Advanced financial accounting a PowerPoint presentation. In this presentation we will discuss enterprise wide disclosure, get ready to account with advanced financial accounting. enterprise wide disclosures established by ASC 280 standards provide users more information about the company’s risks generally made in a footnote to the financial statements. First category of required information to include under ASC 280 is information about products and services so information about products and services disclosure related to them. Companies are generally required to report revenues from external customers for each major product and service or each group of similar products and services. Unless doing so is not practical. primary reason for this is that the company could have organized its operating segments on a different basis from the organization of the entities product lines. So we’ve got then again, companies are generally required to report revenues and external customers for each major product and service. You might be saying, hey, well, they already have the segment’s reporting. But it’s possible that those two things don’t exactly line up in the way they put the segment reporting together and therefore, you know, you have this requirement. second category of required information to include under ASC 280 is going to be related to geographic areas information. The following needs to be reported unless it would be impractical to do so. revenues from external customers attributed to the company’s home country of domiciled revenue from external customers attributed to all foreign countries in which the enterprise generates revenues.

Posts with the required tag

Disclosure Requirements

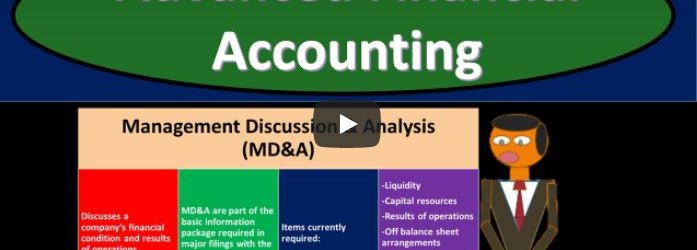

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss disclosure requirements get ready to account with advanced financial accounting disclosure requirements. We have the management discussion and analysis that’s often referred to as the M D and A discusses a company’s financial condition and results from operations. The MD and a are part of the basic information package required in major filing with the SEC, the Securities and Exchange Commission. Items currently required in the MD and a the management discussion and analysis include liquidity, capital resources, results of operations, off balance sheet arrangements, tabular disclosure of contractual obligations, disclosure requirements, pro forma disclosures, pro forma disclosures, financial presentations generally taking the form of summarized financial statements. demonstrate the effect of major transactions that happen after the end of the fiscal period or that happened during the year, but are not fully reflected in the company’s historical cost financial statements.

Registering Securities with SEC Process

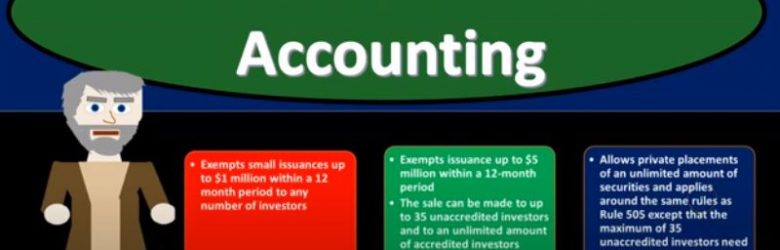

Advanced financial accounting PowerPoint presentation. In this presentation we will discuss the process of registering securities with the SEC, the Securities and Exchange Commission get ready to account with advanced financial accounting, issuing securities. If a company wants to sell debt or stock securities in interstate offerings to the general public, they are usually required by the Securities Act of 1933 to register those securities with the SEC. So one more time, we’re talking about the issuing of securities if a company wants to sell debt or stocks securities in interstate offerings to the general public, so now we got the interstate offerings going to the general public, in order to have that benefit. They are usually required by the Securities Act of 1933 to register those securities with the SEC. And you can see we saw a little bit of history in the prior presentation on how this could develop. Obviously, it’s going to be a benefit to the businesses in order to To generate capital typically to be able to offer the stock to the general public in interstate offerings. But in order to do so then you would think you’d want to have some transparency that will be involved in it so that both sides of the negotiation will be involved. That’s where the SEC came into play here. So we talked a bit about the SEC and its role in a prior presentation we’ll get more into the process of the registration here. General financial statement required for this process will typically include two years of balance sheets three years of statements of income, three years of statements of cash flows, three year of statement of stockholders equity, prior years statements are generally presented on a comparative basis with the current years it will typically have a comparative basis. For the for the comparative years prior and current year.

Enterprisewide Disclosures

Advanced financial accounting a PowerPoint presentation. In this presentation we will discuss enterprise wide disclosure, get ready to account with advanced financial accounting. enterprise wide disclosures established by ASC 280 standards provide users more information about the company’s risks generally made in a footnote to the financial statements. First category of required information to include under ASC 280 is information about products and services so information about products and services disclosure related to them. Companies are generally required to report revenues from external customers for each major product and service or each group of similar products and services. Unless doing so is not practical. primary reason for this is that the company could have organized its operating segments on a different basis from the organization of the entities product lines. So we’ve got then again, companies are generally required to report revenues and external customers for each major product and service. You might be saying, hey, well, they already have the segment’s reporting. But it’s possible that those two things don’t exactly line up in the way they put the segment reporting together and therefore, you know, you have this requirement. second category of required information to include under ASC 280 is going to be related to geographic areas information. The following needs to be reported unless it would be impractical to do so. revenues from external customers attributed to the company’s home country of domiciled revenue from external customers attributed to all foreign countries in which the enterprise generates revenues.

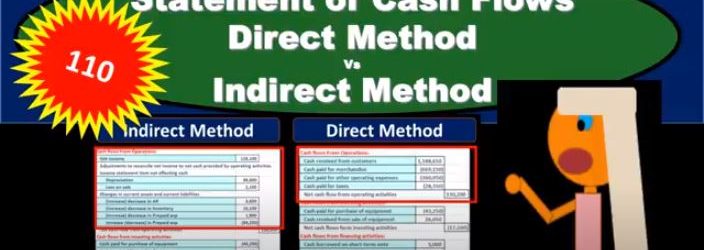

Statement of Cash Flows Direct Method Vs Indirect Method

In this presentation, we will compare and contrast the direct method versus the indirect method for the statement of cash flows. It’s important to note that when we’re comparing the direct and indirect methods, we’re really only talking about the top part, the operating activities portion of the statement of cash flows. In other words, the investing activities and financing activities and in result will remain the same, we’re going to end up with the same result, which of course, will be the Indian cash that we can tie out to the balance sheet. And we’ll have the change of cash here, which is really kind of the what we’re looking for in the statement of cash flows. What’s going to differ is the operating activities, why are they going to differ? Why would we have the operating activities differ? Remember that the operating activities have to do with kind of the income statement you can think of it basically as the income statement being reformatted to a cash flow statement versus an accrual statement. So the income statement that we use is on an accrual basis, and we recognize that Revenue when it’s earned rather than when cash is received expenses when expenses are incurred rather than when cash is paid, that’s gonna be on an accrual basis.