This presentation and we’re going to take a look at the objectives of the bank reconciliation process. In other words, why do we need to do the bank reconciliation for what’s the important of the bank reconciliation? What are we trying to accomplish when entering a bank reconciliation? Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file. We’re thinking about bank reconciliations now. So first of all, let’s go down to our reporting down below, we’re going to be opening up the report, we’re going to be opening up our favorite report that the in the balance sheet so we’re going to open up the balance sheet report.

00:34

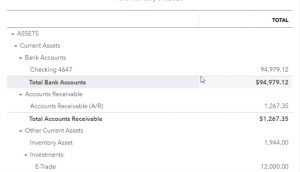

Going to change the dates up top, I’m going to change them from a 10120 to make it 201 30 120. Just for the first month we’re going to be considering the bank reconciliation process first for the first month. Then we’ll reconcile the second month. Let’s go ahead and run that report. And then going to go up top to the tab up top right click on it and duplicate that tab. So what we are considering now is of course the cash account. So we’re considering the cash account because we’re going to be thinking about reconciling the cash account with the bank. I’m going to hold down Control, scroll up a bit, we’re at the 125. So here is our checking account.

01:14

Now what we want to do is basically verify the checking account not only the balance number, but the transactions within it, that’s going to be a really important one because obviously cash is really important, we want to verify the cash account. But that’s not the only reason we want to do the reconciliation note that every other cycle will at some point in time go through cash cash is part of every other cycle. So in other words, if you were to open up the checking account here, and just consider the types of forms that we have here the types of forms that are involved in the checking account, we have obviously deposits we have Expense Type forms, we have the pay bill forms, we have various different forms, that could be affecting the checking account.

01:56

If on the other hand, I go into any other account if I go back To another account, such as accounts receivable, we know just by looking at the forums, there’s only basically a couple forms that are going to affect accounts receivable, that’s the invoice and then the payment. Right, there’s only a couple things that are going to be involved here. If I if I look at any other type of account, if I go back to our summary to our balance sheet and look at any other account here, there’s only a few things that are basically going to affect these accounts. And all of these things. Typically funnel into all these accounts are related in some way to the the checking account.

02:32

So therefore, if we can verify the transactions on the checking account, that they’re valid, then we have a pretty good double check that everything is going well. Let’s take a look at this in a different type of format. If I was to look at the QuickBooks flowchart for QuickBooks desktop, note that all of our cycles here we think about accounting happening basically in cycles. All of these cycles feed into cash at some point in time.

02:58

So if you’re talking about the vendor cycle for us purchasing something, we may just be buying it with cash writing, writing a check or having it come out of our checking account in which case you will affect cash directly or it’s going to go through accounts payable lag a little bit before it gets to cash and then we’re going to pay the bill and then we’re going to have cash affected or we buy inventory hasn’t hit you know, we might be paying for cash yet. And then and then we buy on account have a purchase order then we have the bill then we pay for the inventory. So at some point in time cash is going to be rolling around of course into the vendor section as we purchase things as we cash goes out.

03:34

In the customer section. Same same kind of process. If we have a customer and we make a sale directly, then the cash is affected immediately right at the point of sale or it lags a little bit and that we do work we invoice someone then we receive the payment later. But at some point times cash will be involved Of course in the customer cycle and then in the employees cycle. Then obviously when we pay the employees cash is affected We have to deal with a liability a lag a little bit with the loan with the loans payable or the withholdings. But then of course, we’re going to be paying that out. So every cycle in other words, of course, touches on cash that account, the cash account will be involved in every cycle.

04:14

So therefore, if we can verify the transactions in cash, it’s not a perfect check against an accrual system. Because an accrual system has these timing differences that will happen with accounts payable and accounts receivable and liabilities and whatnot. However, if we, if we take the big picture format, those timing differences should wash out at some point. And if we can verify all the cash accounts, then we’re doing quite well. You know, that’s a pretty huge double check. So, in other words, the biggest check that we have back to QuickBooks Online, that we are in balance that you can rely on your financial statements is the double entry accounting system. assets equal liabilities plus equity debits equal the credits.

04:58

We have that that has to work Because unless you do something really strange, QuickBooks will force you to be in balance in that format. They won’t let you the QuickBooks has that’s one of the internal controls is to use QuickBooks to be in balance. Now if you have that in balance, then the second internal control then hugest and biggest internal control is the reconciliation process to get that third party reconciliation.

05:22

So in other words, like as an as an accountant, if someone hasn’t reconciled the bank accounts, and I and I’m looking at their financial statements, my reliance on their financial statements to be accurate is very low. Like do I think all the transactions are in there? Or, you know, do I trust these financial statements? Not not very hot bed more so than if it wasn’t in a double entry accounting system, if it’s just kind of an income statement. But still, if it’s not reconciled, it’s not as reliable. So pretty much big businesses, small businesses is what I’m trying to point out. Any business whether you use whether you use bank feeds or not, should be using reconciliation process to have that kind of verification.

