Hello. In this presentation we’re going to talk about reversing journal entries as they are related to accrued revenue. When considering reversing journal entries, we’re talking about those journal entries made after the financial statements have been generated after the adjusting process has been done. Remember that the adjusting process happens after all the normal transactions for the month have happened. Then at the end of the month, we have that adjusting process. All journal entries being made as of the same date as of the end of the month in order to make the financial statements correct so that the financial statements can be made. As of that point in time, in this case, the end of the year being 1231 that the cutoff date that the point in time that we make the financial statements, then we want to consider if we want to use reversing journal entries.

00:49

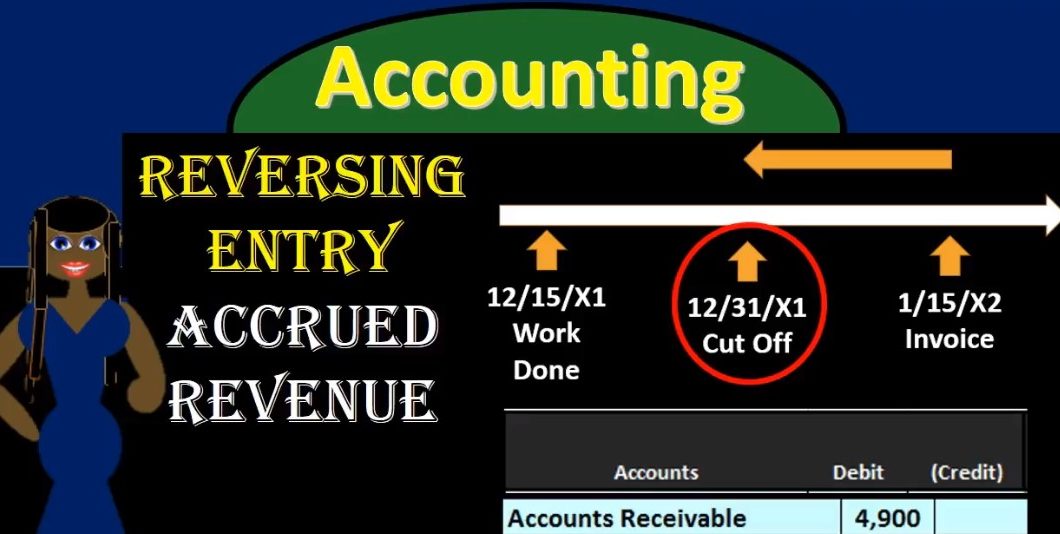

Those will be made the day after the financial statements have been generated in order to make those adjustments to some of the adjusting journal entries that in Need some adjustment in order to make our normal accounting process work. So this time, we’re going to talk about those reversing entries related to accrued revenue and why we might want to use them within our accounting process. We have an example here where we have work was done that the business has done, we’d have done work on 1215 of x one, we didn’t invoice the work until 115 of x two in the next year. So note that we have crossed over the cutoff date, the date of the financial statements between the time the work was done and the invoice was generated. This may happen because just as a normal part of the accounting process, because we did the work here, maybe we had to bill the client, see how much time was spent. So it may be natural that we don’t have the bill go out to a later time.

01:52

But under the revenue recognition principle, we would like this work we need this work to be recorded prior to the date of The financial statements it should be recorded. as of the date the work was done as of 2015. It was not recorded during the system until 115. Therefore, the adjusting journal entry would bring this back to this point in time back to the date of the financial statements. Note it does not make it completely correct. It doesn’t take it back to this point in time, the point time the revenue was earned. Why? Because we don’t need to do that really to make the financial statements right. If we pull it back to the date of the financial statements, then we are correct as of the date of the financial statements and that’s the goal of the adjusting process. And the reason all the journal entries will be made as of 1231. So here is that adjusting journal entry we’re going to debit accounts receivable and credit revenue. And it does this to our accounts accounts receivable is going to go up by the amount of this journal entry and revenue will go up. It looks just like a normal journal entry.

