QuickBooks Online 2021. lists, let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free test drive file that you can find by searching in your favorite browser for QuickBooks Online test drive. We’re in Craig’s design and landscaping services, this time, considering that lists lists is one grouping, or one way to groups items within QuickBooks Online, that are often very important for the setting up of the system of QuickBooks Online. And then they’ll basically be working behind the scenes, as we do our normal processes, those normal processes being the customer cycle, the vendor cycle, and the employees or payroll cycle.

Posts with the financial statements tag

Dark Mode QuickBooks Labs 6.35

QuickBooks Online 2021 dark mode, QuickBooks labs. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars a practice file, before we get into the themes, we just want to go over some of the differences between the layout and the changes that could take place with QuickBooks Online versus the desktop version. Notice if you’re on the online software, like a webpage, they can do more testing and make more changes a lot more rapidly than you will see say in a program that will be downloaded, say something like a desktop version.

QuickBooks Online Comprehensive Problem Introduction 6.05

QuickBooks Online 2021 QuickBooks Online comprehensive problem introduction, let’s get into it with Intuit QuickBooks Online 2021, we’re now going to be working through a comprehensive problem. In order to work through the comprehensive problem and get the most out of it, you would like to have access to a QuickBooks Online file with no data in it, so that you can work through the practice comprehensive problem.

Payroll & Employee Reports & Bank Reconciliation Report 4.40

QuickBooks Online 2021 payroll and employee reports and bank reconciliation reports. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive file, which you can find by typing into your favorite browser, QuickBooks Online test drive or in Craig’s design and landscaping services, we’re going to go down to the reports down below.

Inventory Reports 4.35

QuickBooks Online 2021 inventory reports. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive file, which you can find by searching in your favorite browser. For QuickBooks Online test drive, we’re in Craig’s design and landscaping services. going on down to the reports, we’re going to be opening up now inventory reports, which you can find and which I probably will be looking for in the future by simply typing in inventory in the search field.

Bill Form 1.20

QuickBooks Online 2021. Bill form, let’s get into it with Intuit QuickBooks Online 2021. Here we are in our Google search page, we’re going to be searching for QuickBooks Online test drive. And then we’re going to be selecting the QuickBooks Online test drive from Intuit, the owners of QuickBooks, we’re going to say we are not a robot, and then continue. Here we are in our Craig’s design and landscaping services practice file, we’re going to be continuing on with our vendor section, I’m going to go over to the desktop just to review our items. First, we’re going to take a look at the vendor section.

Vendor, Expense, Purchases, or Accounts Payable AP Cycle 1.15

QuickBooks Online 2021 vendor expense purchases or accounts payable AP cycle, let’s get into it with Intuit QuickBooks Online 2021. Here we are in our Google browser, we’re going to search for QuickBooks Online test drive. And then we’re going to go into the QuickBooks Online test drive from Intuit to get to our practice file, verifying that we are not a robot that keep on trying to think I’m a robot, but I’m not. So I’m going to say no and continue here.

Bank Feeds .25

QuickBooks Online 2021 Bank feeds. Let’s get into it with Intuit QuickBooks Online 2021. Here we are online in our Google search engine. We’re typing in the QuickBooks Online test drive to get to our QuickBooks Online at Test Drive File, we’re going to be clicking on QuickBooks Online at test tribe, verifying that we are not a computer here, and then continue. Here we are in the Craig’s design and landscaping services practice file, we’re going to be touching in on the bank feeds. And the first thing we want to note is that we will be going into bank feeds in more detail, but it will be after the primary practice problem where we will focus specifically on bank feeds.

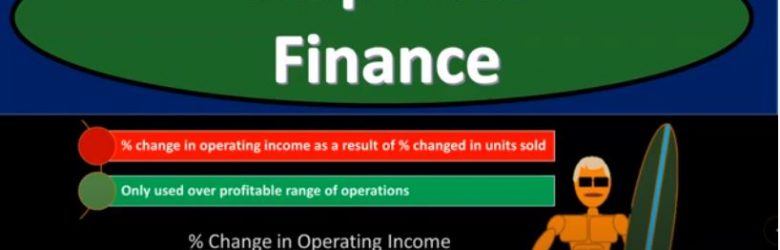

Degree of Operating Leverage 515

Corporate Finance PowerPoint presentation. In this presentation, we will discuss the degree of operating leverage, get ready, it’s time to take your chance with corporate finance, degree of operating leverage. Now remember, when you hear this term leverage, there’s two things that pop into your mind that generally categories of leverage. The first one is probably related to debt debt leverage or financial leverage. And the other related to the cost structure, the one that we’re going to be focusing in on here, the structure between variable costs and fixed costs. So what’s going to be the structure of the variable cost fixed costs, that’s kind of what we’re measuring here, with the degree of operating leverage the fixed costs being the thing that’s going to have more leverage related to it.

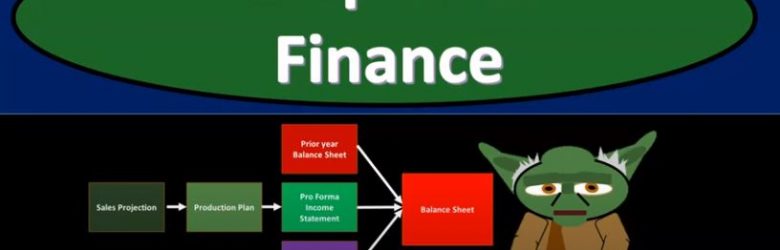

Forecasting Objectives 405

Corporate Finance PowerPoint presentation. In this presentation, we will discuss forecasting objectives Get ready, it’s time to take your chance with corporate finance, forecasting objectives. When thinking about forecasting, we’re thinking about into the future, we’re thinking about kind of like a budgeting or projection type of process, we want to plan ahead making changes in strategy as needed. So we’re going to think about what we think will happen into the future. So we can strategize now, and do what we need. Now, in order to accommodate what we believe will be happening in the future. Based on our best guesses based on our forecasts, we’re going to construct a financial plan to support the growth.