06:03

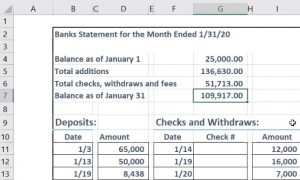

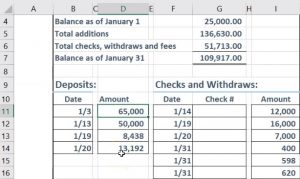

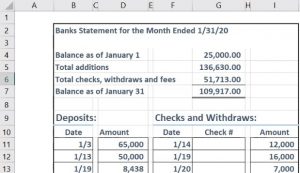

Now, what does the bank reconciliation process do? Well, we’re basically double checking these numbers in the checking account. Now we can see the end result number, you might say, well, that should be easy because this is as of January 31 2020, I have 94,009 79 in the account can’t just go to my bank account and just check that that’s the same number on the bank account. And if we were to do that, we’d have to say, Well, no, because if I go to my bank account, for example, this is our mock bank account. We have the 109 917. It doesn’t tie out doesn’t match and it’s almost never going to match. If you have any significant amount of transactions happening.

06:41

Why isn’t it’s going to match? Because there’s a timing difference. There’s going to be a timing difference between you know, when we write checks, and when those checks get cashed and deposited, that timing difference is going to cause us problems. There’s going to be a timing difference between when we take a deposit to the bank recorded in our QuickBooks system. When the bank actually read the deposit, that should be a shorter timing difference. But there’s still a timing difference there. So now we have to say, well, there’s a timing difference.

07:09

So if I can just take that Indian balance and a tie it to my Indian balance, then I’d be pretty assured that everything’s working in the cash account. And that gives me pretty good confidence about the other accounts that are real rolled into cash as well. But that’s not the case. I don’t have that assurance because I can’t tie out exactly. And if I can’t add exactly, then, then there could be a whole bunch of things that are a problem. It doesn’t matter how, how big the differences between what’s on my books and what’s on the bank statement, because I could be a combination of debits and credits that all aren’t in there. And so it’s going to be a problem. If it doesn’t tie out like kind of exactly, then you it’s not as much of an assurance because there could be other issues involved.

07:53

So what we want to do then, is reconcile if we can reconcile and say hey, I know exactly the checks that are the difference. And the outstanding deposits, those are going to be the differences at the end of the day, then we can then we can reconcile and have assurance. That seems like a difficult thing. But it’s pretty easy to do technically, all we want to do is we’re going to, we’re going to take the bank statement here. So this is going to be our mock bank statement that we’re going to have, we’re going to get this from the bank, you don’t want to have typically you’re just a if you just go and get your transaction report from an online system, for example, that’s not really good enough, because what’s going to happen is you’re going to have some overlap between you know, your prior balance and your next balance.

08:35

In other words, you want to you want a hard set line between the beginning balance of the bank statement and the ending balance. So this beginning balance of this bank statement was the ending balance of Jan of December’s bank statement, December’s bank statements this beginning balance, this ending balance here for this statement will be the beginning balance for the next statement.

08:55

So you really want the actual bank statements and to do this and to do this, basically Monthly as you go through, then your objective is going to be, you know, obviously, the bank statement will look something like this, you’ll have the beginning balance, you’ll have the additions to it, the deposits, then you’ll have the decreases, which will be checks or other kind of electronic transfers and whatnot. And then you’ll have of course, the ending balance, then you’ll have the detail about that the deposits in this case consisting of the detail of these deposits, these are the deposits that make up that number. And then we have these are the decreases the checks and electronic transfers that make up all the decreases.

09:35

So all we want to do then if we can match out the beginning balance that has been reconciled from the QuickBooks system to the bank, then we can go back in and just basically double check all the transactions we can just take and tie them out between the bank and between our books. And then we can find out which ones don’t match and and that will be the reconciling items. Those will be the items that typically are going to be out Outstanding checks and outstanding deposits items in our books that haven’t cleared the bank. So the way we want to do this, then is we want to take it out every number from from the bank statement to our books, and we want to tie them out basically, from the statements to our books.

10:15

Because we would think that if it’s on the bank statement, it should be in our books, unless the bank statement is wrong in error. But it’s unlikely it’s really, you know, some people think you reconcile to check the bank. And really, you’re kind of mostly reconciling to check your books, you know, so it could be possible. I’ve seen the bank the wrong before, but that’s not you know, the norm really the banks, if it’s on the bank statement, what you’re really looking for the outstanding checks, and that’s just a timing difference. It’s nobody’s fault. It’s just the reconciling difference. So so if you check from the bank statement, if it’s on the bank statement, you would think you would find it on our books.

