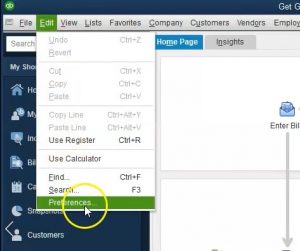

This presentation, we will continue on looking at the company preferences, this time focusing in on the checking preferences, although we will also take a quick look at the bills and the calendar preferences within QuickBooks Pro QuickBooks desktop 2020. Here we are in our get great guitars file, we’re going to go back into the preferences by going to the Edit drop down up top, and we’re going to go back down to our preferences, edit and event preferences, we did the accounting last time, we’re going to be moving down from accounting will be stopping at the checking item here.

0:34

So if I go to the next one, we’re going to say alright, the Bills, Bills has two tabs, we have the my preferences, and we have the company preferences, nothing in my preferences, therefore we go to the company preferences, the default settings are those that we will keep here and those are the bills are due 10 days after receipt. So we when we enter a bill into the system, and when we’re considering the bills, we’re considering these items that will then pay for with a check with a pay bills items typically.

1:02

So when we enter them into the system, we typically have the default saying they’re going to be do within 10 days after the receipt, then it’ll say that they’re basically past due. So we can track that information, warned about duplicate bill numbers from the same vendor. So if we have duplicate bill numbers, it will give us a warning on that, we have the automatically use credits, we’re going to keep the default here automatically use discounts. If you want to set that up, you can select that item and then default for the discounts, we’re going to keep the default setting not having either of them, then we’re going to go to the calendar.

1:37

Within the calendar preferences nothing’s in the my Preferences Tab. If we if we go to the I’m sorry, nothing’s in the company Preferences Tab. Then if we go to the My Preferences Tab, we have the calendar, I’m going to keep the default settings here we have the calendar view, remember the last views the last time we were in there, remember that view or you can say the default view being the view day, weekly, monthly, we have the weekly view showing five, seven days you can choose it to fix it the five for work day week or seven for, you know the full week.

2:11

And then we can show all transactions, I’m going to keep the default with the old transactions, the upcoming past do settings, we can display in the show show only if data exists or Remember last, and then the upcoming date show seven days. And then the past due date, we’re going to show 60 days that are going to be passed to so upcoming seven days. And if it’s past two, we’ve got the 60 days. Next we’re going to go to the checking.

2:41

So the checking in the preferences up top. Once again, we have two tabs first tab my preferences within the my preferences, we’re basically going to be chat taking a look at the major checking account. Now, when we set up the chart of accounts as it was set up for us by the default settings by picking the industry we are in when creating get great guitars file, it didn’t set up a checking account, we don’t have one yet.

3:05

Therefore some of the settings are going to be trying to default to a checking account we have not set up once we set it up considering it is the only checking account, we have these default settings, then we’ll apply to it. So in other words, if we have this open the right checks, which checking account Are you going to basically be using it from Well, we don’t have any checking accounts right now. But if you only have one checking account, obviously that will typically be the default.

3:31

Now if you have more than one checking account, that’s when it becomes confusing. And you’re going to want to basically, you know, make sure the system when you open something up that you would think would go to a checking account such as write checks, it’ll go to the default checking account, if you have for example, I payroll accounts.

3:46

And another checking account. Or if you have other type of investments that are set up for as a cash type of account, as opposed to some other type of account will take a look at those accounts and how and the listing of the accounts and how they’re set up. More detailed. Just note that typically, and In this problem, we’re gonna have one checking account, and therefore anytime it’s asking which account to go to, it’ll be the checking account.

4:09

So once we set the checking account up, in other words, all these will be checked off, we go into that one checking account. So open the bills, open the pay sales tax open and make deposits all would be going to of course our checking account, then I’m going to go to the company preferences up top.

4:26

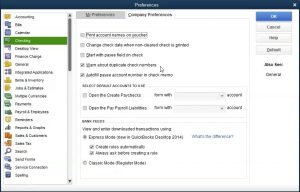

We have and we’re going to be basically keeping the default settings here. So let’s just go through them and review them. We have the print account numbers on the voucher, we’re going to keep the default setting as unchecked, we’re going to say change check date when no clear checks is printed, keep the default setting as unchecked. Start with P field on the check.

4:47

Now if you go into the checks, and you feel that the P field is easier to start with, as opposed to the date, so and usually it’ll start at the upper last left most field. When you enter data, if you always are right checks on the day that you are at, you may it made the date may default to what you needed to be anyways, and you don’t need it to start there.

5:07

So that could be something that you can kind of test out and see if it improves your data input, we’re going to keep the default setting as know, it’s probably best to do that with this problem, because we’re going to have to change the date all the time considering we’re not entering data in real time. But we’ll have to be entering data at some other date than the current date. So then we have to warn about duplicate check numbers.

5:31

Notice that check numbers are something that if we were to print out of the system, or if we were to hand write the checks and benches, enter them into the system as being written, the check numbers are something that are not part of the system that should be pre number checks. In other words, so it’s really important or it’s very useful. It’s a big internal control safeguarding against your cash to have a warning of duplicate check numbers and be able to use the fact that they’re in a numbered sequence. So that’s a good default setting to typically auto fill PE account number in the check memo.

6:05

Again, this is it a nice feature to have to have an auto fill there will keep that as the default, then it says select the account to use open the Create checks, obviously, that would be our one checking account once again. So we would check that off and pick the one checking account which we have not yet set up yet.

6:22

Once we set up the one checking account, it will be going there. And then we have the open the payroll liabilities same thing. Then we have the view and enter downloaded transactions using Express mode. This was new in 2014 will recreate rules automatically. And this will basically do things like auto populate help us to auto populate the checks.

6:44

Remember the checks from the prior period or the prior check that we wrote, so that it’ll start to auto populate, it could help us to memorize the account that we put in last time so that we have an idea of what happened last time, very useful features I would recommend putting those in place. So we’re going to create rules automatically, or always asked before creating a rule. So create rules automatically always ask before creating a rule. We’re going to have them both checked. And that’s as far as we’ll get this time will continue on taking a look at these preferences next time.