02:57

It is just a normal journal entry that happens during The accounting process whenever we do read and we do work on account, receiving receivable and increasing revenue, the only difference here being the reason it needed this adjustment is that the work was done before the invoice was sent out. And it just so happened that that surpassed the cutoff date that cutoff date landed in the middle. And therefore we needed to pull this this transaction back recording the revenue in the time period that the financial statements were covering. Then if we take a look at the invoice date, we also note that we have this same transaction still happening because when we pulled the transaction back in the adjusting process, we did not delete this transaction that happened at the date of the invoice. Therefore, at this point in time, we also recorded accounts receivable increase in accounts receivable. And we had the revenue increase in at this point in time therefore as of one point 15 of the same journal entry has been entered two times due to the adjusting process due to making our financial statements right, as of 1231.

04:09

How can we deal with this one, you might think, well, we should be deleting this, this journal entry happening on 115. Because it really should have happened back here on 1215. And that would be a reasonable assumption. However, if we don’t typically want to do that, because this is actually even though it happened at a later point in time in terms of when the data was entered into the system. It actually happened at an earlier point in time, in terms of when the actual transaction was entered into the system. So it was this this transaction was entered into the system with a date of 1231. But it actually happened. It was entered into the system at a later date, and we don’t normally want to delete the invoice. One reason is because we want the paper trail and we almost never delete anything so that we have that audit trail.

04:56

Another reason is because this journal entry here’s typically More of a bare bones journal entry, just a journal entry, whereas this often has more of the detail in terms of the full invoice, backing up the journal entry that gives possibly more detail in terms of a subsidiary ledger and whatnot. Therefore, typically do not want to delete this entry, we could also have a reversing entry basically as of this date, or we can just do a normal reversing entry process and just put that in as a normal part of the system as we basically have with the adjusting process. So at this point in time, here’s our problem with the adjusting journal entry. And this is the tension that happens between the adjusting journal entries and the normal accounting processes, these types of things can happen and we have to put together a system to deal with them. And that would be that the adjusting journal entry created this journal entry being pulled back and recorded as of the date of 1231. However, it’s also being recorded as of the date of 115. Neither of these are necessarily wrong. Either the accounting to Or the adjusting department did something necessarily wrong, they both did what they had to do in terms of their system, but we need to figure out how we’re going to adjust this.

06:09

Then, if we have the reversing journal entry note the date of the reversing journal entry as of one, one x one, so we’re just going to do the exact opposite, we’re going to take it we’re going to debit the revenue, decreasing the revenue and credit accounts receivable. So what happened is we put it into accounts receivable, we increase revenue as of 1231 made the financial statements with that. And then right after that, the day after the financial statements are generated, we are then going to do this just reverse it out, reduce the revenue, reduce the accounts receivable The day after. And that will be a good system because it’ll it will reverse what we did as of 1231 and get back to the point in time that the books were at almost the problem with that, however, is that the rim but the revenue should have look funny, we almost never will debit a revenue account because we did revenue accounts only go up in the credit direction. So as of the first day of the new year, in this case, we have a debit in revenue, which is really weird, that would be negative revenue. That doesn’t make any sense.

07:18

However, it will make sense at the point in time of 115. The point in time that there the other journal entry was made, because the journal entry was debiting, the accounts receivable and crediting revenue, and therefore, this will then reverse it out, we’re going to that journal entry will reverse out and then pull the ball the amount back out, bringing it back down to zero, those two amounts will net out as of the date of the invoice until that invoice happens, it’s going to be out of balance, that thing will not look correct. And that’s just the price we pay just like it’s the price we pay when we do the adjusting journal entry process and we make the adjustment as of 1231 and ignore The fact that it’s not quite correct as of the day before 1231, or the day before that we’re making it right after the financial statement dates. This will have problems between, in this case January 1 to January 15. We’re just going to recognize that there is a problem there.

08:17

And note that it will be correct as of the date of January 15. And that will make it so that our adjusting department and reversing department can do their jobs have a simple system that we can put in place to reverse this journal entry, so that both of those departments don’t have to do anything too different. If you would like to know more about the adjusting process and the reversing process, we recommend taking a look at the book accounting instruction reference number 300, where we will have a reference to related topics so you can pick the topic you’re most interested in and see topics related to it. We also have links to instructional resources, such as more instructional videos and games. And test banks as well as other resources related to the tech so it can really act kind of as a guide to help you through some of these resources, many of them being free