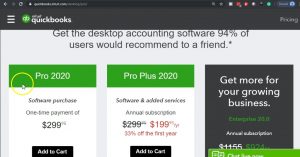

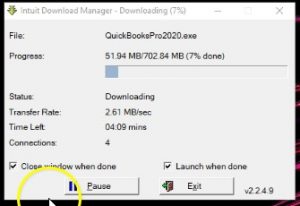

This presentation and we will go through the installation process for QuickBooks Pro 2020. And prior presentations that we have downloaded the software, we’ve actually purchased the software from the Intuit website, the owner of QuickBooks, we have downloaded the software. And now the download or installation software is on our computer on our machine. We’re now just going to run that system in order for it to then install the actual QuickBooks program. This is the icon that we downloaded.

0:30

Remember that this is not the actual QuickBooks program. This is the installation program. This would be very similar that if you had the CD that you would purchase from my box in a store that would have the installation, then once you enter that CD, it would then have to be running in order to install the program. Same concept here, this is the icon and we have to run we should simply be able to double click on it in order to run it.

0:52

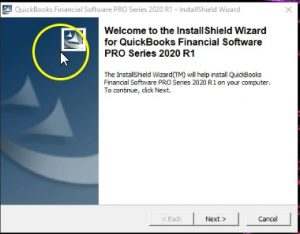

That’s what we’ll do now. Double click QuickBooks is a fairly large program. So note it will take some time and note that if you when you’re running QuickBooks, you want to make sure that the machine is capable of being able to handle QuickBooks it is a larger program to run. Next we’ll see a screen that looks like this, we have Welcome to the install shield wizard for QuickBooks financial software Pro Series 2020 r1.

1:16

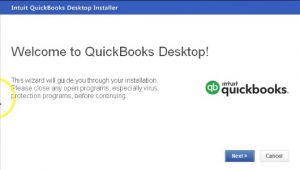

The installation wizard will help install QuickBooks financial software Pro Series 2020 r1 on your computer to continue, click Next. And we will simply do so next. So within the installation process that then says Welcome to QuickBooks desktop, this wizard will guide you through your installation. Please close it any open programs, especially virus protection programs before continuing.

1:41

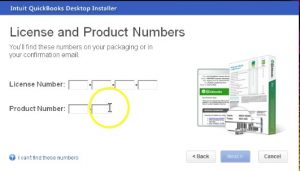

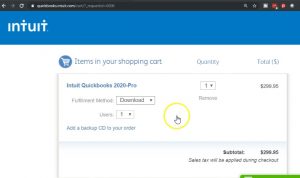

If you have some type of virus protection programs, sometimes they can cause a problem with the installation process, then, of course, you want to be able to look through the terms read through the terms. And then we need to be able to accept the terms or else QuickBooks will not run the process. So we’re going to say that we want to accept the terms of the license agreement and then can you forward. Next, they have the license and product numbers, you’ll find these numbers on your packaging or your confirmation email.

2:09

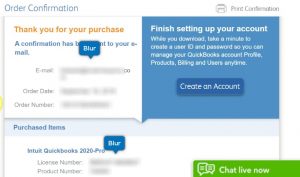

So note, once again, these are those numbers that I’ve told you that we’re going to have to see it that we will be seen again, which we saved and we printed, you should also have an email with those numbers as well. When we installed the information, we saved these numbers, we made a screenshot of them, we put them in a Word document, we printed them, the word document looks like this, where we used a screenshot. And if you didn’t do either of those, check your email, hopefully it’s there.

2:32

We’re going to need these numbers. Anytime we try to enter this into a new machine. If we had another machine and we’re going to try to put this software on we would need it once we’re done, we would of course, select Next. So I’m going to enter that data and select Next. Now, next we can choose the installation type. For most people, the Express version will be fine. So if you’re a small business and you’re putting this on your machine, typically you would want the recommended Express version.