10:53

If it’s not on our books and it’s on the bank statement, then you would think that you probably have to add it You know, if it’s a legitimate thing on the bank statement, then we have to put it on our books. On the other hand, if it’s on our books, and it’s not on the bank statement, then that very well might be the case, because we might have written a check, for example, that had not yet cleared the bank. Because to write a check, I gotta mail it to someone, they have to take it, they got to put it in their bank, their banks got to contact our bank, that could take a while.

11:23

So there’s going to be a timing difference before the bank knows about the check that we already knew about, because we put the check in the system. So we’re right. The bank is kind of wrong. You can say, however, they’re not really wrong. They just don’t have the information yet. The check hasn’t cleared. Therefore, it’s they’re not really wrong. It’s just basically a timing difference. So that means that you want to tie everything from the bank statement out onto our books. Something on our books may not be on the bank statement, because it will be outstanding. And those outstanding items that we we don’t check off in our books will resolve to be the reconciling items.

12:00

That QuickBooks will then create a bank statement or bank reconciliation with. And once we have, once we have that reconciliation process, and we know exactly what the difference is, then we have a good verification that all the cash transactions are correct. If all the cash transactions are correct, that’s a pretty good internal control because cash of course, is involved in all of the accounting cycles. Now, just a quick note on the bank feeds as well note that you might be reliant completely on the bank statement.

12:28

Some people like a small business might basically be the on a cash basis, and just basically been using bank feeds or in essence, just taking the bank statement at the end of the of the month, and putting that into the system. And that’s it, meaning they’re not doing any of any of anything else in the cycle. In other words, not entering invoices or anything like that. There’s no accounts receivable not entering bills, no accounts payable, they’re simply taking the bank statement and entering that directly into the check register.

12:56

Therefore, under that type of system, you’re basically in a very cash basis. system and you’re completely reliant on the bank. See under our system, what’s supposed to happen under a full service bookkeeping system is we enter the system into our books, we write the checks out of our books and record that out of our books. And then we verify that the clear checks match what we have written. Therefore, we have to kind of verification a double verification type process. If you’re completely reliant on on the bank statement. In other words, when you write the check, you’re not even recording it or anything like that.

13:29

You’re waiting till it clears the bank. And then you’re taking the bank statement and just entering the bank statement into your books. I’m not saying there’s anything wrong with that some small business do that just depends. You know how much time you have and how much information you need. I just want to point out that the importance of that or the difference in the internal controls, if you’re doing that, you’re taking the bank statement information integrated directly into the books, therefore whatever’s in QuickBooks, it came directly from the bank statement. That’s all you have.

13:56

You haven’t been recording anything. Anything else you still want. reconcile in that format, you’re still going to reconcile. But there won’t be any outstanding differences in that case. Why? Because Because when we wrote the check, we didn’t put it in QuickBooks system, we just simply wrote the check. And then we waited for it to clear, we didn’t put it into the QuickBooks until it cleared. So everything under that system would be from the bank already. And therefore when we reconcile all we’re checking in that case is that there wasn’t a data input error, you still want to do it because that’s going to check that you didn’t put something in twice or you didn’t miss miss something, not put something in there. So you still want to do the bank reconciliation.

14:36

I just want to point out that if you’re doing a bank reconciliation in that format, where you’re completely reliant on the the bank, possibly of using bank feeds and being completely reliant on the bank feeds, then just relax you still want to reconcile but you’ll have no reconciling differences as we will have here when we have kind of a full service normal you know, I accounting system where the bank reconciliation is a double check. The bank account is a Double check against the books that we have already put into the system. also want to point out here that we’re going to be doing two bank reconciliations for January in February for for a couple of different reasons.

15:10

One, I just want to group them together so we can see them together. And to this is common, this kind of happens in practice, oftentimes, where you just you didn’t reconcile one month. And now you gotta reconcile the two months together. So that could kind of happen. Sometimes people get to the end of the year, and they need to do indeed the year stuff, and therefore they reconcile an entire year, at one point in time. I also want to emphasize the difference between the problems when you do the first bank reconciliation, and the second bank reconciliation. When we do the first bank reconciliation.

15:41

Oftentimes, we don’t have this beginning balance in there correctly, right, because we didn’t reconcile them in the prior month, we just put the beginning balance into the system. We also may have outstanding checks from the prior time period, that that are outstanding that we’re gonna have to enter into our current system in some way. Where we only have a beginning balance that we took from the balance sheet, we don’t know what that you know, we don’t have the detail for the outstanding check.

16:06

So you kind of have to deal with those problems in the first month. That’s why the first month bank reconciliation when you do a new accounting system can be difficult if your if your bank account was open before you started the bank reconciliation, and then the second month should be easier in that format. Because the ending balance once you get one month reconciled, once you do whatever you got to do to get the first month reconciled, then the second month will be easier because the beginning balance should always be right once it once you’re on once you’re on track there.

16:35

So you won’t have that problem in the second month. In the second month. We can concentrate on those items that are uncleared in the first month and how they’ll then clear in the second month if you have a check that didn’t clear in January, the bank because there was a timing difference. It should clear in February and we could see what what that process will look like.