In this presentation we will enter a purchase order and add a new vendor as well as a new inventory item as we do. So let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file. Before we go further further, let’s take a look at the flowchart on the desktop versions of the desktop version here just to take a look at that flowchart. We’re going to be up here in the vendor section, we’re going to be entering the purchase order. So just recall that the purchase order doesn’t actually have a financial transaction. We haven’t received the inventory, we haven’t paid for the inventory and no financial transaction, we’re simply requesting the inventory.

00:35

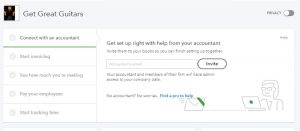

Then we expect to receive the inventory at some future time along with a bill at which point we will then record record that inventory in the system. Okay, so now we’re going to go back to our QuickBooks Online. We’ve seen the purchase order in the past we’ll do it a bit more quickly here. We’re going to go to the drop down up top. We’re going to go to the money going out and we want to then go down to the Send purchase Order send a purchase order. Note the difference in the name it said send purchase order there, it’s simply going to be called a purchase order when you actually open up the form, we’re going to enter a new vendor.

01:11

So we’re going to be purchasing a different piece of equipment a different color guitar. From a new vendor, people have been requesting guitars from Fender, so Fender is going to be our new vendor. So we’re going to be putting in Fender Fender I think that’s how you spell it. And then we’re going to say tab and that’s going to be our new vendor. We don’t have them yet. So therefore, they’re going to ask for the details. We’re just going to keep the name in this case. Note that if it was one of our major vendors, we probably would want the deep details such as the contact information, and you know that that kind of information in there but I’m just going to save it here for now.

01:48

We’re going to say Save, and if we have the email address, then we could obviously just send the purchase order by email. Then we have our information we seen in prior presentations down below. We’re going to put the date as of the ninth. So I’m going to select the date. And I’m just going to select the plus button on the keyboard. And that allows us to kind of go up a few days there to the February 9, then we’re going to be in their product or the item detail, not the category detail down below, we’re going to put in the guitar that we want to purchase. I’m going to abbreviate it for now as an sq. And then we’re going to set up this item as we create the purchase order.

02:24

So we’re going to add that I’m going to say tab, it’s going to say hey, do you want to add the purchase item I’m paraphrasing here, we’re going to say yes, it will be an inventory item. So we want an inventory item because it’s an actual piece. It’s in a guitar that we’re buying. And then I’m actually going to rename it up top. I’m going to call it a Squire and then I’m going to call for the SKU, the Sq and then I’m going to keep the category no category going to scroll down to the amount on hand. This is a required field so but you always want it to basically be zero. You know, you don’t want to be adding when you add a new item, any item on hand typically unless it’s the first time Day of operation.

03:02

So we’re going to say zero as of, and we’re going to say I’m just gonna put any date here, what would typically work. So I’m going to put the first date of the operations, then January 1, again, it’s going to be zero. So I’ll put it as of January 1, I’m not going to put a reorder point at this time. So then we have the inventory, the investment asset account or the inventory asset account is by default to the inventory asset. So when we purchase it, not with this form, but when we get the bill, then we’ll put it on the books as an inventory asset.

03:33

The description once again is going to be the Squires I’m going to say as qu IR E, he said how you spell as qu, er, I think something like that. And then we’re going to say the sales price is going to be 244. So we’ll say sales price to 44. Then the income account will be the income account for product income as opposed to the service income account. And then we have the sales tax. It is taxable. standard rate, so we’re going to keep it taxable standard rate there, the purchase description is going to be the Squire. Again, that’s going to be the purchase description. And then the cost is going to be 168.

04:12

So we’re going to pay 168 for it. And the cost of goods sold is going to be the expense account. In other words, that’s the account that will be affected when we create an invoice or a purchase or sales receipt to actually sell this piece of equipment. Then the vendor that we buy this from is going to be the new vendor we put in there, which is Fender fenders, our new vendor, hey, so we’re going to say Fender All right, then we’re going to say Save and Close. There’s our item is set up, Save and Close. See if it populates. There’s the square and the square.

04:42

So there we have that and then the quantity we’re going to say is one now we’re also going to add a customer remember that the customer field is optional. So when we think about this, if you think about the story of this, if Io back to kind of a flowchart, what’s happening here, we’re imagining someone comes into the store, they’re checking things out, and they’re saying Hey, you got a Nice guitars, I would like a Squire Fender guitar. And we’d say I don’t know, we haven’t ordered from Fender before that would be a new vendor for us. But we can try to do that we can order you the the Squire guitar.

05:11

Therefore, we’re going to make a purchase order. This goes to the the vendor who doesn’t care about the customer. But we care we want to tie that purchase order to the customer so that when we fulfill that order, when we get the guitar, we’re then going to turn around and give it to the customer. So once we have received the guitar over here, we’ll be able to populate this information with the purchase order to pay for the guitar. And we’ll also be able to know and recognize the fact that we need to turn around and create either an invoice or a sales receipt to sell this guitar given the fact that we purchased it specifically for a particular customer.

05:46

That customer then is going to be here that customer is going to be new music stuff. Very interesting name and we’re going to say tab. Now this is a customer field. Again, we would probably want to Our contact information and so on and so forth. But I’m just going to keep it at just the name for the purposes of our practice problem. So there we have it, that’s going to be our purchase order. There’s no transaction, no effect on the financial statements, we’re not going to go to the financial statements, because nothing’s going to happen there. What will happen is we’ll receive the guitar later if everything goes smoothly, and we will then record it on with a bill or with a payment form like an expense form. So that’s what we’ll do, we’re going to say Save and Close. And there we have it.

06:32

Now we’re going to repeat the process again, this time to a vendor we have already set up so we’re going to say new, we’re going to say that we want to go to the money going out we want to send a purchase order which is just going to be called a purchase order when we open up the form. This is going to go to our major vendor that being Epiphone so I’m going to select the drop down and be purchasing another guitar from Epiphone this time. So there it is Epiphone, that’s the one we want, we’re going to keep the date, as of the If I scroll them down, we’re in the item detail. And you’ll note, it’s already populated.

07:04

There’s already something there either because it’s memorizing the last transaction we had. So QuickBooks is trying to help us out and say, Hey, last time, with this particular vendor, you ordered up the Epiphone Les Paul, would you like to do that? Again, we’re going to say yes, and then we’re just going to basically change what we need to change, I’m not going to buy one of these, this is like our main guitar. So we’re going to get three of them, we’re going to take three of those these time at $400, that’s going to be for the total amount of 1200.

07:30

So that’s going to be the amount again, notice there’s numbers here, but there’s no numbers that are going to affect the financial statement. Because we haven’t yet paid for it. We haven’t yet received it. This is just a request form that we will tie out to the bill we expect to receive in the future. So let’s save and close that one. So we’re going to say Save and Close. If you want to take a look at those purchase orders, we can go to the expenses tab.

07:52

So on the left hand side in the expenses tab, then if we go to the first tab, we will see the expense transit actions which of course will include the purchase order. So we have the two purchase orders we have made here and we have the options on the left in terms of the actions going back up top if we were to select a vendor and think about one of these vendors, for example, the new vendor, let’s take a look at which is fender and so if we go into Fender, the new vendor, and I’m going to close the hamburger because it’s easier to see stuff when we go in there. And so there we have it. So there’s the purchase order detail within that particular vendor as well.