This presentation we will look into recording and adjusting entry related to a short term loan. Let’s get into it with Intuit QuickBooks Online. Here we are in our get great guitars file. Let’s first take a look at our reports our balance sheet report for this transaction that we’re going to be recording or this adjusting entry, we’re going to be opening up our favorite report that being the balance sheet report, we’re going to change the dates up top the dates from let’s make it a 1012020 229 to zero. Now, when we think about the adjusting entries, we’re always going to be thinking of them as kind of like the cutoff dates, we’re trying to make things correct as of the cutoff date, which in this case, it’s going to be the end of the second month.

00:41

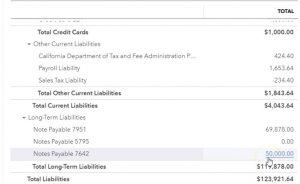

So we’re going to be making adjusting entries as of the end of the second month. Our goal is to get things and things as correct as possible on an accrual basis as of this date. And we may be going back and forth from doing things that are logistically what things that we want to do that make things In the data input a little bit easier to do two things from a reporting basis, that would be better so that we can report more on an accrual basis. That’s kind of what the adjusting entries will help us to do. I’m going to hold down Control and scroll up a bit. And we’re going to scroll down to the loan. So we’re concentrating first on the liabilities down here. And we have the liabilities of the note payable and the note payable up top. You’ll recall that we have two loans at this point in time, we’re going to be concentrating here on the $50,000 loan.

01:32

Now, when we think about these loans, in terms of financial reporting type of perspective, there’s a couple things we need to think about. Is there any interest that has the interest been recorded correctly? Is there any accrued interest that we need to report on the loan and what is the short term and long term portion of the loan is there a short term and long term portion in other words, where should they be classified as either either as a long term loan or a short term loan or a portion will be long term and short term. So long term loan means that it’s going to be due over a year the balance is going to be due after a year’s time period. Short term loan means it’s going to be due within a year.

02:11

Now the traditional loan that we’re probably most familiar with, like a mortgage are typically something that when we finance item, usually a car or something like that would be that we’re going to be paying it off monthly. And therefore if the loan payments are over a year, and we’re paying it off monthly, that we would have a short term and a long term portion. We’ll take a look at that with this, this loan. And we’ll do that in a future presentation. However, we can design a loan in any in any way we want, right, we could design alone, basically, we’re going to take the money out, and then pay the whole back whole loan back plus interest at the end of the term. Or we could be paying simply interest over the term of the loan and then have to pay the balance back at the end.

02:52

So there’s various ways we can set up the loan. We’re going to start with this format. We’re going to pay the entire loan balance back at the end of the The time period, because it’s a little bit easier to think about the short term and long term portion, then we’ll get into the more complicated item where we have both a short term and a long term portion that we need to be breaking out. So if I go back to the loan schedule here, we’re going to say we’re concentrating on this $50,000 loan, the loan for $50,000, it’s going to be paid back at the end of six months, we’re going to say, with an interest rate of 6%.

03:24

Now we’re not going to be paying back the entire loan until the end of the six months and therefore we’re going to pay back at the end of that time period, the 51 519 we’re not in other words, making monthly payments, we’re simply going to pay back the entire balance. You can also think of a loan being set up where basically you only pay the interest for example the the interest here on the loan, not paying back the principal and you would result in a similar a similar item here, similar thing going on. Now because this loan is going to be paid in six months. It’s less than a year therefore the entire world loan is going to be short term.

04:02

So what we need to do then is classify this loan is short term, and then we’re going to deal with the interest, the interest that’s going to be involved that’s been accrued in a future adjusting entry. So first, I’m just going to say, Alright, this entire loan, then is short term. And we put it down here in the long term, because we want to group all the loans together, it’s easier for us from just a logistics point of point of view, to basically group all the loans into one sub category. And you have to choose Should I put that in the short term or the long term sub category, and then once and then at the end of the year, then you got to think about Okay, now I can think about breaking out between the short term and long term portion of them.

04:39

So this one then, is in the long term category, all I’m going to do is make a short term category for the loan. I’m going to record that into it so the financial statements then will reflect a short term loan. After that is done after we do the financial statements for the period end of February. Then I’ll typically do a reversing entry right after that. Because I would rather have it all my loans grouped from a logistical standpoint under one subgroup, in this case to long term liabilities down here.

05:09

Alright, so let’s do that. What’s going to happen then is this loan is going to go down to zero here, we’re going to create another loan account which we’re going to call it current asset, other current asset, and that’s just simply going to be a the current portion of the loan. Alright, so I’m going to duplicate this up top, I’m going to right click on the tab up top, let’s duplicate that tab. Then I’m going to go back to the first tab. Now we could do this with journal entries. And that’s typically the way you would do it will use like a journal entry type form.