2:56

If you look at it, however, you’re going to replace the current version, use existing settings and copy preferences. So it’s going to say hey, what do you currently have in the current system, I’m going to copy the settings and preferences, in essence, and use that current settings in the new version. So you don’t have to basically update everything. If you have some networking needs, if it’s going to be on a server specially if you can have multiple users that will be using it at the same time, then you probably want to contact your IT expert and go through the custom setup and make sure that the network is set up properly.

3:28

In other words, if you’re just going in there with one user at a time, and especially if you’ve had the software before it’s on one computer, then typically you would think that the Express system would be best it’ll copy the prior preferences on it, and then put in the the new system for it. If you have multiple users.

3:45

However, in a more advanced accounting system, then you might be putting it on a server and may need to customize and network options with the custom location upgrade Advanced Server options. Also note if for whatever reason, you wanted to have the 2019 version and the 2020, then you might want to look into more customizations as well. This could happen if you were working with a bookkeeper if you’re a bookkeeping firm, and someone was to give you the 2019 file and you want it to return it to them. In other words, you can always update the file. So if they gave me a backup in 2019, I can update it to 2020.

4:28

But then if I gave them the backup, again, they couldn’t use what I give them on their system, if I give something from 2022 2019 software, they will typically not be able to use it on the older version. If they give something from 2019 to 2020. However, we will be able to use it but to do so will have to update the software. And therefore if I was to give something back, they wouldn’t be able to use it on their side.

4:53

So it’s a one way system that you can advance the material typically up to the current version, but you can’t go back then and open it in the prior version. Now I’m actually going to use the advanced system because I do want to have QuickBooks 2020 and 2019. Therefore the differences the default setting here replaced the version selected below with the version I’m installing here, versus I’m going to change that I’m going to say I want 2020 installed on my machine and 2019. And this is the reason I’m going to go into the more complicated type of setup. So I’m not going to mess up with the networking system here, it’s still on the machine.

5:30

But I am going to make that slight change. If you want to just simply replace 2019, then you can go to that express method. So I’m going to select Next. It’ll then give us one last check, we’re ready to install. And we’re going to say all right, install it, let’s do it. Once again, this installation process could take some time, they’ll typically go through some information down below.

5:51

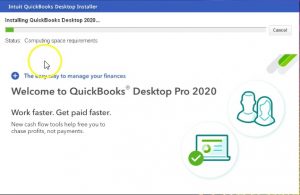

Welcome to QuickBooks, desktop 2020, work faster, get paid faster, they have the new flow tools. So they’ll often when you’re looking for QuickBooks, see if you will have to have some add on type of features, those add on features, of course being the payroll type features, maybe things like purchasing checks that would be associated or be going along with the QuickBooks system.

6:12

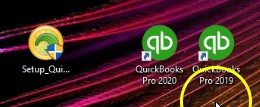

So we’ll just sit and go through the installation process. Now. At the completion of the process, we hopefully get a message such as this, which says congratulations, QuickBooks desktop has successfully installed, I’m going to go ahead and close this look for the QuickBooks desktop icon. And then we can open it from there. So I’ll close this up. We didn’t see the QuickBooks icon here, which will be this green icon with a QB it’s got QuickBooks Pro 2020, down below.

6:41

Now oftentimes, when you’re going to open this thing back up, it wants you to restart the computer. So we’re going to restart the computer and then we should still have this icon here. This then is going to be the icon that we can double click on to open up the actual software. So note, this is the icon that that looks like what it looks like to run the software as opposed to the icon at the beginning of this presentation, which is the installation software.

7:07

Also note that QuickBooks is a little bit different than other types of software when we think about word, or if we think about Microsoft Excel, where we oftentimes go to the actual file, open up the file, which then opens up the program of Word or Excel to run the file that we selected. In other words, if we want to open up the letter that we wanted to go to, we double click on the actual letter of the file, which then opens up the program, which will open up the file, typically with QuickBooks will usually just opened up the software first.

