QuickBooks Online 2021. Now, report formatting basics. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive file, which you can find by searching in your favorite browser. For QuickBooks Online test drive, we’re in Craig’s design and landscaping services practice file, we’re going to practice formatting of reports and customization of reports from the basic or standard reports, we will do so with the balance sheet report.

Posts with the adjusting tag

Report Formatting Basics 2.15

QuickBooks Online 2021. Now, report formatting basics. Let’s get into it with Intuit QuickBooks Online 2021. Here we are in our free QuickBooks Online test drive file, which you can find by searching in your favorite browser. For QuickBooks Online test drive, we’re in Craig’s design and landscaping services practice file, we’re going to practice formatting of reports and customization of reports from the basic or standard reports, we will do so with the balance sheet report. But many of these things can be done to many other types of reports as well.

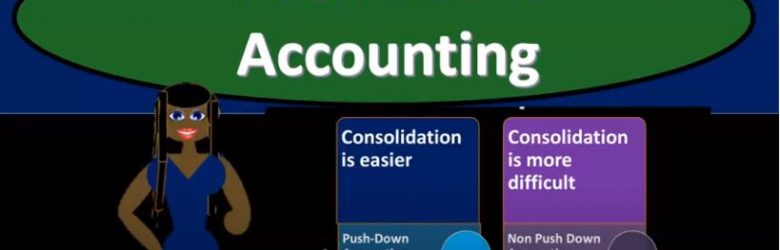

Push Down Accounting

Advanced financial accounting. In this presentation we will discuss push down accounting as it relates to parent subsidiary relationships controlling interest interest over 51%, where we have consolidation accounting taking place, we’re going to be applying pushdown accounting to it, get ready to account with advanced financial accounting. So the concept of pushdown accounting will take place when we have the parent subsidiary type of relationship and we have a situation where the purchase price when the parent purchased the subsidiary, the purchase price was more than the book value of the subsidiary, which could complicate of course the consolidation process as we’ve talked about in prior presentations. So we have a couple different options that we could do.

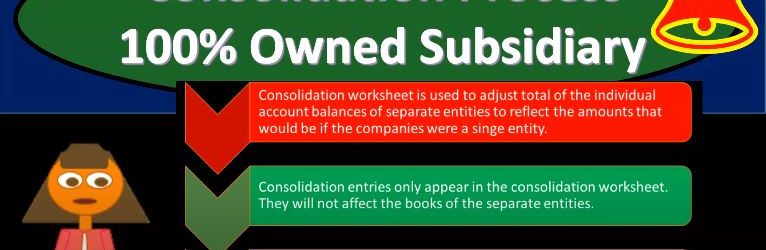

Consolidation Process 100% Owned Subsidiary

This presentation we’re going to take a look at the consolidation process for a 100% owned subsidiary. In other words, when we’re thinking about one company owning another company in advanced financial accounting, we’re usually looking at the situation and spending most of our time where we have some kind of consolidation process. So we want to Vin take the consolidation process and look at it in levels of complexity. So we’re going to start with a level of complexity, that’s going to be an easier setting where we will have 100% owned subsidiary, and then we’ll go from there and add more complications to it. Get ready to account with advanced financial accounting to ownership and control and prior presentations, we took a look at different methods based on different levels of ownership and control. We said in general, if we had zero to 20%, we use the carried value and then 20 percents kind of an arbitrary number, but if we’re over that amount, we’re really looking at the term of significant influence it for over the 20% from 20 to 50% then The assumption is that we would be using the equity method because the assumption would be if over 20% unless spoken otherwise, unless some unreal, some reason, otherwise, we would then have this significant influence and therefore be justified to use the equity method. And then if you’re over 51%, then you may have the consolidation. Now, when we think about these two methods that they carried value in the equity method, we can basically explain those as we go, you know, if you got anything from zero to 20%, then we could just basically say, yeah, then you fall into this category, let’s talk about the accounting in general.

Post Closing Trial Balance

Hello in this section we will define the post closing trial balance. When seeing the post closing trial balance, it’s easiest to look at it in comparison to the adjusted trial balance and consider where we are at in the accounting cycle in the accounting process. When we see these terms such as the adjusted trial balance and post closing trial balance, as well as an unadjusted trial balance, we’re really talking about the same type of thing. We’re talking about a trial balance, meaning we’re going to have the accounts with balances in them. And we’re going to have the amounts related to them. And of course, the debits and the credits will always remain in balance. If it is a trial balance, no matter the name, whether it be just a trial balance on an adjusted trial balance and adjusted trial balance or a post closing trial balance.

Accrued Interest Reversing Entry 10.25

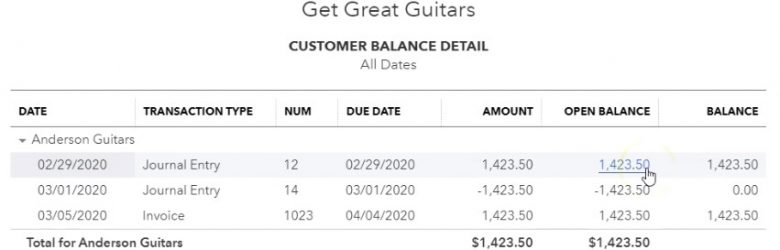

This presentation and we’re going to enter a reversing entry related to accrued interest. Let’s get into it within two, it’s QuickBooks Online. Here we are in our get great guitars file, we’re going to go down to the reports on the left hand side, we’re going to be opening up this time the trusty trial balance, we’re going to be typing in up top to find the trial balance the trial balance, and then we’ll find it and then I’m going to open that up. Then we’re going to change the dates up top, we’re going to change the dates from Oh 1120 to 202 29 to zero.

Advance Customer Payment or Deposit 8.45

This presentation we will record an advanced payment or a customer deposit. In other words, we’re going to receive a deposit in advance for a guitar that we’re going to provide in the future. Let’s get into it with intuits QuickBooks Online. Here we are in our get great guitars file. Let’s first take a look at a flowchart. I won’t spend as much time on it because we seen it in the past what we really want to do here is put that negative receivable on the books which will be dealing with in our adjusting entry process later. The process here note that the normal accounts receivable processes to have an invoice and then we’d receive the payment then we make the deposit here we’re going to say someone came into our shops as they want a guitar.