05:40

However, we can also use the registers so when we can use the registers we’re going to enter these with a register format. We can use the registers here because these are balance sheet accounts and like two accounts affected, so it shouldn’t be too bad to use a register. So I’m going to open up the hamburger I’m going to scroll down to back to 100% down here. going to scroll down to accounting, we’re looking into the chart of accounts. So we want to be on the first tab with the chart of accounts. And you might be on the reconciling tab, so you got to go back to the first tab we’re looking for then the loan.

06:14

So it’s going to be an other current liability. So it’s an order assets, liabilities, equity, income and expense. So we’re down here in the other liabilities is occurrence, and we want the long term liabilities. So here are our two loans. I’m going to go to do this loan down here with the $50,000. In it, we’re going to open up the register for it. Let’s open up that register. Then I’m going to close up the hamburgers and we’ll close up the hamburger and we’re going to choose the type of entry we can have a transfer or a journal entry. So we’re going to choose a journal entry.

06:46

Although we’re not going to be using the debits and credits here because it’s going to be in plus or minus format, but the form that will be used when we kind of drill back down on that with the auto zoom will be the journal entry. So and we’ll see the debits and credits at that point. I’m going to put the date, it’s always at the end of the month Oh to 29 to zero because it is an adjusting entry. So all adjusting entries are as of the end of the month, which here’s to 29. And we’re not gonna have any, I’m going to put a memo, I’m going to just put a DJ entry, I’m going to put that on all the adjusting entries.

07:18

If I remember, hopefully I remember to do that. And we’re going to be decreasing this by the 50,000. And then I need to make a current portion of notes payable. So I’m going to say notes payable, payable, current portion. I was just say current. And then I’m going to say tab, we’re going to set that account up. It’s not going to be a bank account, but an other current liability. So I want to be an other current liability account. And then we have the second drop down here insurance.

07:51

Let’s make it a loan payable. So it’s going to be a loan payable and I’m going to call it note payable current to be consistent. And I’m not going to have a sub Category the multiple loans you could hear, but I’m going to put the current portion all into one account. Rather than having having sub accounts or different accounts for the for the two loans that we have. You can think about doing it either way, if you have a whole lot of loans, it might be easier for you to adjust them by having multiple accounts so you can group them into one account.

08:20

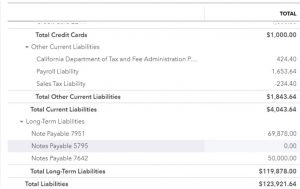

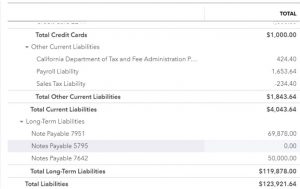

So I plan to put them in one account, and then reverse this back to the method we had before where we have two accounts where we can actually track the loan balances better in them. So I’m going to say Save and Close. And that looks good. And so I’m going to save that. That should bring this balance down to zero. Let’s go back to our balance sheet and see what happens on the balance sheet. Go ahead and refresh the balance sheet that I’m going to close up the old hamburger we’re going to hold down Control and scroll up to that 125 and then if we scroll down to the liabilities section, we have in the other current liabilities now this notes payable, notice it’s kind of grouped in there by alphabetical Order under the other current liabilities, we could have had basically a subgroup of the notes payable. And then the two notes payable broken out by by a number by making the sub categories.

09:14

However, it I’m only putting it into the current liability section here for financial reporting purposes. And they don’t really need to see the breakout between short term and long term. The only reason I would do it to make those two accounts is if I if I had more than two accounts or something like that, just to make this adjusting journal entry process easier for me to see and tie out to the amortization schedules, which we’ll take a look at later, then that’s the only reason I would basically do that.

09:41

Other than that, I would group them together just for reporting purposes. And then I’m going to put them back in to their long term accounts that are all subgroup down here under the one account having the short term and long term portion grouped together. And we’ll see that as more of a problem when we think about this one which will have a short term and long term portion to it, so that so that then I can track the loan balances as I entered the payments in one account without dealing with the short term and long term thing going on.

10:08

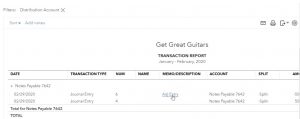

So you’ll see this one now went down to zero. And we have now put it into the current portion to represent that it’s going to be due within a year, that’s going to be what we’re going to use for financial reporting purposes so that we can see that that’s a current loan. And then again, we’re going to reverse that at the beginning of next month, just to put it back to where it was. So logistically, we can have everything all loans under this one, one section. Before we close up, I do want to just take a look at the adjusting journal entries. So if I go into this notes payable account, here we go into that account, we can see the journal entry there’s two journal entries.

10:45

Here we’re looking at the adjusting journal entry. That’s the one that we just entered. If we select that adjusting journal entry, you’ll notice it doesn’t go back to the register, but you see the journal entry here. And if you’re used to debits and credits and adjusting journal entries, then you may be rather see it in this format. Now I’m going to add on the other side a DJ entry so we can see it on the other side here as well for our description or note that I’m going to say save it and why can it go down here to save and close? And that’s going to be it and then I’m going to scroll back up and go back to our report. And that is it.