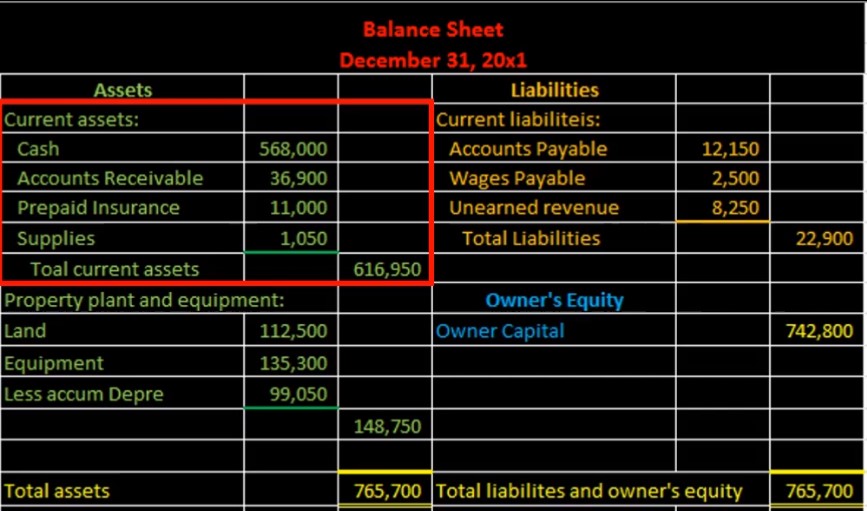

Hello in this lecture, we’re going to create the current asset section of the balance sheet, we’re going to create this current asset section from a trial balance, we’re going to piece together the financial statements piece by piece as we go through a series of lectures, the trial balance being here at this is going to be the adjusted trial balance. And what will happen is we will then find a home for all of the accounts on the financial statements. Once we then do that, that means that we have then converted this from the double entry accounting system being in the format of debits minus credits equaling zero or debits equaling the credits to the assets equals liabilities plus the owner’s equity, basically the accounting equation, which is reflected on the balance sheet. So we’re going to start off by doing the current assets section, which will just be this part we’re going to find a home for these first few accounts.

00:51

And that’s going to include cash, accounts receivable, prepaid insurance supplies, not land, why not land, land is not a current asset because it’s going to be a loan term asset. Difference between current assets are things that are going to be more liquid things that we are going to readily use soon or is close to cash. And that’s because it’s more comparable to the liabilities, we want to know what’s close to cash, those are going to be the things that we can more readily use to pay the current liabilities, the things that will be due relatively soon. In order to do that, we’re going to say, okay, we’re in the assets section, and all we’re going to do is just pull these numbers over, we’re gonna say current assets, colon, look at the format, because the format is going to really tell you a lot about how to create the financial statements as well as how to read the financial statements. So we’re going to say, this is going to be an asset section, another subsection represented by a colon, then we’re going to indent so we’re just going to pull over these accounts.

01:44

Notice it’s slightly indented here. We’re just pulling over the cash account. We’re going to pull that into the inside and then sum them up on the outside. This doesn’t represent debits and credits, what we’re doing is taking the building blocks of debits and credits over here, and then transposing those To a plus and minus format over here, transforming that bat process from the double entry accounting system in terms of debits and credits to the same double entry accounting system, which now will be in terms of assets equal liabilities plus equity. Then we’re gonna do the same for accounts receivable, which is pulling this number here. Here’s the accounts table, we’re just pulling that number over, we’re putting it in the inner column, not a debit column, it’s just going to be the inner column that we’re subtotal in. We’re going to do the same for the prepaid insurance which is pulling the prepaid insurance over into our balance sheet.

02:31

And we will do the same for the supplies, we will stop there not including land land is not a current asset, then we will put a underline under here and we will then sum that up. Notice again, the format colon here, that means it’s a sub category within indented these items here, then we indented again, and now we’re putting the sub category on the right hand side, how is that calculated? It’s just going to be the 560 8000 plus the 36 nine plus the 11,000 plus two 1050 We are now summing it up on the right hand side. That’s going to be the format that we will repeat as we go through all the financial statements. We can now see that this has been recreated from our trial balance been the current asset section of the balance sheet, we’re going to move on to next time, property, plant and equipment, then on to the rest of the balance sheet and the income statement and the statement of owner’s equity, and then discuss how these financial statements fit together.