In the dynamic world of accounting, professionals are tasked with the critical responsibility of ensuring financial transparency, adhering to established standards, and safeguarding confidential client information. This presentation dives into the intricate web of general standards, compliance accounting principles, and the delicate handling of confidential client data.

I. General Standards and Compliance:

A. Professional Competence: In the realm of auditing, professional competence is not a mere formality but a cornerstone. The diversity of audit engagements demands a nuanced understanding of different industries, organizational sizes, and levels. The key is to ensure that the professionals engaged possess the requisite competence tailored to the specifics of each audit.

B. Due Professional Care: Applying due diligence in the performance of audit procedures is crucial. This involves meticulous planning and supervision throughout the auditing process. By exercising due professional care, auditors can navigate the intricacies, compile sufficient relevant data, and build a robust foundation of evidence to support their opinions.

II. Accounting Principles and Rules:

A. Conformity with GAAP: Expressing an opinion on financial statements requires adherence to Generally Accepted Accounting Principles (GAAP). Any departure from accounting principles established by authorized bodies could impact the overall assessment. The duty lies in ensuring that financial statements are fairly stated in accordance with GAAP.

III. Confidential Client Information:

A. Non-Disclosure without Consent: Upholding client trust is paramount in handling confidential information. Professionals in public practice are strictly prohibited from disclosing any confidential information without explicit client consent. However, exceptions exist, acknowledging that certain situations may necessitate disclosure.

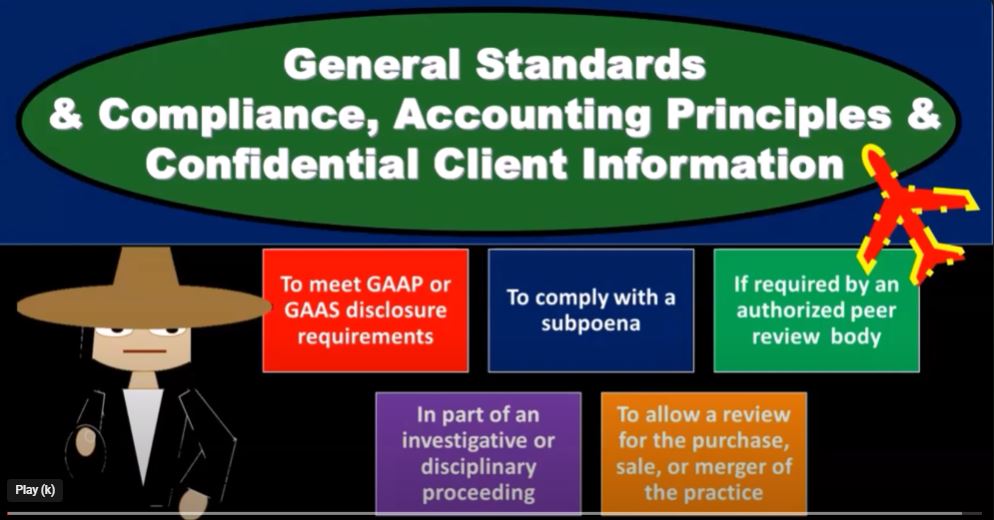

B. Exceptions to Non-Disclosure Rule:

- Compliance with GAAP or GAS Disclosure Requirements: Information may be disclosed to meet specific Generally Accepted Accounting Principles (GAAP) or Generally Accepted Standards (GAS) disclosure requirements.

- Compliance with a Subpoena: Legitimate subpoenas require compliance, balancing the need for disclosure with legal obligations.

- Required by an Authorized Peer Review Body: Disclosures may be necessary to comply with evaluations conducted by authorized peer review bodies within the accounting profession.

- Part of an Investigative or Disciplinary Proceeding: In instances of investigations or disciplinary proceedings, disclosure may be required to uphold professional standards.

- Allowance for the Purchase, Sale, or Merger of the Practice: Facilitating transparency during significant practice changes, such as mergers, sales, or purchases, may necessitate the disclosure of certain information.

Conclusion:

As accounting professionals navigate the multifaceted landscape of standards, principles, and confidentiality, the essence lies in striking a delicate balance. Upholding professional competence, due professional care, and ethical handling of confidential information are indispensable in maintaining the integrity of the accounting profession. By adhering to these principles, professionals contribute to a financial landscape built on transparency, trust, and accountability.