This presentation and we will take a look at the banking section of the homepage within QuickBooks Pro what 2020 QuickBooks desktop 2020. Here we are in our get great guitars file which we set up in a previous presentation. If you don’t have access to the get great guitars file, that’s okay, you can follow along with your own data, we currently have the homepage open, the homepage is usually open when you open QuickBooks However, you can also open it by selecting the company drop down up top and go into the homepage.

0:31

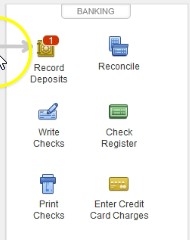

This is going to give us a nice flow chart a flow chart by activity or cycle including the vendor cycle and the customer cycle and the employees cycle, we took a look at the vendor and customer cycles in a previous presentation. Now we’re going to be looking at the banking section know that the banking section doesn’t have a nice flow chart to it.

0:50

But the banking I except for of course, the deposit here, which is in essence, usually hopefully, most of the deposits been an extension of the receivable cycle, because the deposits hopefully most of them are from customers. However, most of the banking items are just going to be the groupings of what are going to be commonly used items.

1:07

So these are things that QuickBooks, basically things are important enough to put on the homepage. So they’re going to have to quick access to it on the homepage. They’re basically saying, hey, these things are things that you may want to use, they’re kind of important, we’re going to put them on the homepage, you can find most of them in other locations. And many of them I actually go into with other locations. However, the fact that they are on the homepage mean, they’re important items.

1:33

Now, of course, we have the deposit here, which we looked at when we thought of the customer section, that’s going to be hopefully many of the deposits being the end result of our customer cycle, where we get the Create sales receipts, and the receive payments from customers and then we deposit them however, we may have deposits for other things as well, we as the owner may be depositing money, we might have got a loan out and deposit money into the banking section.

1:58

That’s why the deposits isn’t banking, even though we’re hoping that many of the deposits is going to be connected to the customer section. And it’s intimately involved. Of course, with the customer cycle in that fashion as well. We then have the reconcile. So when we think about reconciliation, we’re typically thinking about a bank reconciliation. So the banking section, of course, is going to include the reconciliation of our books to the books of the bank, that gives us a third party kind of verification that we have done the proper data input into the system.

2:32

Now the bank reconciliation will spend a lot more time with later it’s not going to be a data input screen, what it’s going to do is help us to kind of verify that the data input that we have put in place is correct. And then if we need to do more data input, we can go into something like the register and put more data in place, we’ll go into the bank reconciliation in depth as we go through a practice problem.

2:53

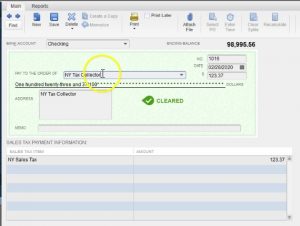

Also note that you can see these up top tier, if you go to the bank and drop down. Typically I would go to reconciliation here to banking, and then reconcile here, you can also of course, make the deposit here too, I often use the deposit in the home screen. When I reconcile for whatever reason, I typically go to the banking section up top and reconciled rather than using this item, then we have the right checks. writing checks is actually it’s just what you would expect it’s going to be the right checks feature, it’s going to look like a check when we open it up, we see the check.

3:26

Now this is going to be a data input form within QuickBooks like the others we have seen it will record of course, a transaction in QuickBooks as we write a check, for example, if we go to the previous check here. So in this case, we paid the sales tax, which is to the New York tax collector, this is the amount of the payment, the other side is down here, it was paid out of a bill payment, so it’s actually going to be decreasing the accounts payable. So the check of course means that the checking account will be going down, and the other side will be indicated down here.

3:56

If it came out of accounts payable, then it’ll be decreasing accounts payable. And if we wrote a check for some other expense item, then it’ll be listed as that expense item down here, closing this back out. And then the right checks. Of course, you can do up top as well, you can go to the banking up top, and you can go to the right checks in the drop down, then we have the check register.

4:19

Now oftentimes, if you’re entering data into QuickBooks, it can be easier to enter it straight into the check register. So if I just want to write if I just want to interject into the check register, or if I want to enter increases or decreases to the checking account, oftentimes, I will just simply go to the check register rather than writing checks. So I’ll just go right to the check register, which will look like this.

