In the complex world of financial auditing, the standard unqualified report stands as the pinnacle of assurance, affirming that the financial statements are in conformity with generally accepted accounting principles (GAAP). However, auditors often encounter situations that lead to departures from this standard, raising flags and demanding a closer examination. In this presentation, we delve into the scenarios where deviations occur, the types of reports they may trigger, and the implications for both auditors and the entities being audited.

The Standard Unqualified Report: Before exploring departures, let’s revisit the foundation—the standard unqualified report. This report, the most common and expected outcome, signifies that the financial statements are presented in all material respects in accordance with GAAP. It’s the ideal scenario, and auditors aim to provide this unqualified opinion after gathering sufficient evidence during the audit process.

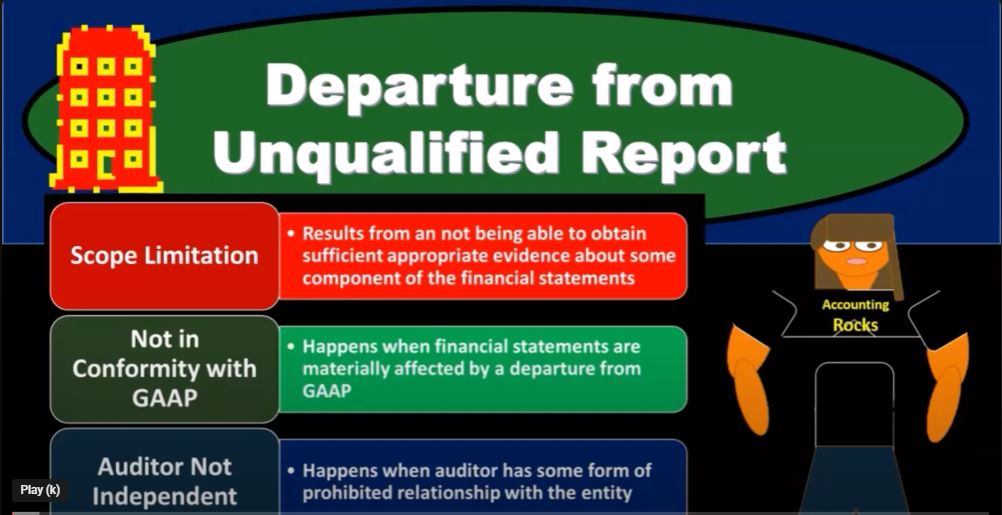

Departures and Their Significance: A departure from the unqualified report indicates a substantial issue that prevents auditors from providing the standard opinion. These departures could stem from various reasons, such as scope limitations, deviations from GAAP, or a lack of auditor independence. Each departure signifies a potential hurdle in achieving the standard unqualified report and demands a tailored approach in the audit process.

Types of Departures and Modified Reports: When faced with departures, auditors have to modify their reports to accurately reflect the circumstances. Understanding the hierarchy of reports is crucial:

- Unqualified Report: The standard and most desirable opinion.

- Qualified Report: Issued when there’s a specific qualification, but the rest of the financial statements comply with GAAP.

- Disclaimer of Opinion: Given when a scope limitation hinders the audit process, preventing the issuance of a qualified or unqualified opinion.

- Adverse Report: The most severe form, indicating a fundamental misalignment with GAAP.

Scenarios Leading to Departures: Departures typically arise in three main scenarios:

- Scope Limitation: When auditors face challenges in obtaining sufficient appropriate evidence for certain components of the financial statements.

- Lack of Conformity with GAAP: Material departures from GAAP principles in the financial statements.

- Lack of Auditor Independence: When auditors have prohibited relationships with the entity being audited.

Responses to Departures: The response to each departure scenario is distinct:

- Scope Limitation: May lead to a qualified report or a disclaimer of opinion, depending on the significance of the limitation.

- Lack of Conformity with GAAP: Results in a qualified or adverse opinion based on the materiality of the departure.

- Lack of Auditor Independence: Requires a disclaimer of opinion, as independence is a fundamental requirement for providing an opinion.

Conclusion: While unqualified reports are the goal, auditors must be prepared for departures and understand how to navigate them. Thorough planning, client selection, and integrity assessments can minimize the likelihood of encountering scenarios that lead to disclaimers or adverse opinions. In the intricate dance of financial auditing, staying informed and adaptive is key to providing valuable insights while upholding the highest standards of professional integrity.