7:38

Even though we could have multiple different software programs within it, you can possibly you can go to the actual file and open it in a similar fashion as Microsoft Word. But usually that’s not the case. Usually we open up the program, and it will simply open up the previous file that we were using. If we only use one QuickBooks file, it will always be at that location. Just remember that we want to make sure that we know where that location is of the actual file, not just the QuickBooks software. So that’s going to be here, we’re going to go ahead and restart the system.

8:14

We have now restarted the system note we have the two icons on the desktop, this is QuickBooks 2020, QuickBooks, 2002 and 19. Right beside it, so it is possible to have both of them on your system. And there are some times when that might be advantageous. You’ll recall that this is the system or the icon of the item that we used in order to run the program. In order to open up the program, we can of course, just simply double click on the icon.

8:40

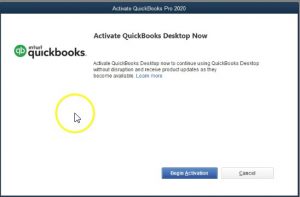

As I do I get a pop up here says activate QuickBooks desktop now activate QuickBooks desktop. Now to continue using QuickBooks desktop without disruption and receive product updates as they become available. We can continue and learn more, I’m going to begin and activate the we then get a confirmation your activation is now complete, we can then provide a review to QuickBooks to see how they did.

9:05

Also note as we go through the setup process, we may get some more items that you might see pop up this could change over time that will be included. Do you want to add payroll? We’ve seen that a few times? Do you want to add checks or other types of resources? These are types of items that are going to be paper items typically, that can run and print out of the QuickBooks system, and therefore they match up well. So they’re basically asking, would you like to purchase checks?

9:29

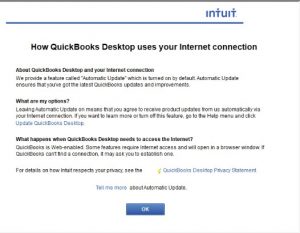

Would you like to purchase them other stamps or printing supplies that could coincide or work well with your office products such as QuickBooks, we didn’t have an item saying how QuickBooks desktop uses your internet connection about QuickBooks, desktop and your internet connection. Now remember, the QuickBooks is on the desktop, but it does get updated a lot. So because we want to be on the most latest system, it’s going to have to connect to the internet in order to do that. So we provide feature called automatic update, which is turned on by default.

10:00

So by default, QuickBooks will be updating. So if you notice your computer like running slow or doing something funny, at some point in time, it may be that of course QuickBooks is running, connecting to the internet in order to get that automatic update. Update ensures that you’ve got the latest QuickBooks updates and improvements. What are my options, leave an automatic update on means that you agreed to receive product updates from an automatically via your internet connection.

10:29

If you want to learn more, or turn off these features, go to the Help menu and click this item. So you might want to set it up and you say hey, I’d like to turn off the automatic updates, I’d like to tell it when to update. And that in that if that’s what you would like that you’d have to turn on a default turn off the default setting, which are to have the automatic updates to be downloaded automatically.

10:51

What happens when QuickBooks desktop needs to access the internet, QuickBooks is web enabled, some features required internet access, it will open in a browser window. If QuickBooks can’t find a connection, it may ask you to establish one for details on how into it respects your privacy. See these issues below. Obviously, the fact that it’s going to end from QuickBooks and the Intuit website downloading data from the website, we want to make sure that’s a secure connection.

11:20

Typically, you would think QuickBooks being into a large company, they would have that a fairly secure connection, but you want to basically check the terms you can go into more detail on that and select okay here. Normally, when you open QuickBooks, it’ll open to a screen such as this or to the prior company file you were in. Typically it’ll open to a screen such as this, this will give you a window of the latest type of set of documents or QuickBooks files that had been open.

11:47

So if you only work with one company file, in other words, even after the install, you will have this page which will have the latest file or the file that you typically work on. You can open it up directly from here. Remember that we opened up the software, the files are separate from the software, the QuickBooks files. If we only have one company, then QuickBooks will be recognizing that company we can just simply go into it although we want to know where that file is on the computer. Next time we’ll go into more detail about these items within it. The software is installed this time