4:40

And then if you see the note that check register, and we’ll just give a quick list of in essence, the checks and the deposits that are going to be involved here. So the check register is a is a huge tool that can really make things faster, especially if you’re doing types of data input where you’re basically taking the bank statement at the end of the month and entering it into the QuickBooks file in order to get your data into QuickBooks, well, then, it’s a lot more tedious to be entering using deposit forms and checks, it’s much easier to go directly into the register and enter that information directly into the register much faster.

5:17

To do so we’ll talk about when it might be more appropriate to use the register when it might be more appropriate to use the forms as we go through example problems for it. So just note that if we think about the register, of course, this is going to be a check, this one went to the Internal Revenue Service. And this is going to be the other side of it, which is going to be the payroll liability.

5:37

If I double click on this little check icon here, then of course, we get back to a check. closing this back out, closing or and then the other side of this would be deposits. So here’s the deposit. If I was to double click on a deposit form, you get to the actual deposit screen that we’ve looked at in prior presentations. closing this back out. So this can be a great tool should look a little bit like a checkbook if anybody’s still used to enter in the information into their checkbook.

6:06

This should remind you of the checkbook. Note that you can also find this and this is where I would typically go in order to get into the check register to the bank and drop down. And then you go to use register. And you’ll will usually default to the check register. But be aware that you can open a similar register for just about any balance sheet account here. So you could select just about any balance sheet your account you want.

6:30

And if you are in some other screen, such as the customer section or the vendor section, it may default to something other than the checking account. And then you’re just gonna have to take yourself out of that screen and come back. And so for example, if I close this back out, close this back out, I go to the customer section by selecting customers up top. And then if I went into the check register from here, I go to banking use register.

6:58

Notice it just took me right to a different register, which is actually accounts receivable, it looks like it looks like a check register, kind of. But this is not the check register. This is a accounts receivable register, I’m going to close this back out and close this back out. So then if I close this back out, and I will do that, again, banking, use register. Now it defaults to the checking account, and we’re back to the check register.

7:22

So just be aware of that. closing this back out, we’re back to our banking section, then we have the printing of the checks. Now when you print checks, you still need to buy the checks, because they need to have the pre printed numbers on them. They’ll be bought in such a way that they’ll be in the size of basically paper typically normal paper that you put into the printer. And then you can put the into the printer and you can then print the check straight out of QuickBooks if you so choose.

7:48

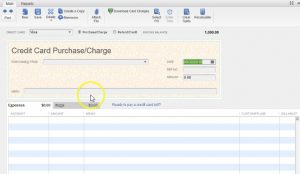

So that could be a nice feature to have. So you can write the checks and then you get the checks it will be listed here that you can then print them directly out of QuickBooks. Next, you’re going to have the internet credit card charges. So if you select the Enter credit card charges, you have a similar type of screen that we have seen for the checks and the bills. So we have the purchase from and then we’ve got the data input screen entering the MT amount, and then the expenses or the items will be for inventory.

8:19

So the expense will be the tab that we will typically use the items would be an inventory amount tab, closing this back out, that’s going to be our major forms that we’re going to be using. Within the banking section. Obviously, the one you’ll use the most that will be like a forum is going to be the record deposits, which we’ve looked in the past and the creating of the checks, the reconciliation isn’t really exactly a form, that’s going to be something that we’re going to be doing as a reconciling item important, but not recording that transaction.

8:50

As we’ve seen with some of these other items that are in the vendor and customer section. The check register isn’t an actual form really, because the the check register will contain the deposits and the checks in a kind of a shorthand format. So the register is a tool that can allow us to enter things enter forms, such as the deposit and checks more efficiently. The print checks is of course the printing feature of the printing checks.

9:20

It’s not really the data input form to print the checks, that’s the activity of printing them. And then we have the inter the credit card deposit, which is a transaction type of form. So you want to kind of differentiate between the forms that are going to be transaction forms because whenever you think about a form, you want to think about how that forms set up so that the data input will be easy to do, what’s going to be the effect of that form on the financial statements on the balance sheet and the profit and loss