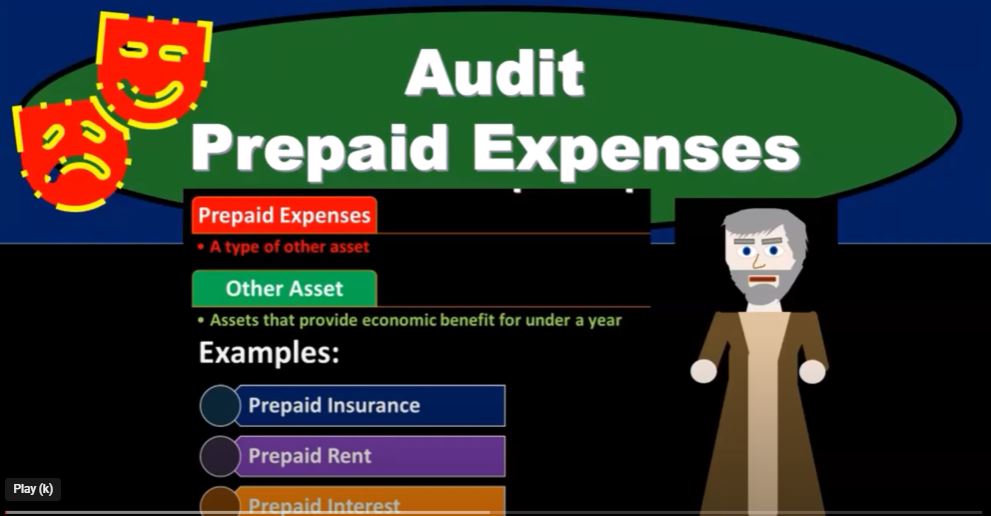

Understanding Prepaid Expenses: Other assets encompass assets that provide economic benefit within a year. Prepaid expenses, a subset of other assets, involve payments made before receiving the associated benefits. The quintessential example is prepaid insurance, where coverage is paid for in advance, anticipating future benefits.

Types of Prepaid Expenses: While prepaid insurance is the most common example, companies may also prepay for rent, interest, or other services. The decision to prepay often involves strategic considerations, such as negotiating advantageous terms or aligning with contractual agreements.

Inherent Risks and Control Considerations: Inherent risk, inherent to the process being audited, is coupled with control risk, influenced by the controls implemented by the company. Detection risk, set by auditors, complements these. Generally, inherent risk for prepaid expenses is low due to the straightforward nature of the accounts. Control procedures, especially in the purchasing process, play a crucial role in mitigating risks associated with prepaid expenses.

Audit Procedures for Prepaid Expenses:

- Substantive Procedures:

- Verify the prepaid insurance schedule, examining payment dates.

- Obtain insurance policies to understand coverage periods.

- For publicly traded companies, review month-end reconciliations.

- Assertions and Testing:

- Valuation:

- Assess the portion of the policy that has expired and remains prepaid.

- Verify the accuracy of adjusting entries for expired portions.

- Rights and Obligations:

- Confirm policy beneficiaries.

- Inquire with insurance brokers for external confirmation.

- Existence and Completeness:

- Confirm policies with external sources.

- Scrutinize supporting source documents.

- Classification:

- Ensure proper classification of prepaid expenses.

- Valuation:

Conclusion: The audit process for prepaid expenses involves a meticulous examination of inherent risks, control procedures, and substantive testing. By focusing on valuation, rights and obligations, existence and completeness, and classification assertions, auditors can ensure a thorough and efficient audit of prepaid expenses, contributing to the overall reliability of financial statements.