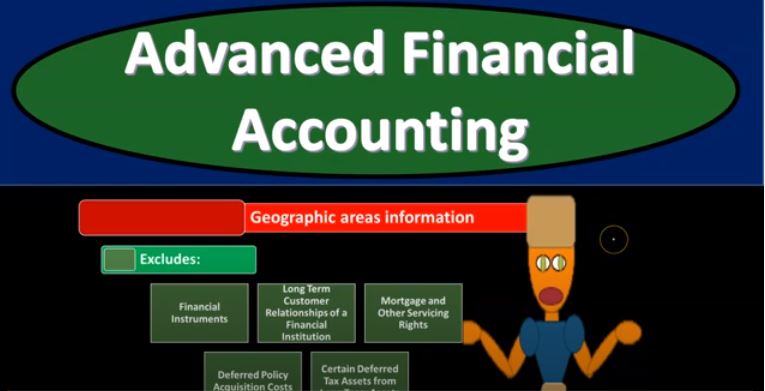

Advanced financial accounting a PowerPoint presentation. In this presentation we will discuss enterprise wide disclosure, get ready to account with advanced financial accounting. enterprise wide disclosures established by ASC 280 standards provide users more information about the company’s risks generally made in a footnote to the financial statements. First category of required information to include under ASC 280 is information about products and services so information about products and services disclosure related to them. Companies are generally required to report revenues from external customers for each major product and service or each group of similar products and services. Unless doing so is not practical. primary reason for this is that the company could have organized its operating segments on a different basis from the organization of the entities product lines. So we’ve got then again, companies are generally required to report revenues and external customers for each major product and service. You might be saying, hey, well, they already have the segment’s reporting. But it’s possible that those two things don’t exactly line up in the way they put the segment reporting together and therefore, you know, you have this requirement. second category of required information to include under ASC 280 is going to be related to geographic areas information. The following needs to be reported unless it would be impractical to do so. revenues from external customers attributed to the company’s home country of domiciled revenue from external customers attributed to all foreign countries in which the enterprise generates revenues.

01:49

If revenues from external customers generated in the individual country are material, then the revenues from the country needs to be separately disclosed. So we’re Continuing on with the geographic information here for under Section 280. The following needs to be reported unless it would be impractical to do so, long lived product productive ly productive assets located in the entity’s home country. So we’ve got the long term the long lived assets in assets located in the entities home country, total assets located in all foreign countries in which the entity hold assets. If the assets in an individual country are material, then that country’s assets need to be disclosed separately. third category of required information to include under ASC 280 is related to information about major customer, so major customer, major customers, individual customer definition, each of the following is considered to be an individual customer. So obviously any individual customer, we also have governments including the federal government, state governments, local government, foreign government, so we can have the qualifying as the customer materiality is 10% or more of the entities revenue, so generally the threshold materiality threshold 10% or more of the entities revenue